Get Ready For The Crash- Plan For The Worst

Lance Roberts | Aug 02, 2017 08:17AM ET

Currently, things could not be better.

Stocks are hitting all time highs. Confidence is at record levels, and investors are “all in.”

But maybe it is just for those reasons that we should take a pause. Records are records for a reason.

Every strongly trending bull market throughout history has ended, usually very abruptly and with little warning. Few ever foresaw the signs leading to the “Crash of 1929,” “The Great Depression,” the “1974 Bear Market,” the “Crash of ’87”, Long-Term Capital Management, the “Dot.com” bust, the “Financial Crisis,” etc. These events are often written off as “once in a generation” or “1-in-100-year events,” however, it is worth noting these financial shocks have come along much more often than suggested. Importantly, all of these events had a significant negative impact on an individual’s “plan for retirement.”

I bring this up because I received several emails as of late questioning me about current levels of savings and investments and whether there would be enough to make it through retirement. In almost every situation, there were significant flaws in their analysis due primarily to the use of “online financial planning” tools which are fraught with wrong assumptions. I wanted to go through some very basic concepts that you need to consider when planning for your retirement whether it is in 5 years or 25 years and more importantly dispel a few myths.

The Market Does Not Return X% Per Year

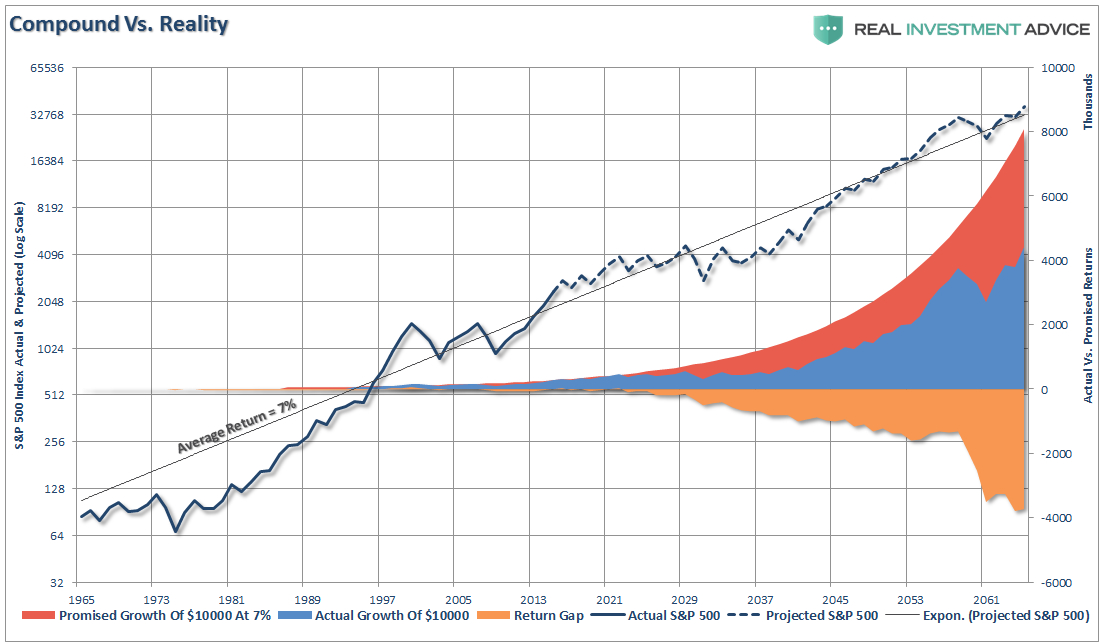

One of the biggest mistakes that people make is assuming markets will grow at a consistent rate over the given time frame to retirement. There is a massive difference between compounded returns and real returns as shown. The assumption is that an investment is made in 1965 at the age of 20. In 2000, the individual is now 55 and just 10 years from retirement. The S&P 500 is actual through 2016 and projected through age 100 using historical volatility and market cycles as a precedent for future returns.

While the historical AVERAGE return is 7% for both series, the shortfall between “compounded” returns and “actual” returns is significant. That shortfall is compounded further when you begin to add in the impact of fees, taxes, and inflation over the given time frame.

The single biggest mistake made in financial planning is NOT to include variable rates of return in your planning process.

Furthermore, choosing rates of return for planning purposes that are outside historical norms is a critical mistake. Stocks tend to grow roughly at the rate of GDP plus dividends. Into today’s world GDP is expected to grow at roughly 2% in the future with dividends around 2% currently. The difference between 8% returns and 4% is quite substantial. Also, to achieve 8% in a 4% return environment, you must increase your return over the market by 100%. The level of “risk” that must be taken on to outperform the markets by such a degree is enormous. While markets can have years of significant outperformance, it only takes one devastating year of losses to wipe out years of accumulation.

Plan for realistic returns in the future as well as adjust and account for market swings that will impact the ending value of your money.

