OTC Markets Group: A Year Of Investment For The Future

Edison | Aug 14, 2019 09:08AM ET

Hutchison China MediTech Ltd (NASDAQ:HCM) continues to make progress towards its global strategic aspirations. The interim results highlight the opportunities for Elunate (fruquintinib) capsules in China, with potential inclusion in China’s exclusive NRDL list in Q419, and the breadth of clinical and regulatory catalysts that lie ahead for multiple R&D assets. Surufatinib’s China NDA submission is on track (Q419) and approval in NET would seal HCM’s position as a premier, innovative, China-based oncology company. The years 2021–22 are pivotal; partner AstraZeneca (AZN) could launch savolitinib in China for NSCLC (MET exon 14) and it could become HCM’s first asset to launch globally (2022) in combination with Tagrisso for NSCLC (c-Met +ve). Given the recent underperformance of the shares and the real potential for HCM to become a global oncology player, we believe it is appropriate to revisit the shares. We value HCM at $5.7bn.

Pipeline coming to fruition

Elunate is now being commercialised in China (third-line CRC) by partner Eli Lilly (NYSE:LLY) (Lilly), a major inflection point for HCM and validation of its R&D philosophy. While the early sales trajectory is notable (H119 in-market of sales of $11.4m), the most interesting opportunity lies in inclusion on China’s NRDL, as this would translate into automatic inclusion in all state-funded hospitals (more eligible patients) and automatic reimbursement (albeit it at a lower price). Next for potential launch in China is surufatinib (launch for treatment of NET expected early 2021). In addition, a interim analysis of the pivotal China Phase III study (SANET-p) in pancreatic NET is due in H120, which, if positive, could further widen its market potential in this area of unmet need.

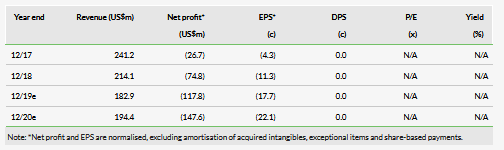

Financials: Funded to key inflection points

HCM has reduced its FY19 R&D expense guidance to $130–170m (from $160–200m), reflecting the depreciation of Chinese yuan versus the US dollar (China R&D) and the phasing of global surufatinib and fruquintinib Phase IIb/III trials. HCM reported available cash resources of $383.6m, which, combined with the net profit generation from the CP division, means it is well funded to key value inflection points (NDA submissions for savolitinib, surufatinib and fruquintinib in 2019–21).

Valuation: $5.7bn (£6.99/share)

We value HCM at $5.7bn (£6.99/share) vs $5.6bn previously. We make no changes to our product forecasts, but have trimmed R&D costs for 2019 (phasing costs into 2020) to reflect FY19 guidance, rolled forward our model, and updated for FX and net cash of $237.3m at 30 June 2019.

Business description

Hutchison China MediTech is an innovative China-based biopharmaceutical company targeting the global market for novel, highly selective oral oncology and immunology drugs. Its established commercial platform business continues to expand its outreach.

Global aspirations

HCM’s recent share price underperformance provides an opportunity to revisit the investment case. We believe the long-term investment case is solid, with multiple near-term catalysts (regulatory filing and potential approval for surufatinib and savolitinib) as HCM successfully launches numerous assets to market (~2020/21 and beyond) in China and internationally. Its broad mid- to late-stage innovation platform (IP) will translate into diverse global revenue streams with a multitude of other compounds coming to the fore from HCM’s established and proven innovative R&D platform. Existing partnering deals for savolitinib and fruquintinib support the investment case as milestones and royalties on sales continue to bolster the P&L. HCM has global strategic aspirations, and it is only a matter of when rather than if its aspirations are met, in our view. HCM continues to invest in expanding its global innovation organisation; it now has >440 scientific personnel based in China and the US (Shanghai, Suzhou and New Jersey).

