Pandemic 2020 Is Gone. Will 2021 Be Better For Gold?

Sunshine Profits | Jan 15, 2021 05:57AM ET

Hurray! The disastrous year of 2020, which brought about the COVID-19 pandemic, the Great Lockdown, and the economic crisis, is over! Now, the question is what will 2021 be like – both for the U.S. economy and the gold market.

To provide an answer, below I analyze the most important economic trends for the next year and their implications for the yellow metal.

- Society gains herd immunity by vaccination and the health crisis is overcome.

- With herd immunity approaching, the social fabric returns to normality, and the economy recovers.

- The vaccine rollout increases the risk appetite, reducing the safe-haven demand for both gold and the greenback .

- The return to normality and realization of the pent-up demand (comeback of spending that was put on hold during the U.S. epidemic ) accelerates the CPI inflation rate .

- The Fed stays accommodative, but the recovery in the GDP growth and the labor market makes the U.S. monetary policy less aggressively dovish than in 2020.

- However, the Fed continues to use all of its tools to support the economy in 2021 and, in particular, it does not hike the federal funds rate, even if inflation rises.

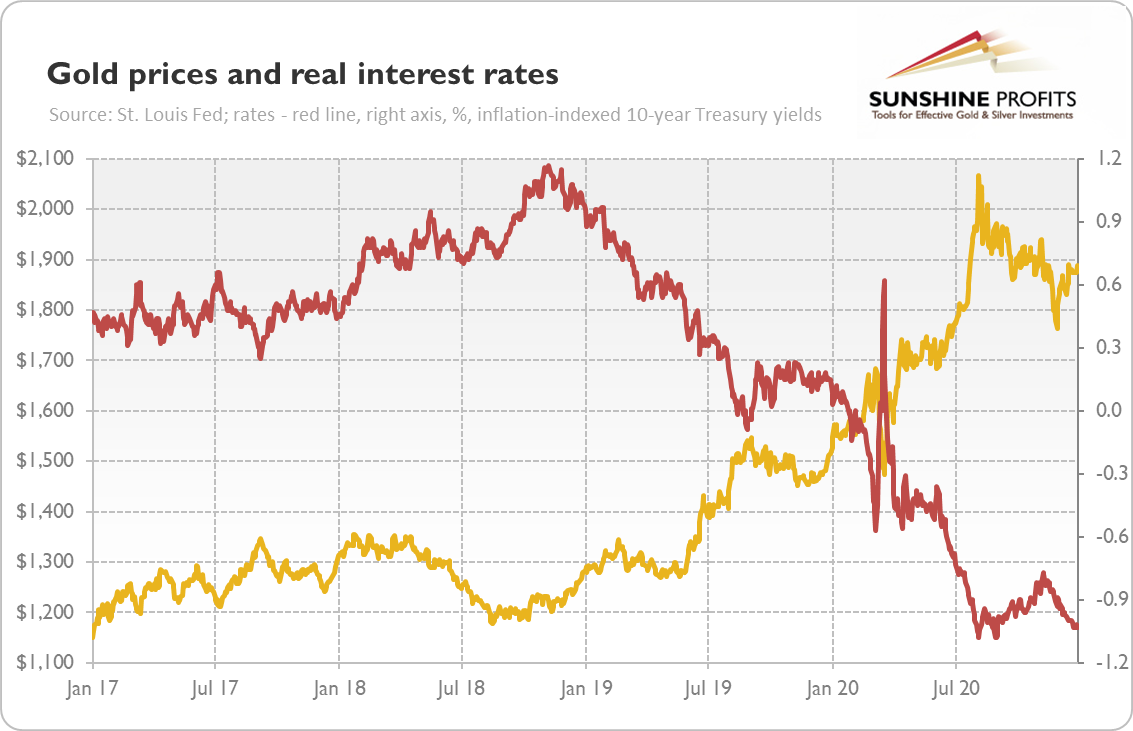

- As a result, the real interest rates stay at ultra-low levels. However, the potential for further declines, similar in scale to 2020, is limited, unless inflation jumps.

- The American fiscal policy also remains easy, although relative to 2020, government spending declines, while the budget deficit narrows as a share of the GDP.

- However, the public debt burdens continue to rise. Although the ratio of debt to GDP decreased in Q3 2020 amid the rebound in the GDP, it’s likely to increase further in the future, especially if Congress approves the new fiscal stimulus.

