Optimistic Fed Message Does Little For Dollar

XM Group | Feb 01, 2018 04:08AM ET

Here are the latest developments in global markets:

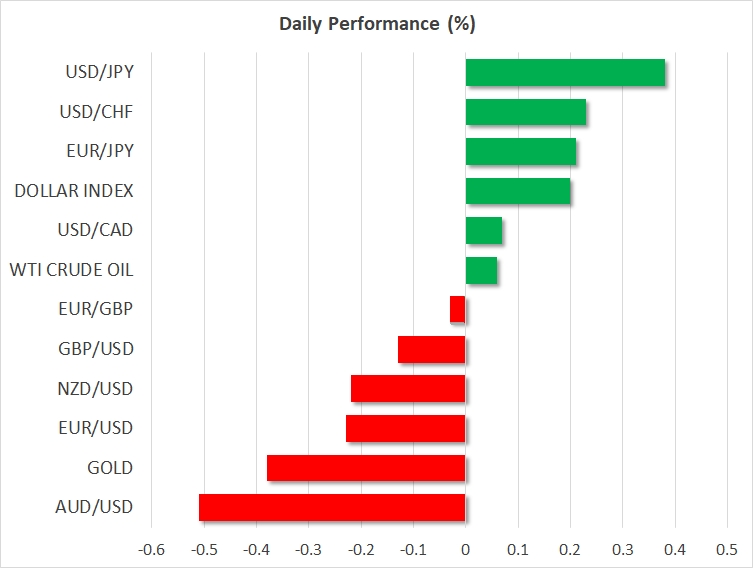

· FOREX: The dollar index traded 0.2% higher on Thursday, recovering some of its recent losses, buoyed by the Fed’s slightly more hawkish tone on the US economic outlook upon completion of its two-day meeting on monetary policy.

· STOCKS: Japanese markets skyrocketed, with the Nikkei 225 moving 1.7% higher and the Topix surging by 1.8%, both indices regaining some of the ground they lost in recent days. In Hong Kong, the Hang Seng was down by 0.4%, while in Europe, futures tracking the Euro Stoxx 50 are 0.6% higher. Turning to the US, the S&P 500, Dow Jones and Nasdaq Composite all finished higher yesterday, albeit not by much. The Dow gained the most out of the three, advancing by less than 0.3%. The relatively muted performance of these indices is being attributed to the surge in US Treasury yields, with the 10-Year benchmark briefly topping 2.75% overnight, its highest level since April 2014.

· COMMODITIES: Gold was nearly 0.4% lower, last trading near $1340 per ounce, as the modest rebound in the greenback weighed on the dollar-denominated precious metal. Oil prices were little changed, with both WTI and Brent crude rising by less than 0.1%. Interestingly enough, both oil benchmarks finished the day higher yesterday, even despite the weekly EIA inventory data showing a much higher build in stockpiles than what was anticipated.

Major movers: FOMC upgrades inflation outlook, paves the way for March hike

The Fed kept its policy unchanged yesterday via a unanimous vote, as was widely anticipated. The statement accompanying the decision had a more optimistic tone compared to previously, upgrading the committee’s assessment of inflation. Inflation is now anticipated “to move up this year” and to stabilize around 2%, from previously being expected to remain somewhat below 2%. Policymakers also appeared upbeat on the broader economy, noting that gains in employment, household spending, and business investment have been solid.

The dollar spiked up on the news, but quickly gave back all of its winnings to trade virtually unchanged in the following hours, before assuming a direction during the Asian trading session Thursday and moving a little higher. The relatively indecisive price action in the USD, at least initially, may reflect the fact that many investors already anticipated a slightly more hawkish bias by the committee, given the economy’s solid performance. Markets have fully priced-in a March rate increase, while another two quarter-point hikes by the end of the year are almost fully factored in, according to the Fed funds futures.

The greenback gained the most against the aussie, which suffered a little overnight after Australia’s building approvals for December came in significantly lower than projected.

Day ahead:Major economieson the receiving end of PMI data; US jobless claims also on the horizon