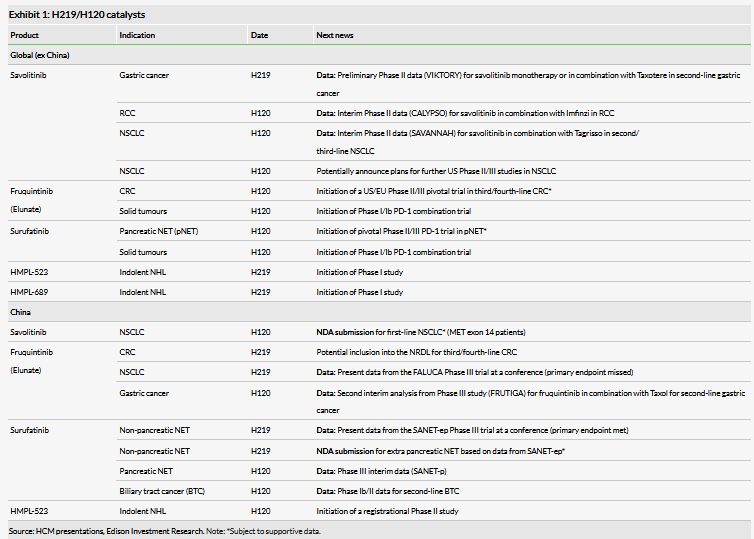

CK Hutchison Holdings (CKH) completed a secondary offering of ADSs in July 2019, which has reduced its holding to 51.15% (from 60.2% previously). We see this as a significant positive for HCM as it increases the free float, potentially leading to better liquidity. We note that this had no effect on shares in issue and does not dilute any current shareholders. An eventual listing on SEHK will be determined by a number of factors including, but not limited to, management decisions and market conditions. In our view, a capital raise on existing markets (AIM/Nasdaq) is still likely in the next 24 months. However, cash resources as last reported (30 June 2019) of $383.6m are more than sufficient to fund HCM to key inflection points (NDA submissions for savolitinib, surufatinib and fruquintinib in 2019–21). HCM could explore non-dilutive finance options such as divesting non-core commercial platform (CP) assets. Exhibit 1 highlights the plethora of clinical and regulatory catalysts ahead. For more details, see our outlook note, An emerging global biopharma.

Elunate early sales encouraging; NRDL inclusion is key

The launch of Elunate (fruquintinib capsules) for metastatic colorectal cancer (third-line and above) by partner Lilly was a defining moment for HCM, as it was the first of its IP assets to launch in China, and the first China-discovered and developed new drug for oncology to have full approval and reach the market. HCM reported H119 royalties of $1.7m and $3.0m of sales of Elunate manufactured by HCM for Lilly. The reported $1.7m royalties translates into $11.4m Elunate end-user sales in H119, as reported by Lilly.

At the interim results, HCM presented data on the sales evolution of oncology drugs by its international and domestic peers. A key inflection in sales growth is inclusion on China’s National Reimbursement Drug List (NRDL), which will define the opportunity for full-scale reimbursement nationally, albeit on lower pricing (discount to be agreed by Eli Lilly (NYSE:LLY) and China’s central government). A fourfold ramp in the second full year from launch would require us to revisit our overall peak sales expectations. Inclusion on the NRDL is expected in Q419. Elunate has been added to two regional reimbursement lists in China during the last six months (Zhuhai and Shanghai), which highlights that Elunate’s utility in third-line CRC has been recognised at a local level.

Elunate’s next China development focus is on Phase III gastric cancer (FRUTIGA), for which approval could occur in 2021/22. Life cycle management and extending the labelled use to other solid tumour types will expand Elunate’s commercial opportunity further. The global development programme is underway in colorectal cancer, with Phase Ib enrolling patients in the US. HCM has started planning the global Phase II/III US/EU registration trial (starting in 2020) in third/fourth-line mCRC in patients who are resistant or intolerant to Bayer’s Stivarga. It has filed the FALUCA data for publication, potentially at ESMO 2019 or WCLC 2019; the data should shed light on the failure of fruquintinib monotherapy to meet the overall survival (OS) endpoint in third-line non-small-cell lung carcinoma (NSCLC), having demonstrated statistically significant improvement in all secondary efficacy endpoints.