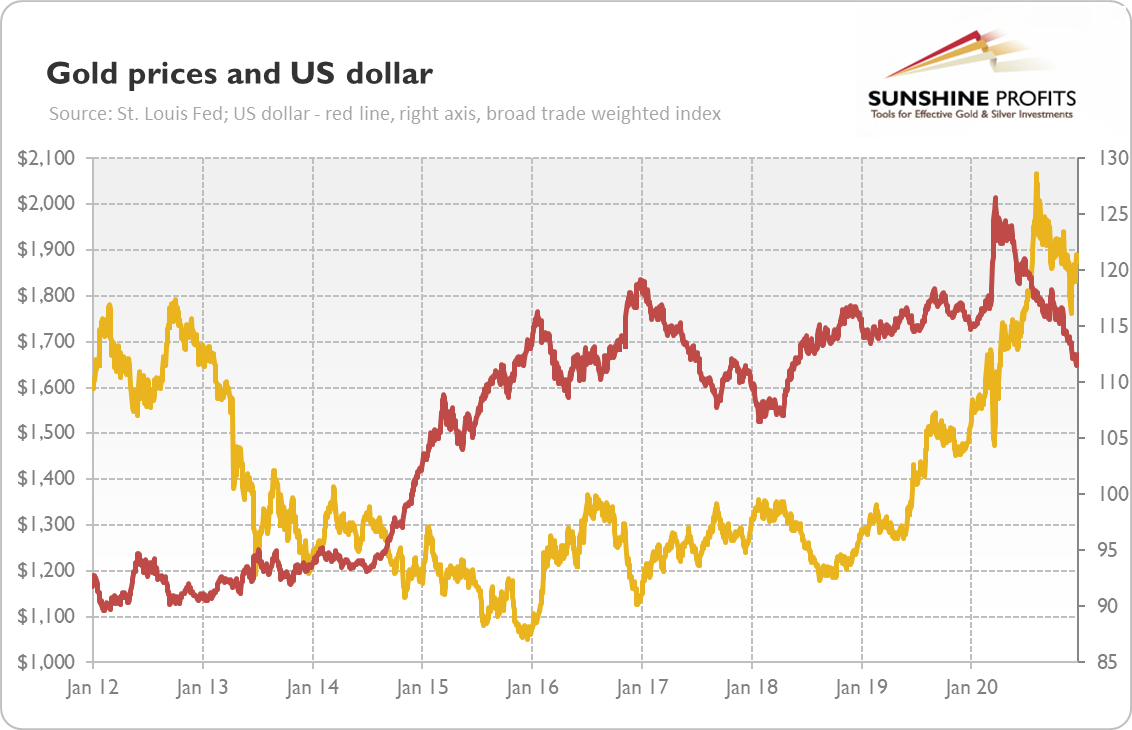

- Given the dovish Fed conducting a zero-interest rate policy , increasing debt burden, and strengthened risk appetite amid the vaccine rollout, the U.S. dollar weakens further. The American currency has already lost more than 11 percent against a broad basket of other currencies since its March peak.

What does this macroeconomic outlook imply for the gold prices? This is a great question, as some of the trends will be supportive for the yellow metal, while others might constitute headwinds, and some factors could theoretically be both positive and negative for the price of gold. For instance, the end of the recession seems to be bad for the yellow metal, but gold often shines during the very early phase of an economic recovery, especially if it is accompanied by reflation, i.e., a return of inflation.

The tailwinds include the continuation of easy monetary and fiscal policies. The federal debt will remain high, while the interest rates will stay low, supporting the gold prices, as was the case in the past (see the chart below).

There is also an upward risk of higher inflation. In such a macroeconomic environment, the U.S. dollar should weaken against other currencies, thus supporting gold prices. As a reminder, the relative strength of the greenback in recent years (see the chart below) limited the gains in the precious metals market.

However, there are also headwinds. You see, levels are significantly different concepts than changes. The latter often matter more for the markets. What do I mean? Well, although both monetary and fiscal policies will remain accommodative, they will be less accommodative than in 2020. Although the real interest rates should stay very low, they will not decline as much as last year (if at all).

In other words, the economy will normalize this year after suffering a deep downturn in 2020, so the economic policy will be less aggressive. Hence, the level of bond yields and the ratio of federal debt to GDP should stabilize somewhat – actually, thanks to the rebound in the GDP in the third quarter of 2020, the share of public indebtedness in the U.S. economy has decreased, as the chart below shows.

Hence, although the price of gold could be supported by the continuation of easy monetary and fiscal policies, low real interest rates, and weak dollar, it’s potential to rally could be limited. The accommodative stance of central banks and unwillingness to normalize the monetary policy for the coming years should prevent a significant bear market in gold, but without any fresh triggers of further declines in the bond yields or without the spark of inflation, the great bull market is also not very likely. So, unless we either see a serious solvency crisis or sovereign debt crisis, or an substantial acceleration in inflation, gold may enter a sideways trend. Or it can actually go south, if it smells the normalization of monetary policy or increases in the interest rates.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts .

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.