Park Group: Results In Line And Strategic Plan Taking Shape

Edison | Jul 01, 2019 07:30AM ET

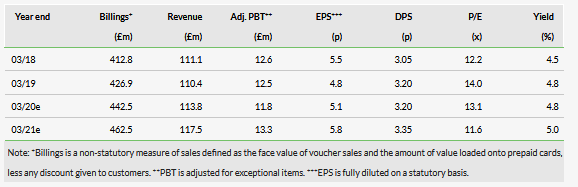

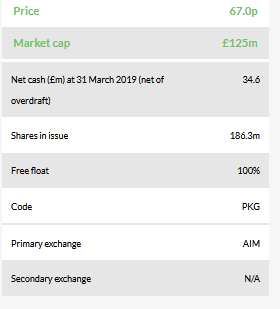

Park Group (LON:PARKP) results for the year to 31 March 2019 were in line with our expectations and those of the market. The core offering of higher-value, own-branded, multi-retailer redemption product, c 85% of billings, showed good progress, although profit deferral to future periods increased under IFRS 15. Despite this and costs associated with the strategic plan, adjusted profits were little changed. Plan implementation costs will have an increased effect this year, but management targets a relatively quick payback period and medium-term income statement benefits of £2–5m pa.

Business description

Park Group is a specialised financial services business and is the UK’s leading provider of multi-retailer redemption products to the corporate and consumer markets. Consumers can access these products directly through its market-leading Christmas Savings offering. Corporate customers use these products to supply a range of incentive and reward products, often tailor-made.

Good momentum in core offering

Billings grew 3.4% to £426.9m or c 5% adjusted for £6.2m of discontinued low-margin business, while higher-value, core multi-retailer billings grew 6.3% with cards particularly strong. IFRS 15 effects related to the growing share of multi-retailer product and cards in particular held back reported revenues and gross profit, with net profit deferral into future accounting periods increasing to c £1.2m from £0.3m in the prior year. Adjusted PBT of £12.5m (FY18: £12.6m) is before the previously disclosed £1.2m property impairment, and if adjusted for profit deferral, one-off pensions costs (£0.3m) and strategic development costs (£0.5m), ‘underlying PBT’ would have been considerably higher and well above the prior year. With total cash balances continuing to grow and a debt-free balance sheet, DPS grew 5%.

Investing for faster medium-term growth

Management expects similar top-line trends in the current year and continues to guide to implementation costs for the strategic business plan of c £2.0m (net of cost savings achieved). This includes the income statement impacts from significantly increased capex. Our FY20 forecasts are little changed, other than the assumption of a pause in DPS growth given the capex requirements, and we introduce an FY21 forecast, which includes reduced net investment costs and further top-line growth but does not capture the medium-term strategic business plan benefits. Management targets P&L benefits of £2–5m pa after FY21.

Valuation: Attractive yield and medium-term growth

Our modified DCF valuation is unchanged at 90p, but now incorporates a two-stage, long-term growth assumption to capture the benefits of the strategic investment (see page 15). With near-term earnings suppressed by investment spend, the implied CY20e P/E at 90p is 18.0x and CY21e 16.2x, which we believe is reasonable.

Investment summary

Company description: Building on strengths

Park has a strong track record of profitable growth and product development, and is supported by a strong, liquid, debt-free balance sheet. It is the UK’s leading provider of multi-retailer redemption products, a market that is large and growing, while fragmentation provides ample scope for market share gains. Having undertaken a business review, the new management team assembled over the past year is implementing a strategic business review aimed at building on the group’s existing strengths and market positioning to accelerate growth, and improving efficiency by enhancing its products, providing product and branding clarity, and investing in its core infrastructure with a particular focus on increased digitalisation.

Financials: Investing for growth

FY19 saw good underlying progress in Park’s core multi-retailer redemption offering, and through the business-to-business (B2B) channel. We expect these trends to continue over the next two years, although the current (FY20) year will be affected by implementation costs for the strategic business plan. We expect further investment costs in FY21, but at a reduced level and supporting FY21 profit growth. Management targets a payback period of no more than three years from the investments planned and from 2021 onwards (effectively affecting FY22 and outside our forecasting period) aims for £2.0–5.0m pa in income statement benefits. Park’s business model generates strong operational cash flow, and it has a liquid and debt-free balance sheet to support its investment plans. Given the scale of the investment, we forecast a pause in dividend growth in FY20 before growth resumes in FY21.

