Overreaching Enthusiasm?

Declan Fallon | Nov 24, 2014 12:31AM ET

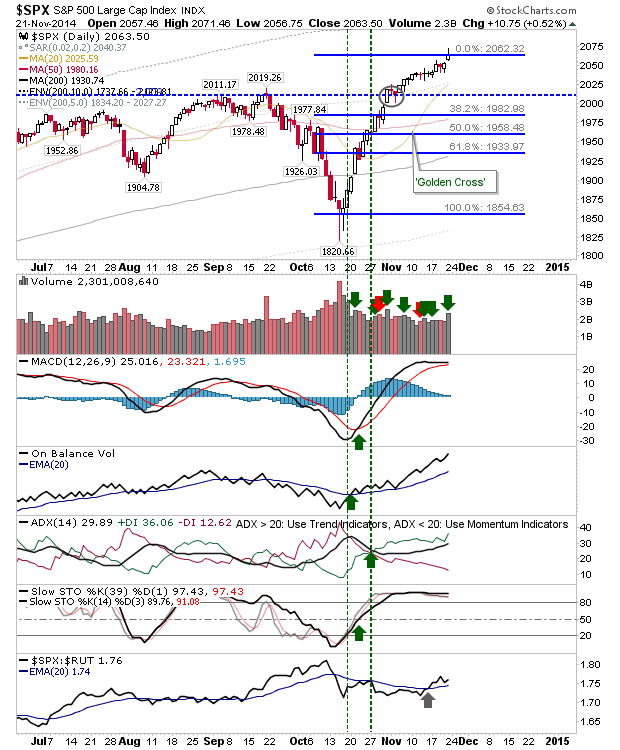

Bullish monetary policy rumblings from China and Europe had kick started a bright opening for markets on Friday, but the feel good factor gradually wore off as the day lengthened, and in the end, the day felt oddly bearish. The S&P 500 closed with a bearish inverse hammer, which could turn into a bearish shooting star if there is a gap down today, Monday. Volume climbed to register technical accumulation, but this could mark significant overhead supply if sellers come back today. I have widened the Fib levels for the next decline. Note, pending MACD trigger 'sell,' although other technicals are in good shape.

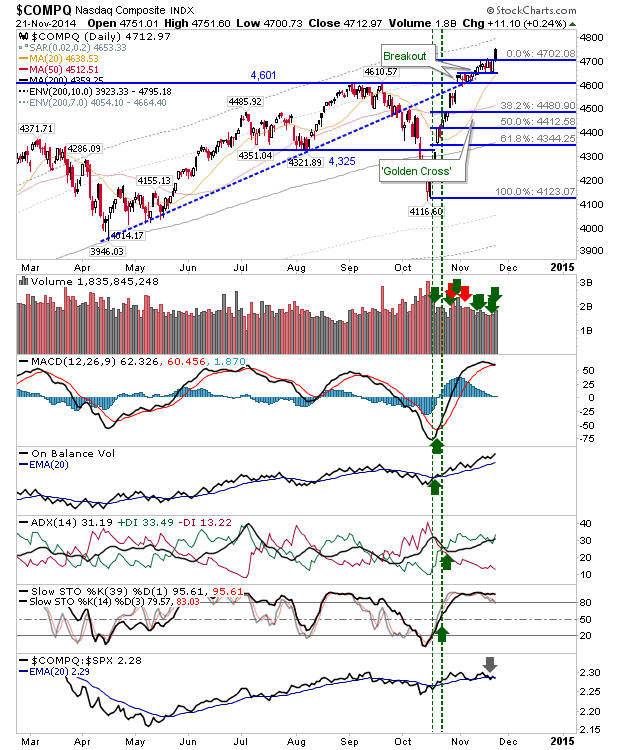

The NASDAQ did alright as it emerged from a secondary handle. The 'black' candlestick finished close to breakout support, and there isn't much room for further losses. It also looks more likely to trigger a MACD trigger 'sell'. There is also a worrying relative shift away from (speculative) technology stocks to safety first, Large Caps.

The Russell 2000 is working a challenge on a 'bull trap', but it's doing so under the cover of larger resistance. I have widened Fib levels and drawn in what might evolve into a 'bull flag.' Technicals are mixed, and with flatline moving averages this isn't offering a clear advantage one way or the other. Even the relative relationship to other indices is lacking direction.

One index which is still offering bulls something is the Semiconductor Index. Friday's 'spinning top' is neutral, but it has knocked out the September 'bull trap.'

The other watch area for Monday is the tag of the declining resistance for the NASDAQ Summation Index and NASDAQ Bullish Percents. This might mark a reversal point for the NASDAQ - which would also suggest the 'black' candlestick in the NASDAQ will mark a swing peak top.

For Monday, look for a reversal opportunities in the S&P and NASDAQ. If bulls manage a bright start, then the Semiconductor index could deliver fresh upside.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.