Surufatinib next in line for China launch

Surufatinib (previously known as sulfatinib) could be the first of HCM’s non-partnered assets to reach the China market in early 2021 (NDA submission expected in late 2019). The strategy for surufatinib was recently validated as positive interim data were announced in the SANET-ep Phase III trial testing surufatinib in non-pancreatic NET China patients. This was based on the trial meeting its primary endpoint of progression-free survival (PFS) at the interim analysis and the trial was unblinded a year ahead of schedule.

NETs are cancers that arise out of cells of the endocrine and nervous systems, predominately the digestive and respiratory tracts. While the current prevalence of NET in the US is ~141,000 patients (incidence of ~19,000 new cases per year, source www.cancer.net ), current treatment modalities are limited to subsets of NET with no broadly effective drugs across the NET spectrum. HCM believes that actual incidence of NET in China could be higher than the reported incidence of 67,600, and prevalence could be even greater once an effective broad-spectrum treatment becomes available. Expanding the treatment paradigm could improve diagnosis rates and increase eligible patient numbers. Surufatinib could improve on the profiles of existing NET treatments, including somatostatin-based treatments and kinase inhibitor therapies (such as Afinitor and Sutent). Broad spectrum use will yield commercial success if it can be used for treating the broad base of NET patients. An interim analysis for the pivotal China Phase III study in pancreatic NET(SANET-p) is due at H120, which, if positive, could further widen its market potential in this area of large unmet need.

A US Phase Ib/II trial in pancreatic NET and biliary tract cancer has completed enrolment of NET patients. An end of Phase II meeting with the FDA is planned for Q419, to discuss the Phase III US/EU registration study which HCM expects to start in Q120. HCM retains full worldwide rights to surufatinib.

Savolitinib could coat-tail Tagrisso

An estimated 2–3% of newly diagnosed NSCLC patients have a specific mutation known as MET Exon 14 skipping (Exon 14 of the MET gene is not functioning or deleted), leading to c-Met over expression. In China, HCM estimates this to be 10,000 patients. A registrational Phase II clinical trial is underway (enrolment complete) in patients who have progressed on prior chemotherapy, or are unable to tolerate additional rounds of chemotherapy. Although the patient size is relatively small, this indication could be savolitinib’s first China NDA submission in 2020 and its first monotherapy indication in the region. In the longer term in China, we believe a savolitinib plus Tagrisso combination will expand use in other subsets of NSCLC.

In the field of lung cancer, AZN’s Tagrisso is raising the bar as it moves into the first-line setting in EGFR mutation-positive NSCLC, reporting sales of $1.41bn in H119. Savolitinib’s largest opportunity could be in combination with Tagrisso in EGFRm MET+ NSCLC patients as MET mutations are one of the biggest drivers for Tagrisso resistance. Following the encouraging data seen from the TATTON study, in December 2018 AZN and HCM initiated the global registrational study SAVANNAH for Tagrisso refractory NSCLC patients. HCM’s partnership with AZN remains crucial to the development of savolitinib and our forecast peak sales. Interim data are expected in mid-2020 and the strength of the data will determine whether a larger Phase III is required as part of the US regulatory submission package, although it could be sufficient for NDA filing.

Commercial platform profits reinvested in R&D

HCM has multiple strings to its bow. Its China commercial platform division continues to deliver year-on-year revenue growth of 2% (7% at CER) and net income growth of 3% (9% at CER). Contributions from non-consolidated JVs, primarily Shanghai Hutchison Pharma (SHPL) and Hutchison Baiyunshan (HBYS), are reported below the loss from operations line under US GAAP as equity in earnings of equity investee, net of tax. HCM receives the majority of profits generated from this division as dividends, which the company has reinvested in its innovation pipeline since inception. To date, $423m has been reinvested in the business. HCM’s non-consolidated JV HBYS’s vacant land (Plot 2) in Guangzhou remains for sale as part of the Guangzhou municipal government urban development scheme. HCM expects an auction value in excess of $100m, of which 40–50% would be paid to HBYS as compensation for return of the land use rights. We expect that half of this would make its way to HCM via special dividends and would likely be reinvested in the business, although this is not reflected in our forecasts given the uncertainty on timing. Exhibit 2 highlights HCM’s objectives for existing assets spanning the breadth of its businesses in 2019–21.