Valuation: Attractive yield and medium-term growth

Our approach to valuing Park is to consider a potential absolute valuation, based on a modified DCF analysis, alongside a relative value based on a comparison with a selected group of listed stocks which are engaged in activities that provide some overlap with Park. Our DCF value is unchanged at 90p, although we have introduced an intermediate stage of growth to capture the benefits of the strategic business plan investment. Given that our near-term forecasts are suppressed by investment spending and capture none of the benefits, it is difficult to attach a target multiple, but we note that the 90p DCF value implies P/E multiples (18.0x CY20 and 16.2x CY21) that appear reasonable in the context of the comparator stocks. Meanwhile, Park offers an attractive yield approaching 5% with dividends well covered by earnings and supported by a strong debt-free balance sheet.

Sensitivities

Our forecast assumptions are set out in detail in the financial section below. The key sensitivities to our outlook for the business (and discussed in more detail on page 16) are:

- The impact of interest rates on cash balances.

- General economic growth.

- Brand perception and customer confidence, especially in Christmas savings.

- Business continuity and IT.

- Regulation, especially in respect of e-money.

UK leader in multi-redemption cards and vouchers

Park Group is a UK-based, specialised financial services business, and is the UK’s leading provider of multi-retailer redemption products (cards, vouchers and e-codes) to the corporate and consumer markets. The UK market is large (the UK Gift Card & Voucher Association estimates c £6bn per year) and growing, while fragmentation provides ample scope for market share gains.

Customers access Park products directly in the business to consumer (B2C) channel through the Park Christmas Savings and the online highstreetvouchers.com brands, while the business to business (B2B) access brand Love2shop Business brand provides similar products to business, primarily for customer and employee incentives and rewards programmes. Park’s own in-house, multi-retailer redemption products are the core of its offering, accepted by a wide range of carefully selected retail partners, and account for the overwhelming majority of billings (c 85% of the total in FY19). It also offers third-party sourced single retailer products (eg M&S gift cards), a range of goods (hampers and other merchandise) and provides various services (eg software as a service).

For the group as a whole, the majority of sales are generated online, which complements and supports traditional distribution through a direct salesforce and agents. Most income is generated from the service fees paid to Park by partner retailers, leisure and other service providers, based on the face value of money spent in their outlets. Interest is earned on all prepaid cash until the obligation to the redeemers has been settled.

Park has a cash-generative business model, a debt-free balance sheet and a good track record of profitable growth, supporting a progressive dividend policy. This is a very positive starting point for the new senior management team to build on. The new strategy that was presented in December 2018, following a comprehensive review of the business, has identified a number of opportunities to accelerate growth and improve efficiency. The core multi-retailer redemption offering, where the scale of the market provides significant potential, will be given even greater focus and the digitalisation of the business will be accelerated to enhance the attractiveness, accessibility, reach and delivery of existing products, tap new market segments and areas of demand, and enhance efficiency.

In the following section, we review Park’s business model and strategy, including a discussion of IFRS 15 accounting. Readers already familiar with the company may wish to go to page 9 where we review the recently released FY19 results, followed by an update on our financial forecasts and valuation.

Business model and strategy

Hampers to fintech

As a multi-million-pound leader in the UK multi-retailer redemption market, the Park of today is unrecognisable from its origins as a Christmas hamper supplier, established in 1966, and run out of the family butchery chain of founder Peter Johnson, who retired as chairman in 2016. Over the years, Park first introduced multi-retailer redemption vouchers into the Christmas savings business (in the 1980s), an attractive and convenient alternative to hampers for customers, and later expanded its distribution by entering the corporate (B2B) market. The 2010 introduction of FCA-authorised prepaid cards, supported by the in-house developed ‘flexecash’ card engine, marked the start of the group’s further evolution towards the electronic and digital product that now accounts for a little more than half of core billings.

