Opening Bell: Oil Shares Lead Europe Higher; Crude, Metals Slip

Investing.com | Nov 28, 2017 06:35AM ET

by Pinchas Cohen

Key Events

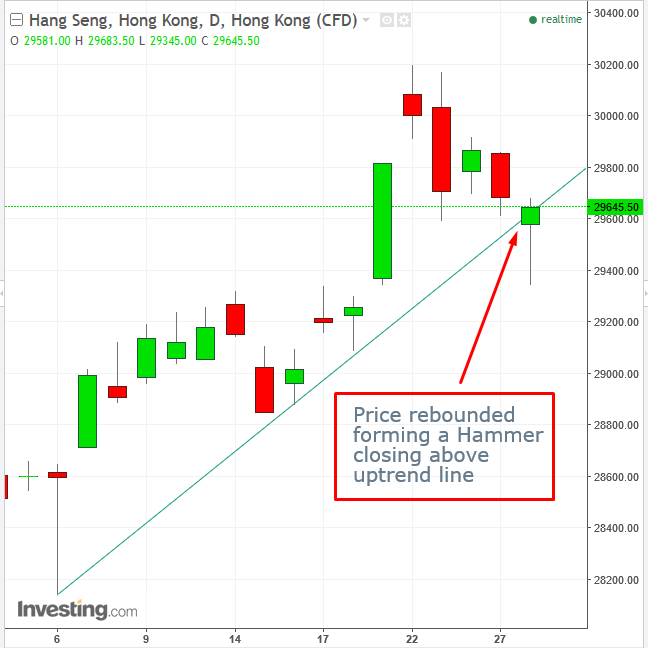

Asian equities resumed their slide this morning, for a second day, once again led China shares. However, unlike yesterday, today’s decline was fueled by Hong Kong's major index, the Hang Seng, rather than mainland China's Shanghai Composite, yesterday's culprit.

As investors sift through the Chinese government's new regulations, concerns are rising that regulators will limit the flow of funds from the mainland to Hong Kong, according to the South China Morning Post. These flows have helped drive the Hang Seng to decade highs.

The selloff cooled however, before Asian markets closed and stocks rebounded, led by technology and consumer shares. The Shanghai Composite ended with a gain, while the Hang Seng, squarely on the receiving-end of the regulatory limits, finished with a loss. Still, the index did come back from a 0.99 percent loss to just -0.13 percent on the day, forming a bullish hammer and closing back above its uptrend line to boot.

Global Financial Affairs

Shares in Europe diverged from the Asian declines, rallying on oil and gas stocks which offset a fall among miners, following a slide in metals prices. While natural gas futures extended their rally after yesterday's gains, oil's descent heads into its second day. Shares rallied after Royal Dutch Shell (NYSE:RDSa) confirmed a $25 billion buyback plan.

West Texas crude extended its slide from its highest level in more than two years after US drillers expanded operations, as many feared and expected they would, ahead of this week's meeting in Vienna between OPEC and Non-OPEC oil producing countries, amid concerns a production cut extension would not be officially announced.

Industrial metals resumed their decline, led by copper and nickel, on concerns the economy of the world’s biggest metal buyer, China, may be cooling, based on weakening Chinese macro data and slowing home sales.

Commodities in general are within an uptrend. More specifically, as can be seen via the chart above of the Bloomberg Industrial Metals Index, so too are industrial metals. China’s economic expansion may have slowed on a monthly basis, still, it’s up 25.1 percent on an annual basis.

The pound fell this morning, after an early gain, and is trading at the lowest level of the session. The down-move came as Ireland's Deputy Prime Minister Frances Fitzgerald faces a deepening political crisis and a no-confidence vote. The situation threatens what little headway has been made on the Brexit talks front since the Northern Ireland border question is one of three key issues on which the EU is requiring “sufficient progress” before the union will agree to move on to Britain’s future relationship with the bloc.

The GBP/USD pair has completed a H&S top on the hourly chart. Cable is currently struggling over the uptrend line since November 13. A close below it would confirm the bearishness of the pattern.

The yen reversed gains after a rally which was partly fueled by a Kyodo News report that Japan had detected radio signals suggesting North Korea is preparing for another missile launch.

Up Ahead

- Fed Chair-nominee Jerome Powell faces his Senate confirmation hearing today. Expectations are that his confirmation is all but assured.

- The U.S. Senate could debate and vote on tax-cut legislation as soon as this week.

- President Trump will meet with Democratic and Republican Congressional leaders Tuesday to discuss a Federal spending plan to prevent a partial government shutdown in order to keep things running after current funding expires on December 8.

- In China, the official and Caixin manufacturing PMIs are expected to show mostly steady momentum when they're announced late Wednesday evening US time.

- Japan's industrial production is forecast to have rebounded in October, but CPI may show a sharp divergence between headline and core inflation when the metrics are released on Thursday, according to Bloomberg Intelligence.

- The second print of third-quarter U.S. GDP on Wednesday may be revised upward thanks to consumer spending and inventory accumulation, Bloomberg Intelligence said. The core PCE deflator, the Fed’s preferred inflation gauge, is due Thursday.

- OPEC meets in Vienna on Thursday.

Market Moves

Stocks

- The Stoxx Europe 600 Index jumped 0.2 percent as of 8:10 London time (3:10 EDT).

- The U.K.’s FTSE 100 rose 0.1 percent.

- Germany’s DAX rose 0.2 percent.

- Japan’s Nikkei 225 Stock Average declined less than 0.05 percent to the lowest in a week.

- The MSCI Asia Pacific Index decreased 0.1 percent to the lowest in a week.

- The MSCI Emerging Markets Index jumped 0.2 percent.

- S&P 500 Futures increased less than 0.05 percent to 2,602.50, the highest on record, pointing to the possibility of new records later today on the benchmark index itself.

Currencies

- The Dollar Index advanced for a second day, up 0.10 percent to 92.98.

- The euro gained 0.1 percent to $1.1905.

- The British pound rose 0.1 percent to $1.3335.

- The Japanese yen decreased 0.1 percent to 111.25 per dollar.

Bonds

- The yield on 10-year Treasuries jumped one basis point to 2.33 percent.

- Germany’s 10-year yield increased less than one basis point to 0.34 percent.

- Britain’s 10-year yield declined less than one basis point to 1.252 percent.

- Japan’s 10-year yield fell less than one basis point to 0.04 percent.

Commodities

- West Texas Intermediate crude declined 0.4 percent to $57.90 a barrel, the lowest in a week.

- Gold dipped 0.1 percent to $1,293.36 an ounce.

- Copper fell 1.2 percent to $3.12 a pound, the lowest in more than a week.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.