Most Likely You Aren’t Saving Enough

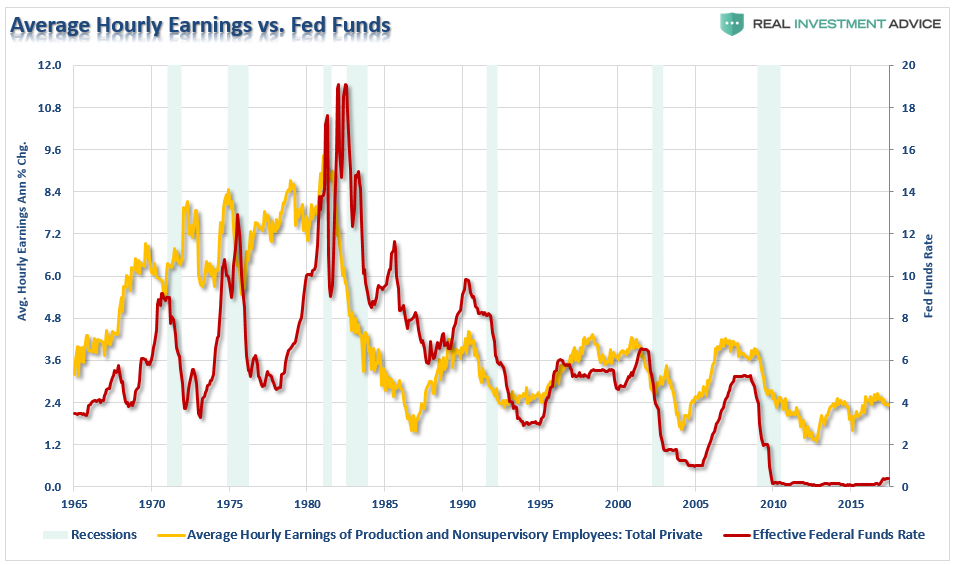

Here are some shocking statistics for you. The average salary in America is about $55,000 a year as per the US Census Bureau. A critical mistake that many individuals make is assuming that salaries will grow at some specific annual rate until you retire. As shown in the chart below, this is not necessarily a realistic assumption.

The other statistic that goes along with this is that the average American has ONLY about ONE year of salary saved up for retirement. The point to be made is that very few individuals have saved adequately enough to actual retire and live off the income their portfolio will generate.

However, for those that “THINK” they have adequate savings, they most likely need to rethink their plan. Given the highly indebted levels of the global economy today, it is impossible for interest rates to rise significantly in the future due to the impact of debt servicing requirements. This means that the old “4% rule of thumb” as a withdrawal rate likely needs to be tucked away in the history books. This also means that most individuals are not just undersaved for retirement, but grossly so. Example:

Mr. Smith needs $60,000 pre-tax to live on in retirement. At 4% interest rates he needs $1.5 million saved up. However, at 2%, that requirement jumps to $3 million.

In reality, most Americans are woefully unprepared for retirement and are hoping that Social Security, or their pension , will provide the social safety net they need to make it through. There is a real probability in the coming years that the massively underfunded status of these programs will lead to less than expected results for retirees.

Retirement Is More Costly Than You Think

Most people that I see are running around with the idea that they can retire on 70% of their current income. In reality, this will leave you far short of the retirement dream that you are hoping for. In a recent survey of 5000 retirees, the average difference between pre and post-retirement incomes was about 12%. The reason is that while your house may be paid off and your children gone at retirement – individuals tend to substitute other items that eat into the retirement budget such as picking up an expensive hobby like golf, traveling more, or spoiling grandchildren. However, the biggest bite out of retirement savings will come from the result of surging medical expenses and higher health care insurance costs.

To be safe, you should be planning on 100% of your current income stream for retirement. If you aren’t – you could find yourself coming up short, and you don’t want to find that out once you are already IN retirement.

Rules Of The Road

You cannot INVEST your way to your retirement goal. As the last two decades should have taught you by now, the stock market is not a “get wealthy for retirement” scheme. You cannot continue to under save for your retirement hoping the stock market will make up the difference. This is the same trap that pension funds all across this country have fallen into and are now paying the price for.

Chasing an arbitrary index that is 100% invested in the equity market requires you to take on far more risk that you most likely want. Two massive bear markets over the last decade have left many individuals further away from retirement than they ever imagined. Furthermore, all investors lost something far more valuable than money – the TIME that was needed to prepare properly for retirement.

Investing for retirement, no matter what age you are, should be done conservatively and cautiously with the goal of outpacing inflation over time. This doesn’t mean that you should never invest in the stock market, it just means that your portfolio should be constructed to deliver a rate of return sufficient to meet your long-term goals with as little risk as possible.

- The only way to ensure you will be adequately prepared for retirement is to “save more and spend less.” It ain’t sexy, but it will absolutely work.

- You Will Be WRONG. The markets cycle, just like the economy, and what goes up will eventually come down. More importantly, the further the markets rise, the bigger the correction will be. RISK does NOT equal return. RISK = How much you will lose when you are wrong, and you will be wrong more often than you think.

- Don’t worry about paying off your house. A paid off house is great, but if you are going into retirement house rich and cash poor you will be in trouble. You don’t pay off your house UNTIL your retirement savings are fully in place and secure.

- In regards to retirement savings – have a large CASH cushion going into retirement. You do not want to be forced to draw OUT of a pool of investments during years where the market is declining. This compounds the losses in the portfolio and destroys principal which cannot be replaced.

- Plan for the worst. You should want a happy and secure retirement – so plan for the worst. If you are banking solely on Social Security and a pension plan, what would happen if the pension was cut? Corporate bankruptcies happen all the time and to companies that most never expected. By planning for the worst, anything other outcome means you are in great shape.

Most likely what ever retirement planning you have done, is wrong. Change your assumptions, ask questions and plan for the worst. There is no one more concerned about YOUR money than you and if you don’t take an active interest in your money – why should anyone else?

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.