Exhibit 3: Product split (FY19)*

The specialised financial service business of today

Exhibit 4 provides a pictorial summary of the group and its business model. Consumers have traditionally accessed Park products directly through the Christmas savings offering, but in recent years have increasingly done so through the fast-growing highstreetcouchers.com (hsv.com) website. Park is the UK market leader in Christmas savings, accounting for 92% of FY19 Consumer business billings, and operates in the UK under the Park, Family and Country brands and in Ireland under the Park Ireland brand. Christmas savings customers purchase its own multi-retailer redemption products, third-party retailer cards and vouchers, hampers and other goods, typically on a 45-week prepaid instalment plan, which offers them a way to budget for Christmas and a relatively convenient way of shopping. Customers and agents are typically recruited from September/October onwards for orders that will be fulfilled in Christmas of the following year and as a result, the first half of the financial year is loss-making, with most revenues and all of the profits generated in the second half. Many customers still prefer to deal with Park via agents (we estimate a little more than half), although a growing share of customers deal directly with Park, encouraged by its ongoing investment in e-commerce and mobile enablement, and use of social media. The 1.8% decline in Christmas 2018 customers to c 428k obscures the success in attracting a record c 60k new direct accounts, substantially offsetting the steady attrition of agency customers, which mirrors other agency distribution business. The strategic plan includes a number of initiatives aimed at improvements in both products and customer experience that are designed to support further growth in direct customers as well as supporting the agency channel.

The hsv.com website served 133k other (ie non-Christmas savings) consumer customers in FY19, up 10% on the previous year. Unlike Christmas savings, purchases are more ‘ad-hoc’ and spontaneous, and average order sizes are smaller with shorter duration customer cash balances on which to earn interest.

Exhibit 4: Park Group business model

Consumers are also provided with Park products indirectly through the corporate access brand Love2shop Business. The Corporate business provides c 37k businesses with primarily customer and employee incentive, recognition and rewards products, and packages based on the broad Park product offering. Park estimates that c 2m individual recipients receive its products indirectly through the B2C channel, for redemption with retail and other partners. The core incentive and rewards product has shown strong growth over a number of years, although progress at the divisional level has been tempered by reductions in other areas such as sales to the home collected credit sector and intermediaries. This underlying growth has been supported by ongoing product investment and the development of flexible online platforms. The customer base has typically been ‘SME’ in nature, although larger businesses are increasingly being targeted.

Park’s own multi-retailer redemption products are provided under the Love2shop brand, the UK’s leading multi-retailer gift card and prepaid card brand, with high levels of customer awareness. The voucher is accepted by almost 200 retail and other partners in more than 25,000 outlets, while the card, requiring additional connectivity, is accepted in a more focused subset of this group. Historically, the multi-redemption product has operated within the ‘closed-loop’ network of retail partners from which it receives service fees. However, in 2016 Park began to sell a Mastercard (NYSE:MA) product, for ‘open-loop’ use at a broader range of outlets and for which customers have proved willing to pay a premium for the added flexibility.

In addition to Park’s own multi-retailer redemption offering, customers also purchase Park hampers and other third-party merchandise, and third-party single retailer cards and vouchers. Corporate customers also pay consultancy and service fees in respect of incentive rewards programmes provided by Park.

A key performance indicator for the group is billings, a non-statutory measure of customer activity, which represents the gross value of vouchers, cards, and other goods and services provided. This is our preferred measure of ‘sales’ as, unlike statutory revenues, it is unaffected by changes in business mix between multi-retailer redemption product and other goods and services, including single retailer cards, vouchers and e-codes.

Revenues for the core multi-retailer redemption products are reported ‘net’, representing the service fee received by Park from the partner retailer when the card, voucher or e-code is redeemed, as well as cardholder fees and breakage, also recognised in line with redemption. Cardholder fees are levied, at card expiry, on unspent balances in respect of cards where the holder has a right of redemption. Breakage relates to the recognition of unspent balances on vouchers and cards where the holder has no right of redemption. The introduction of IFRS 15 for the first time in FY19 brought voucher reporting (previously on a ‘gross’ basis) into line with cards and greatly reduced reported revenues but not ultimate profitability (ie excluding timing recognition effects). Because revenues are reported net, there is no cost of sales and gross margin is therefore 100%.