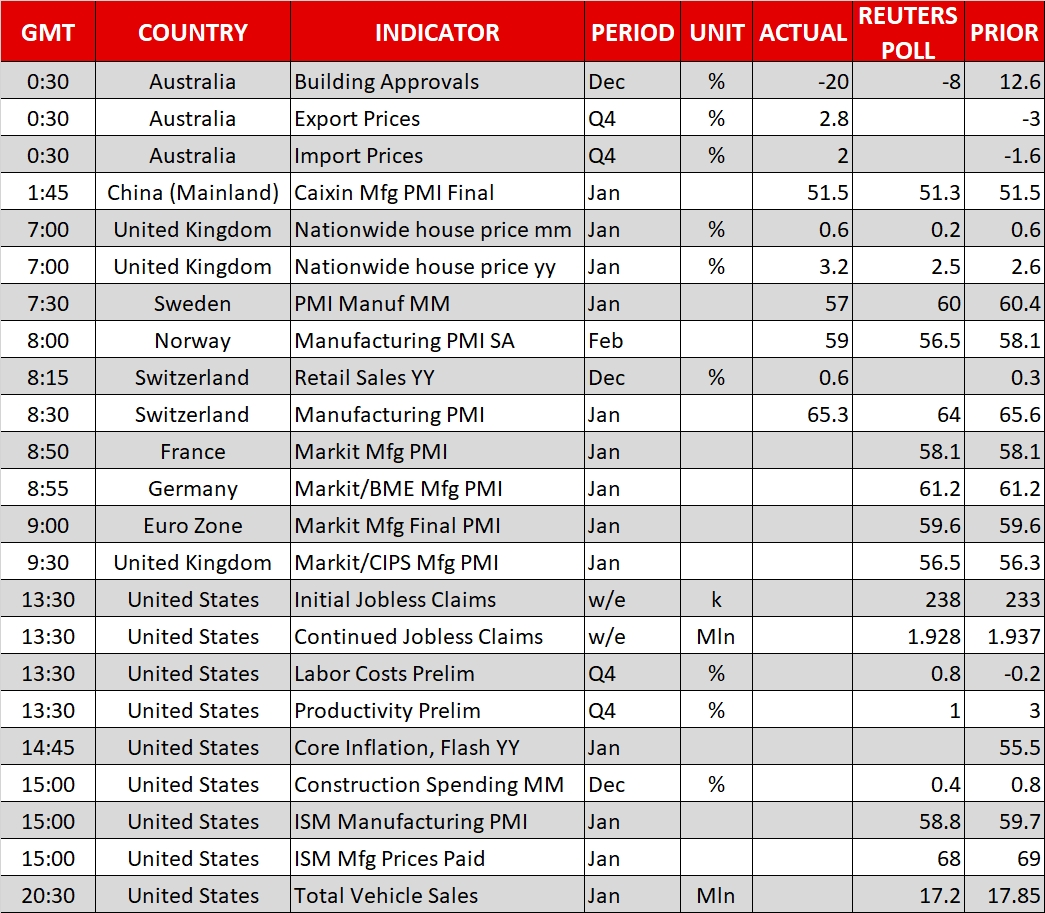

The eurozone will see the final release of Markit’s manufacturing PMI for the month of January at 0900 GMT. The reading is expected to be confirmed at 59.6, reflecting a decrease from December’s 60.6, though still pointing to robust sectoral growth by comfortably exceeding the 50 mark that separates expansion from contraction. Germany and France, the eurozone’s two largest economies, will see the release of their manufacturing PMI figures for the first month of the year a few minutes earlier (at 0855 GMT and 0850 GMT respectively).

The UK will also be on the receiving end of manufacturing PMI data. The January Markit/CIPS manufacturing PMI will be made public at 0930 GMT. The measure is anticipated to tick slightly higher relative to December, remaining well above 50. Unlike the eurozone that sees the release of a flash estimate as well, the UK only receives a single release; this may render sterling more “susceptible” to greater market movement upon release of the data and in case of a surprise.

Over in the US, of most interest are likely to be data on weekly initial and continued jobless claims due at 1330 GMT, as well as the ISM’s January manufacturing PMI scheduled for release at 1500 GMT. First-time jobless claims applicants are expected to have increased during the week ending January 27, though not by much and still remain well below the 300k threshold that’s associated with a healthy labor market. The ISM’s survey on manufacturing activity is projected to reflect a reduction compared to December, though at 58.8 – should expectations materialize – it would still constitute a robust number.

Other releases that might draw some attention out of the US are Q4 2017 preliminary data on labor costs and productivity (1330 GMT), Markit’s final reading on January manufacturing PMI (1445 GMT), December construction spending figures (1500 GMT) and January’s total vehicle sales (2030 GMT).

ECB executive board member and chief economist Peter Praet will be giving a speech at the luncheon conference of Cercle de Lorraine at 1115 GMT.

On the equities front, corporate giants Alibaba (NYSE:BABA), Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL) and Google parent Alphabet (NASDAQ:GOOGL) will be among companies releasing quarterly earnings reports on Thursday.

Technical Analysis: GBP/USD bullish bias could be under threat as RSI halts advance

GBP/USD is trading roughly 150 pips below the one-and-a-half-year high of 1.4344 hit on January 25. The Tenkan-sen line remains above the Kijun-sen line and the RSI indicator is in bullish territory above 50. The aforementioned are supporting the view for a bullish short-term bias. Notice though that the RSI has halted its advance after rising well above the 70 overbought level last week. This could be an indication of changing dynamics in the short-term.

A stronger manufacturing PMI out of the UK during morning European trading hours – or weaker releases out of the US later on Thursday – could see the pair gaining ground. The area around the 1.42 handle – a level of potential psychological significance – might be acting as immediate resistance at the moment. An upside breakup would turn the focus to the range around last week’s one-and-a-half-year high of 1.4344 as an additional barrier to stronger bullish movement.

Weaker UK data, or equivalently more robust figures out of the US, on the other hand, might see the pair heading lower. In this case, the area around the current level of the Tenkan-sen at 1.41, which coincides with a point of potential psychological importance, might offer support.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.