One Click For The 500 Best High Yield Investments

Contrarian Outlook | May 25, 2018 06:20AM ET

Looking for high yield investments, packed in a convenient fund wrapper? You’d better look beyond these three popular names.

I’m going to show you how to “cherry pick” their best holdings today. We’ll even discuss some better “clicks to make” so that you can sell these dumb money funds if you hold them, and buy some better value (and higher yields!) instead.

What’s the price of popularity? Well, investors have sunk about $43 billion into three of the ETF world’s biggest, most prominent names. And they have less to show for it than several better-managed but under-the-radar funds.

In fact, given that these aforementioned “dumb funds” are among the biggest players in their three respective asset classes, it’s very likely that you own one if not more of these first-in-name but second-class ETFs.

Let’s start by picking apart these three 3%-6% losers. Then, I’ll share a dozen superior funds with yields averaging 8%!

Vanguard High Dividend Yield ETF (VYM)

Dividend Yield: 3.1%

Something just doesn’t feel right about a fund featuring the words “high dividend yield” doling out a mere 3%. But you’ll find a few of these among the major fund providers, including the Vanguard High Dividend Yield ETF (VYM).

When Vanguard, iShares and the like throw out terms like “high dividend” and “high yield,” what they really mean is simply “more than the market.” In this case, the VYM’s 3.1% certainly is greater than the 1.9% you can fetch from the SPDR S&P 500 ETF (SPY), but it’s far shy of the 5%-10% yields I typically cover in this space.

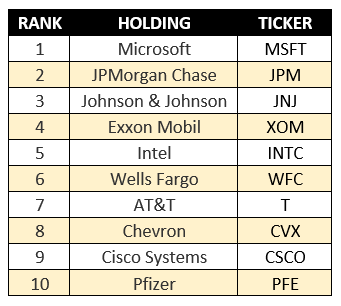

There’s nothing novel about how VYM delivers this high yield, either. It simply tracks an index of “common stocks of companies characterized by high dividend yields.” You’ll be unsurprised, then, to find that top holdings include the likes of Microsoft (NASDAQ:MSFT), Johnson & Johnson (NYSE:JNJ) and AT&T (NYSE:T).

Source: Vanguard

This essentially makes VYM a slower-growth, higher-yielding version of the S&P 500. Thus, you’ll be hard-pressed to generate any outperformance – especially with such a small yield advantage.

You can easily replace VYM with a closed-end fund like this Gabelli offering , or one of several CEFs I’ll highlight in a minute.

iShares U.S. Preferred Stock ETF (PFF)

Dividend Yield: 5.6%

The iShares U.S. Preferred Stock ETF (PFF), at more than $16 billion in assets under management, is the largest preferred-stock ETF by a country mile. It boasts more than triple the AUM of its closest competitor, the PowerShares Preferred Portfolio (PGX).

And that’s where the superiority ends.

A quick look for the uninitiated: iShares’ PFF is a portfolio of roughly 300 preferred stocks – so-called “hybrid” securities that trade on exchanges just like common stocks, but share a few traits with bonds, such as a fixed regular distribution and a tendency to trade around an initial par value.

PFF is similar to most preferred-stock funds in that the lion’s share of its holdings are preferreds from financial companies such as HSBC (NYSE:HSBC)), Barclays (NYSE:BCS) and Citigroup (NYSE:C).

However, it’s actually inferior to other preferred-stock ETFs in several ways. PFF boasts a merely middle-of-the-road yield and a good-but-not great expense ratio of 0.47% that several other funds have undercut.

It’s also a lackluster performer compared not just to other preferred ETFs, but also several closed-end funds . These CEFs boast agile managers who can identify preferred values, giving them an edge over index-based funds such as PFF.

iShares’ PFF Is Not the Preferred Way to Play

Long story short: There are plenty more fish in the sea than PFF, and most of them look more appetizing.

Vanguard REIT ETF (VNQ)

Dividend Yield: 4.8%

Real estate investment trusts (REITs) are one of my favorite sources of high income , and when it comes to REIT ETFs, nothing comes close to the size and scale of the Vanguard REIT ETF (VNQ). This $29 billion fund dwarfs the next largest fund – VNQ’s worldly brother, the Vanguard Global ex-U.S. Real Estate ETF (VNQI), which boasts closer to $6 billion in assets.

This is as comprehensive a real estate fund as you could ask for. VNQ holds more than 180 REITs representing just about every slice of the real estate pie, from office space and industrial land to apartments and hotels to retail and healthcare properties.

Vanguard’s VNQ Has Stepped Into a Lousy Neighborhood

That’s all well and good, but VNQ’s traditionally lackluster yield compared to other real estate options, as well as a broad, thinly screened mandate that lets in a lot of riff raff, has put Vanguard’s REIT offering near the back of the pack.

VNQ might be the most popular way to invest in REITs, but popularity isn’t the same as quality.

12 Quality Funds Paying 8% That Will Let You Retire on Dividends Alone

The mediocre yields of VYM, VNQ and PFF simply aren’t going to get you to the retirement finish line – at least not in any condition to actually enjoy your post-career life. Your funds need to be delivering substantial yields of around 7% to 9%, and they also need to occasionally deliver some growth to compliment that income and help pad your nest egg for a rainy day.

These “basic” ETFs won’t get the job done. But the 12 funds and “triple threat” stocks in my sure can!

The financial media loves to praise the likes of Vanguard and iShares for their low-cost index funds, but in certain categories – like high yield – you get what you pay for. But why settle for 6% a year, or just $30,000 in annual income from a half-million-dollar portfolio, when you could be bringing in nearly double that in total returns from well-managed funds that can pivot on a dime?

My puts you in the driver’s seat for the most important years of your life. This all-star portfolio will deliver an average yield of 8% while also growing your nest egg – a vital 1-2 punch that ensures you can both pay the bills and weather a sudden calamity without burning down your account.

I’ve been elbow-deep in annual reports, analyst commentary and spreadsheets for months, and the result is an “ultimate” dividend portfolio that provides you with …

- No-doubt 6%, 7% even 8% yields – and in a couple of cases, double-digit dividends!

- The potential for 7% to 15% in annual capital gains

- Robust dividend growth that will keep up with (and beat) inflation

This all-star roster includes the best of the high-yield world’s best, from CEFs to preferred stocks to REITs. And this portfolio will let you live off dividend income alone without ever touching your nest egg. So your monthly bills? Paid. And if disaster strikes? You’re covered.

You need much more than Social Security and meager blue-chip returns to retire the way you deserve. Don’t settle. Instead, invest intelligently and lock in the sizable, dependable dividend checks that will let you see the world and live in comfort for the rest of your days.

This is the retirement you deserve.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement ."

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.