Revenues for single-retailer redemption products and other goods and services continue to be reported on a gross basis, representing the gross value of goods and services shipped and invoiced to customers in the period. The reported gross margin, after cost of sales, is significantly lower than that reported for multi-retailer redemption product.

A more detailed explanation of the impact that IFRS 15 has had on the financial statements can be found on page 17. It is important to note that cash flow and ultimate profitability were unaffected by the new accounting standard.

Strategic opportunities to accelerate growth

The strategic review undertaken by the new management team during the second half of 2018 and communicated to the market in December 2018 recognises the group’s significant historical development in multi-retailer redemption products, where it is the leader in a fragmented UK market, and its good track record of profitable growth, but concluded that there is much that the group can do to improve its current offering and performance, and there is significant untapped market potential still to be addressed. Feedback from this customer review showed that there is a strong appetite for the multi-retailer product in the market and that Park is generally well regarded by its own customers, but with upside potential to increase revenues and efficiency from improving and simplifying the product range, as well as how the products can be bought and used. Market analysis indicates there is untapped potential in the £2bn+ consumer market for multi-redemption cards and vouchers in which it is currently only modestly represented.

Significant market opportunity

The UK Gift Card & Voucher Association, an industry trade body, estimates that the UK market has shown double-digit annual growth over the past five years to reach more than £6bn. It estimates that growth in the second half of 2018 was 11.7%, up from 8.7% in the first half. Within this overall market growth there is a significant trend shift in the mix of product formats with cards, and to an even greater extent digital, growing strongly and increasing share at the expense of paper vouchers. This trend is not new, and Park has been investing in its card and digital capabilities over many years. However, the new management team intends to push this transformation harder to support growth in existing markets, open new markets and improve efficiency.

Further analysis of the marketplace highlights a particular opportunity from addressing the broader consumer market for a multi-redemption product, alongside Park’s existing dominant position in the Christmas savings consumer segment and strong positions in the corporate market segments (Exhibit 6). Park believes that enhancements to its product offering are also likely to strengthen its appeal to business customers.

Strategic business plan initiatives and actions

Park’s strategic business plan and investment is aligned with industry growth and the strong trend towards card and digital delivery. In brief, the four pillars of the strategy (with more details below) are:

- Productivity. Park wants to be more efficient and effective in what it does. It is investing in people technology and services and is in the process of moving the majority of its core operations to new offices in Liverpool’s city centre.

- Appeal. Park wants to broaden its customer appeal to drive faster growth, including the launch of new product targeting a broader customer base. It has already expanded its e-code and virtual card offering, is exploring opportunities to establish an in-store gift card, and is reviewing its marketing practices with the goal of getting better value for the money that it spends.

- Clarity. The core multi-retailer redemption offering has been given even greater focus, with a simplified product range, faster migration from paper to card, and a review of the brand architecture. To provide focus, the hamper production operation has been separated out and management structures have been realigned to better co-ordinate the key functions of customer management (consumers, businesses and retailers), and product and marketing,

- Experience. Park recognises the potential from being easier to work with for all its customers, consumers, business customers and retailer partners.

Relocation well advanced

The group is in the process of moving the majority of its core operations to new offices in Liverpool’s city centre (fulfilment and redemption activities will remain at the current site, along with separated hamper production). The existing site is effectively industrial, with scattered office buildings that are inappropriate to support efficient, creative and collaborative working. The move is also intended to provide the core activities with access to a wider talent pool, benefiting from an existing hub of like-minded fintech businesses in central Liverpool. Management anticipates that productivity improvements and the potential sale or subletting of vacated space should substantially mitigate the cost of the move and accelerate the payback period.

