Overbought Conditions Extend Further As Currencies Flash Major Signals

Dr. Duru | May 10, 2013 01:55AM ET

: 75.8% (5th overbought day)

VIX Status: 13.1

General (Short-term) Trading Call: Hold (see below for more details)

Commentary

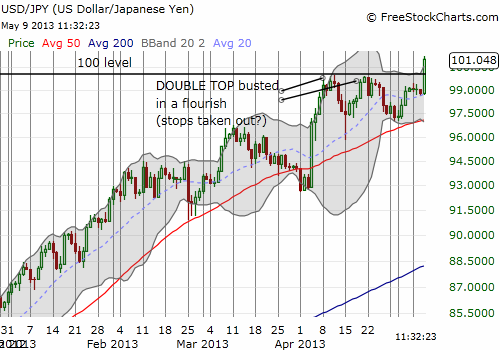

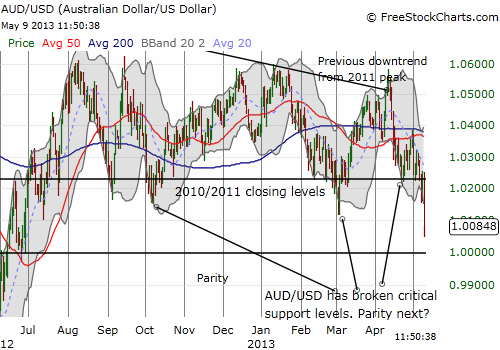

T2108 closed at 75.8%; its 5th overbought day. This is above the median duration of 4 days for an overbought period (at or above 70%) but less than the average of 7-8 days. T2108 is also still within the region of maximum downside risk as discussed in A Mystifying Rate Cut By The Reserve Bank Of Australia .”) With the euro and pound also weakening against the U.S. dollar, I am inclined to think of this move more as a dollar-strong, than a yen-weak move, even as the Aussie surged against the yen as well. Hopefully, the signals will get sorted out in the coming days or week. Until then, I am on high alert (and making numerous quick trades shorting yen and Aussie against the U.S. dollar along with other opportunistic trades – this is the time to make them while stops are getting taken out and trade triggers are fast and loose). Here are the tell-tell charts…

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Be careful out there!

Full disclosure: long CAT shares and puts, short AUD/USD

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.