Valuation

We value HCM at $5.7bn (£6.99/share) vs $5.6bn previously. We make no changes to our product forecasts; we have trimmed R&D costs for 2019 (phasing into 2020) to reflect FY19 guidance, rolled forward our model and updated for FX and net cash of $237m at 30 June 2019.

We use a risk-adjusted net present value (NPV) method to discount future cash flows for the innovation platform (IP) (valuation of $4,050m). We use earnings-based multiples for HCM’s commercial platform (CP) (subs and JVs), and applying a 20.4x multiple on our forecast 2019 net attributable profit (equity in earnings of equity investees, net of tax) for the JVs of $39.2m yields a valuation of $800.4m (Exhibit 3).

Financials

HCM reported consolidated group revenues of $102.2m in H119 (+0% as reported, +5% CER; H118: $102.2m) and group net loss of $45.4m (H118: $32.7m). Depreciation of the Chinese yuan versus the US dollar has affected top-line growth as reported in US dollars given the translation impact, as all revenues related to its China commercial platform (CP) business are generated in Chinese yuan.

CP reported consolidated sales of $90.2m (+2% as reported, +7% CER; H118: $88.6m). Sales of non-consolidated JVs SHPL and HBYS grew +2% (+8% CER) to $276.9m (H118: $271.7m). Total consolidated net income from CP increased +3% (+9% at CER) to $27.7m (H118: $26.9m). We forecast consolidated CP revenues of $154.2m in 2019 and $157.6m in 2020.

IP reported consolidated revenues of $12.0m in H119 ($5.5m of which was received from Lilly for Elunate manufacturing, service fee revenues and royalty income) compared to $13.6m in H118. In H119, IP reported a net loss of $63.8m (H118: $52.9m). We forecast IP revenues of $28.7m in 2019 and $36.8m in 2020, largely driven by developmental royalties on sales on Elunate and service fees from partners.

Profit before tax and equity in earnings of equity investees at group level reported a loss of $68.3m in H119 (vs a loss of $50.5m in H118). R&D expenses increased significantly to $69.3m in H119 ($60.1m in H118), reflecting investment throughout the portfolio, expansion of the US and international clinical and regulatory operations, and establishment of the China oncology commercial infrastructure. S&M expenses decreased to $7.5m in H119 (vs $9.4m in H118) and administrative expenses increased to $18.8m (vs $14.5m in H118). For FY19, HCM has reduced its guidance for R&D expenses to $130–170m from $160–200m and adjusted non-GAAP group net cash flow excluding financing activities to $90–120m from $120–150m. The depreciation of the Chinese yuan has effectively reduced China R&D expenses in US dollar terms, and start-up costs for the global Phase II/III registration studies for surufatinib and fruquintinib will move into 2020.

We now expect R&D expenses to increase to $152.5m in 2019 and $190.0m in 2020 (reported GAAP basis), reflecting the substantial need for investment in the burgeoning clinical trial programmes across the IP division, including the increased investment in China and global trials plus the initiation of combination strategies across the portfolio.

We forecast net losses at group level of $117.8m in 2019 and $147.6m in 2020. HCM reported a healthy cash position, with available cash resources of $383.6m (at 30 June 2019) at group level (cash and cash equivalents and short-term investments of $237.3m, and unutilised bank borrowing facilities of $146.3m). Additionally, HCM’s non-consolidated joint ventures (SHPL, HBYS, and NSP) held $64.0m (at 30 June). HCM reported no debt at 30 June 2019 after paying down debt in H119, with the intention of drawing down debt from a facility with HSBC in H219. In terms of cash utilisation by operations, we forecast $99.2m in 2019 and $130.0m in 2020.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.