Accelerated digitalisation

Park has accelerated its IT investment in both back office functions and digital capability in order to improve both efficiency and functionality. In the near term, investment in digital enablement will see enhanced app capability, new mobile digital enablement and new personalised e-delivery of e-codes. An immediate goal is to be able to offer full digital enablement across the product range, integrated to support contactless and mobile wallets for consumers. Over the medium term, management would like to reach a point where digital products are the default, with paper vouchers and cards providing support as demanded by consumers, rather than representing separate product lines. If achieved, the ease of use for the consumer would be greatly enhanced. With the technology in place, it should also be possible to develop a common list of retailers/redeemers across payment methods, and also to provide valuable analytical feedback to the retailers.

New consumer product

The group continues to work on the details of a new product targeting a substantial share of the £2bn+ consumer market for multi-redemption cards and vouchers in which it is currently only modestly represented. The process is still at a relatively early stage and management has given few details as yet. It is expected that a prototype will soon be completed and that market testing will commence later in 2019. The intention is to build on existing strengths, while more effectively targeting a broader demographic than the current Christmas savings business and will initially focus on gifting. Recognising market trends and the fact that by 2020 half of the workforce will be millennials, the product is expected to be digitally enabled and allow for greater personalisation so as to make the gifting process a more rewarding experience for the consumer. It seems likely that the profitability of the product will continue to be driven by retailer service fees and interest earned on customer balances, although compared with Christmas savings these balances may be of shorter duration and potentially more variable.

Strategic plan financials

Management has not changed its previous guidance that the implementation costs for the strategic business plan will negatively affect the current (FY20) year by £2.0m, net of savings that are already being achieved. This includes £1m of investment in the new consumer market product, £0.8m in temporary overlapping property costs resulting from the relocation of the core operations, and £1.0m in technology-related costs, offset by cost benefits of £0.8m realised during the year.

Additional IT capex to support implementation of the strategic plan is expected to be c £4.0m over the next two years, with a three-year payback period. Property capex related to the migration of the core activities to central Liverpool will generate £1.5m of property capex in the current (FY20) year, but management expects the disposal of redundant property assets to generate proceeds of c £5.0m in FY21.

Income statement benefits of £2.0–5.0m are targeted by management from 2021 onwards, effectively emerging from FY22. This expectation is based on:

- reduced costs of paper vouchers and related overheads;

- improved margins from the mix shift to card, code and virtual products;

- operating efficiencies from the office move, offsetting rental costs; and

- incremental customers and revenues as a result of the new product, once launched.

Management and governance

A substantially new senior management team has been assembled over the past year or so, led by chief executive Ian O’Doherty, who joined Park in January 2018. He brings a strong background in financial services, specifically in banking, payments and card services, which appears well suited to leading the continued development of the business. Prior to joining Park, his experience includes 25 years at MBNA, most recently as chairman and CEO of MBNA in the UK, where he oversaw the reorganisation of the business and the re-engineering of its digital capabilities. The new CFO, Tim Clancy, took up his post in August 2018, joining Park from Assurant (NYSE:AIZ) Europe, the European subsidiary of Assurant, the US-listed global insurance provider, where he had held the role of chief financial officer since 2013. That role has included overseeing several acquisitions in the UK and Europe and their integration into the group. Other important appointments have been made in the areas of operation and technology, including a new chief information officer, chief transformation officer and head of HR.

Overseeing and steering the group through the changes in management has been the board of directors, comprising five members, led by non-executive chairman Laura Carstensen, and including two additional non-executive directors in addition to the executive members, the CEO and CFO. Laura Carstensen was elected to the board in September 2013 and became chairman in June 2016. She is a former partner in city law firm Slaughter and May, and a former member and deputy chairman of the UK Competition Commission (now the Competition and Markets Authority). In view of her experience both inside and outside of the group, we welcome the recent announcement that she has agreed to continue in her role for another three years from June 2019, ensuring that she will remain fully involved in guiding the executive team as it continues to implement the strategic business plan.

The other two non-executive directors are Michael de Kare-Silver, who joined the board in September 2013 and intends to retire by rotation at the 2019 AGM, and John Gittins, who joined the board in September 2016 and has more than 20 years’ experience as a CFO across a number of sectors and territories.

