Outlook For Alcohol Industry Dim On Soft Beer Sales & Tariffs

Zacks Investment Research | Sep 29, 2019 11:11PM ET

Companies producing, importing, exporting, marketing and selling alcoholic beverages like beer, craft beer, draft beer, ciders, wine, rums, whiskey, liqueurs, vodka, tequila, champagnes, brandy, amaretto, ready-to-drink cocktails and malt mainly constitute the Zacks Zacks Industry Rank , which is basically the average of the Zacks Rank of all the member stocks, indicates gloomy near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group’s earnings growth potential. In the past year, the industry’s earnings estimate for the current year has moved down approximately 7.2%.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Outperforms Shareholder Returns

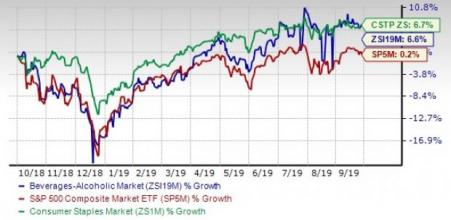

The Zacks Beverages – Alcohol industry has outperformed the S&P 500 and is almost on par with its sector over the past year.

While the stocks in this industry have collectively gained 6.6%, the Zacks S&P 500 Composite and Zacks Consumer Staples sector have rallied 0.2% and 6.7%, respectively.

One-Year Price Performance

Beverages – Alcohol Industry’s Valuation

On the basis of forward 12-month price-to-earnings (P/E) ratio, which is commonly used for valuing Consumer Staples stocks, the industry is currently trading at 23.94X compared with the S&P 500’s 19.51X and the sector’s 16.86X.

Over the last five years, the industry has traded as high as 27.52X, as low as 18.91X, and at the median of 23.15X, as the chart below shows.

Price-to-Earnings Ratio (Past 5 Years)

Bottom Line

Companies in the alcohol industry are likely to benefit from efforts to offer low-or-no-alcohol variations. Product innovation with increased focus on premiumization, variations in taste, use of natural ingredients and cannabis-infused drinks should meet the growing consumer demand for healthy drinking alternatives. However, higher costs and tariff-related impacts on the export of spirits continue to weigh on the performance of industry participants. An unimpressive Zacks Industry Rank also raises concerns.

None of the stocks in the Zacks Beverages – Alcohol universe currently has a Zacks Rank #1 (Strong Buy) or 2 (Buy). However, we suggest four stocks with a Zacks Rank #3 (Hold) from the same industry, which investors may hold on to. You can see the complete list of today’s Zacks #1 Rank stocks here.

Let’s have a look at them.

The Boston Beer Company Inc. (SAM): The stock of this Boston, MA-based company, which is the largest craft brewer in the United States, has rallied 22% in the past year. The Zacks Consensus Estimate for its current-year earnings has been stable in the last seven days. It carries a Zacks Rank #3.

Price and Consensus: SAM

Brown-Forman Corporation: The stock of this Louisville, KY-based company has risen 22.6% in the past year. The Zacks Consensus Estimate for its current-year earnings has moved up a penny in the past 30 days. It carries a Zacks Rank #3.

Price and Consensus: BF.B

Ambev S.A. (ABEV): This Sao Paulo, Brazil-based company produces and sells beer, draft beer, carbonated soft drinks, other non-alcoholic beverages, malt, and food products in the Americas. It carries a Zacks Rank #3 and the stock has rallied 19.6% year to date. The Zacks Consensus Estimate for the company’s fiscal-year earnings has been unchanged in the past 30 days.

Price and Consensus: ABEV

Diageo (LON:DGE) plc (DEO): The stock of this London-based company has rallied 13% in the past year. The company is involved in producing, distilling, brewing, bottling, packaging as well as distributing spirits, wine and beer. It operates in around 180 countries. The Zacks Consensus Estimate for its current-year earnings has been stable in the past 30 days. It carries a Zacks Rank #3.

Price and Consensus: DEO

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

Zacks Investment Research

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.