Old FX Themes in Disarray. SNB on Tap Tomorrow

Saxo Bank | Mar 14, 2012 11:24AM ET

The G10 FX school of fish are not swimming the way they used to as the QE driver of earlier this year has yielded to...confusion? Today we look at USDJPY seasonality and how the market is dealing with the pause in QE.

Norges Bank throws its weight around

Today the Norges Bank dropped rates another 25 bps to 1.50% and lowered guidance, moves that certainly surprised the market, as EURNOK rallied some 10 big figures on the day on the news. Governor Olsen griped about a “two-speed” economy in Norway and the general message was that inflation was not going to be a problem any time in the near future and that growth worries persist. Remember that, while Norway is a credible safe haven from the QE theme, much of the recent market movement has been focused on at least a pause in that theme, if not an outright reversal. We are currently looking at a global economy that is out of synch, with China possibly moving into an easing phase while the US is exiting the easing stance (however temporarily). Canada appears to be in the same boat as the US, if not more hawkish. And the ECB recently expressed the desire to take a breath while the Norges Bank is tilting into easing mode.

Chart: EUR/NOK

EURNOK dropped to a new lows recently well below 7.50, levels only see for a few months back in 2002 when the NOK carry trade was all the rage (can you believe the deposit rate began 2003 at 6.50%). Back then, Norges Bank became extremely concerned with the strength of the krone and belatedly discovered that rates were headed much lower elsewhere. It proceeded to whack the rate to 2.25% by the end of the year. Today’s Norges Bank is easing late in the cycle as well, and the shift away from the QE theme combined with today’s surprise dovishness from the bank is seeing NOK longs finding the exits in the burning NOK building a tad crowded. The action has gotten out of hand in some of the crosses and is unlikely to continue at this pace (NZDNOK is an interesting one to ponder for those looking to fade this move in days to come.)

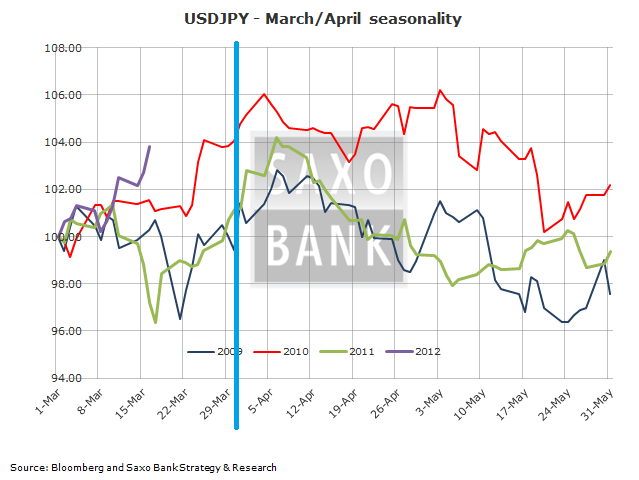

USD/JPY seasonality

The JPY sell-off continues apace, with EURJPY impressively taking out 109 today and USDJPY spiking well above 83. We looked at our charts and realized that this is the fourth year in the row that USDJPY has rallied into Japan’s financial year end at the end of March – all within a secular bear market in USDJPY over that time frame. The previous three years, the market rolled over again sometime in April. This year could see the same pattern unless both the bond market sell-off and the stock market rally are slowed or stopped very soon ahead of the year end. 85.50 is the next big chart point if we look back to the 2009 lows and 2011 highs.

It’s interesting times for FX as the various themes and cross themes are rather cacophonous at the moment. JPY and NOK and AUD weak on the same day? (JPY and NOK were the most negatively correlated currencies in the G-10 universe over the last 50 trading days at -0.97!) The GBP and CAD simultaneously strong? There is plenty going on here as the patterns of old seem to be disintegrating more every day.

Risk is up and so are bond yields (that won’t last long if the rate of yield rises continues) and a former pro-risk currency like Aussie is performing poorly despite the healthy risk appetite abounding everywhere as the strength of the US recovery has at least temporarily derailed the QE theme – punishing gold and silver as value stores for the moment. At the same time, investors worry about the new focus in Chinese growth toward greater consumption and slower infrastructure investment, and this in turn is another worry Down Under, as the only cylinders that are firing in the Australian economy are those geared towards digging things out of the ground and shipping them to China.

At the same time, the US is looking solid and oil prices are still elevated, leading to a sudden celebration of both of the North American dollars – particularly the loonie, which remains at the top of the heap after a relatively hawkish recent BoC meeting and as the country’s economy is often played, fairly or not, as a satellite of the US economy. My long, long awaited AUDCAD sell-off has finally gotten under way in earnest in recent weeks and the pair crossed below its 200-day moving average today.

Chart: AUD/CAD

AUD/USD is biting below its 200-day moving average as the loonie has moved to the head of the class on the long-time neglect of the Canadian currency and on the Aussie-negatives we discuss above.

Tomorrow promises to be a very interesting day, with fireworks possibly continuing as the SNB is on tap and may make another move – the market certainly seems to be positioning for such a reality as EURCHF seems to finally be stirring from its slumber, and the move in the JPY and in interest rates higher would provide strong thematic tailwinds for further SNB efforts geared at weakening the franc. Stay tuned.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.