Good FY19 progress with the core offering

FY19 results were in line with our expectations and market consensus and showed good underlying progress in Park’s core offering of higher-value, own-branded, multi-retailer redemption products. At the headline level, sales were negatively affected by the discontinuance of some low-margin business and, although the business mix developments are positive for margin, the deferral of revenue and profit to subsequent reporting periods increased under IFRS 15 accounting. Peak cash flow increased further, maintaining a strong debt-free balance sheet and supporting dividend growth.

We discuss the FY19 results in detail below and in the following sections provide a detailed overview of our forecasts and valuation.

The key financial and operational developments for the period were as follows:

- Group billings increased by 3.4% to £426.9m (FY18: £412.8m), driven by good growth in Corporate with Consumer billings broadly flat.

- Corporate billings grew 8.1% to £194.8m, or 46% of the total, despite the discontinuance of £6.2m of low-margin third-party product through the intermediary channel. Strong growth was achieved in incentive and rewards products, and Park was particularly successful at attracting new larger clients, with revenues from new clients who billed more than £100k increasing fivefold. The total number of corporate clients served by Park increased by 7.5% to just over 37,000.

- Reflecting the group’s strategy to promote its own-branded product, multi-retailer billings (cards, vouchers and e-codes) increased by 6.3%, while third-party single retailer billings and other income (hampers and other goods, fees and services) were lower. The share of multi-retailer product increased to 84.9% from 82.6% the year before.

Within the mix of multi- and single retailer billings, cards grew strongly, increasing the share of the total to 47.7% (FY18: 42.3%). In underlying terms, adjusting for a £4.3m negative impact as part of the discontinued intermediary business, codes also advanced and paper (vouchers) declined. These mix changes reflect structural changes in the marketplace and the group’s strategy, and the higher margin earned on cards is positive for ultimate profitability.

- Revenues were marginally lower, down 0.6% to £110.4m. Multi-retailer redemption product revenues were strongly ahead, including an increased share of higher-value cards and reflecting the trend in billings. However, as these sales are reported on a net basis, the impact was outweighed by the lower revenues from single retailer product, reported on a gross basis, and to a lesser extent the small reduction in other income. The lower revenue on single retailer product includes the effect of the discontinued intermediary business.

- The increased share of multi-redemption business in the year increased the net deferral of revenues and gross profit in the year. Gross profit reduced slightly, by 0.5% to £31.3m, as the net revenue deferral increased to £1.2m from £0.3m in FY18.

- Distribution costs fell slightly despite increased billings, reflecting operational efficiencies made possible by the continued increase in digital product delivery. Administrative expenses rose modestly despite c £0.5m of expenses related to the strategic review undertaken by the new management team, c £0.5m of additional payroll costs relating to the new management team, and a one-off pension charge of £0.3m relating to a UK court ruling in respect of guaranteed minimum pensions for males and females. The main offset was a significant reduction in share-based payment expenses of c £0.4m.

- As previously disclosed, the FY19 results included an exceptional non-cash impairment charge of £1.2m due to the write-down of the value of its Valley Road site following an external review by property consultants. Much of the site will be surplus to requirement as the group shifts its core business functions and most of its staff to new offices in the centre of Liverpool, and the group is considering the options, which may include a sale and leaseback of those areas still required.

- Net finance income benefited from an increase in average cash balances (both the shareholder balance and the segregated customer balances on which Park earns interest) and a slight pick-up in interest margin, reflecting firmer short-term bank deposit rates. The seasonal ‘peak’ cash balance for the year reached £235.8m (FY18: £229.0m) and the average cash balance during the year was £174m (FY18: £165m).

- Reported PBT was £11.3m compared with £12.6m in FY18. Adjusted PBT, excluding the exceptional charge, was £12.5m, little changed on FY18. Further adjustment for the increased IFRS 15 impact, non-recurring pensions costs and strategic development costs suggests an underlying PBT of more than £14m and provides a better indication of the underlying progress in the year.

- Net income of £8.9m was 12.8% lower than in FY18 and diluted EPS was 4.77p. The final dividend was declared at 2.15p per share, up 4.9% on the year, making a total dividend for the year of 3.2p, also ahead by 4.9%. The continued increase in DPS reflects a good level of earnings cover, a strong liquid and debt-free balance sheet, and management confidence for the future.

