Philly Fed Future Activity Points To Weakness

Lance Roberts | Feb 17, 2012 12:42AM ET

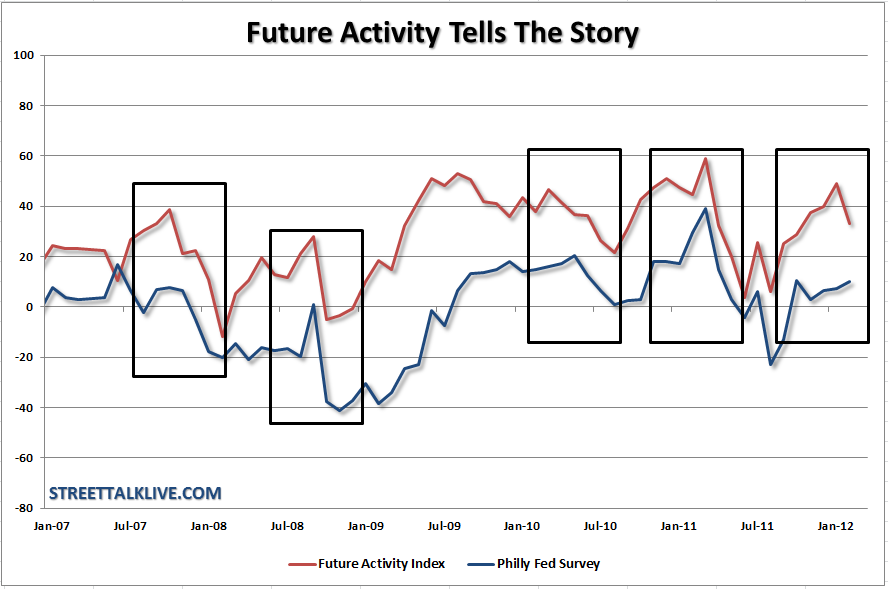

The Philadelphia Federal Reserve Board posted their monthly business activity survey this morning. While the media was quick to jump on the headline number which did show a rise from an anemic 7.5 to 10.2 what was missed was the dive in the expectations of future activity by 16 points. As you can see in the chart above when future expectations dive - the current index tends to follow. While the media dismissed the recent economic numbers out of Europe the manufactures in the Philly Fed region haven't. With big chunk of exports and profits coming from the Eurozone the recession that plagues the region is no trivial matter. If the future activity index continues to weaken we should see weaker numbers out of the current activity index in the months ahead.

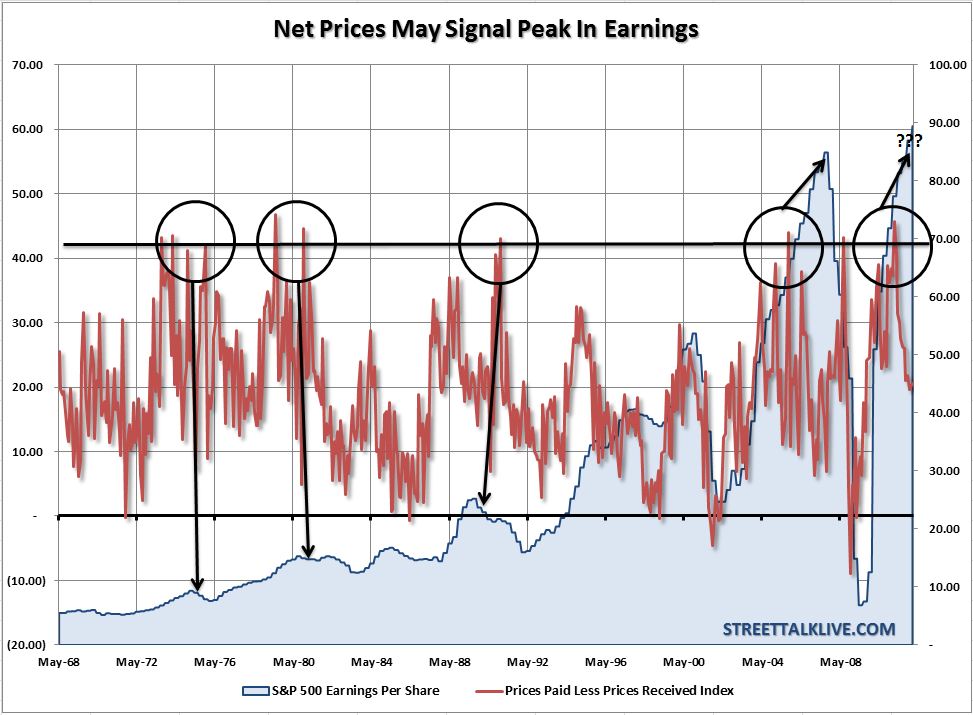

The Empire Manufacturing Index that we saw earlier this week, while up over all, displayed weakness in six out of the nine underlying components. Of particular note was the weakness in new orders and backlogs which doesn't bode well for future economic strength. In today's Philly Fed report we witnessed employment drop by over 10 points from 11.6 to 1.1 which is definitely a sign of concern and prices paid rise which points to profit margin compression ahead.

With profit margins already pushing peaks for this cycle, and the financial markets pricing in extended economic growth, the weakening of margins due to pricing pressures puts investors at risk. Expectations for Q4 earnings were reduced by roughly 50% going into the earnings season and the beat rate of those reduced expectations has still been extremely weak. The markets are currently advancing on hopes of a resolution in Greece but even if that is done it is likely that the repricing of risk in the face of weakening margins will be just as damaging.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.