Forecasting assumptions and estimates

FY19 in line and modest changes to FY20

As noted above, the FY19 results detailed in the section above were very much in line with our estimates, revised after the trading update in late April 2019, and market consensus. Billings were slightly ahead of our expectations and revenues very slightly below due to the IFRS 15 effects being slightly greater than we had allowed for. Adjusted PBT was in line with our estimate, but the tax charge was higher than we allowed for, due to the treatment of the exceptional property impairment, with a small impact on net income and EPS.

We set out our forecasts in detail below, but in summary we have made only a small change to FY20 billings, although our revenue forecast shows a slightly larger adjustment as we continue to refine our forecasting under IFRS 15. We expect Park’s own-branded, multi-retailer redemption product to grow faster than overall billings and this is positive for margins and PBT (forecast marginally increased). The only material change to our FY20 forecasts is that we now assume DPS will be held at the same level as FY19, reflecting the strategic investment spending that will negatively affect PBT by a net c £2.0m. Strategic investment spending will also affect cash flow in FY20, but we expect the shareholder cash balance to remain strong at c £34m.

We also introduce FY21 estimates for the first time. We expect similar underlying trends, with continued growth in billings and the share of multi-retailer redemption product. We have not factored in any significant benefit from the strategic investment programme but do expect profitability to benefit from a reduction in net strategic spending.

Key forecasting assumptions

Our key forecasting assumptions include further growth in billings, with a focus on multi-retailer redemption products. Under IFRS 15 accounting, we expect this business mix to suppress revenue growth relative to billings growth, but to be positive for profitability. The caveat is that if the multi-redemption share of billings is materially stronger than we forecast, this may increase profit deferral into subsequent periods, as was seen in FY19. Specifically, we forecast:

- Billings growth driven by Corporate. We look for a slight increase in billings growth during FY20 and FY21, driven by continued growth in Corporate, focused on incentive and rewards products, and modest growth in Consumer, with continued strong growth in direct (hsv.com) sales and slight growth in the larger Christmas savings business in FY21. We have not allowed for any material impact from the strategic business plan or any contribution from the planned new consumer product during the forecast period.

- Further increase in share of multi-retailer redemption and cards/e-codes. In terms of product mix, in line with management’s strategy and market trends, we expect faster growth in Park’s own-branded, multi-retailer redemption product, and within this in cards and e-codes. This mix shift is positive for ultimate profitability.

- Under IFRS 15, revenues will continue to trail billings. Given the growth that we forecast in multi-retailer redemption (reported net) versus single retailer (reported gross), we expect revenues to grow but at a lower rate than billings. Implicit in our assumptions is a broadly stable pattern of redemption activity and we also note that if the share of multi-retailer redemption products increases at an even faster rate than we forecast, this will tend to further suppress revenues versus billings.

- We expect gross profit to increase at a faster rate than either billings or revenues. This is driven by the increasing share of higher-profitability, multi-redemption product in our forecast sales mix, reported on a net basis, or effectively a 100% gross margin on revenues. In FY19, the strong increase in growth and share of multi-redemption product led to an increase in revenue and gross profit deferral, but our forecasts for a more moderate shift in product mix during FY20 and FY21 indicate a closer balance between new revenue deferral and run-off or revenue emergence from prior years. The increase in gross margin that we forecast, both relative to billings and revenues, reflects the mix shift towards higher-margin product and implicitly assumes no change in product margins or redemption patterns.

- Our forecasts for administrative costs reflect management’s guidance of a net £2.0m in strategic business plan implementation costs in FY20. We expect some of this to fall away in FY21, substantially offsetting upward pressure from business growth and inflation in the year.

- We expect interest income to grow modestly, driven by continued growth in total cash balances (monies held in trust and shareholder cash), and reflecting order and billings growth, particularly cards. We assume a similar c 0.9% margin on balances to that earned in FY19.

- Our shareholder cash flow forecasts reflect the additional IT investment (£4.0m over two years) and property investment/disposal (£1.5m investment in FY20 and £5.0 disposal proceeds in FY21) guided to by management, and the recurring depreciation and amortisation effects are captured in our income statement forecasts.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.