Oil Limits And Climate Change

Gail Tverberg | May 24, 2013 07:38AM ET

They say that every cloud has a silver lining. If future energy consumption (which is mostly fossil fuel) drops because of a financial collapse brought on by high oil prices and other limits, then, at least in theory, climate change should be less of a problem. One of the important variables in climate change models is the amount of carbon dioxide from the burning of fossil fuels that enters the atmosphere. In a recent post (Climate Change: The Standard Fixes Don’t Work .)

One of the implicit assumptions in the IPCC report is that continued growth in a finite world makes sense, and can be expected to continue until 2100. In fact, we are reaching limits of many kinds.

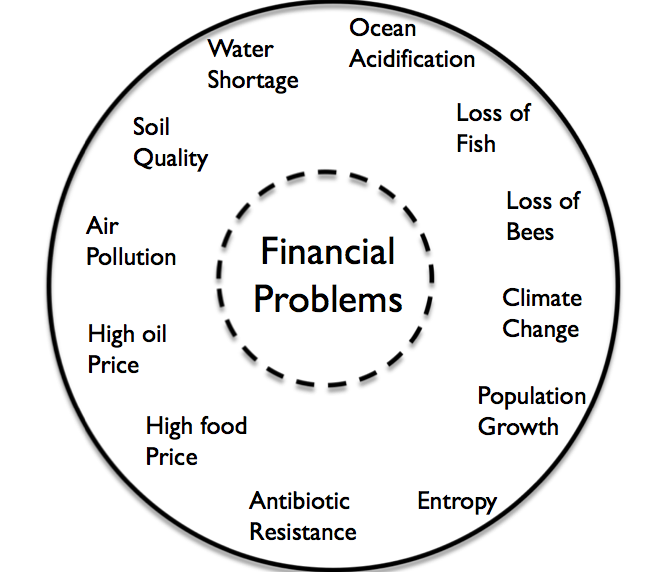

Figure 5. Various types of limits we are now reaching

In fact, modelers should be considering all of the limits simultaneously. Modeling any one limit on Figure 5 by itself will produce results that will suggest that that limit is a huge problem, that perhaps can be fixed. To a significant extent, there are workarounds for many of these problems, including more research on antibiotics, desalination of water, and intermittent renewables to substitute for some fossil fuels. The problem with each of these workarounds is that they all involve higher cost, and thus tend to create financial problems, especially for governments that try to fix the problems. Thus, the real issue is a likely near-term financial problem. This financial problem can be expected to lead to economic shrinkage which will by itself help mitigate several of the problems, including climate change.

Given the multiple limits we are reaching, I think we need to step back. Energy is truly needed to create products and services of all kinds. The IPCC is claiming that with a few tweaks, economic growth of the type we have grown to expect can continue until the year 2100. This assertion is clearly false, with or without the tweaks they are advocating.

We need to be figuring out how to live with a world that is rapidly changing for the worse, in terms of energy availability. I am not sure climate change should be our Number 1 concern, because the CO2 part of the problem is likely to mostly take care of itself. Instead, we need to be looking at how we can make the best use possible of energy sources we have. We also need to be cutting back on the real source of demand–population growth.

Perhaps we need to be thinking about different options than we have been thinking about to date–for example, making supply chains shorter and bringing production closer to the end-user. We might want to make such a change in an attempt to sustain production for longer, whether or not this has an adverse CO2 effect, viewed from today’s peculiar perspective: Only manufacturing which results in local CO2 production seems to be viewed as “bad;” exporting coal to China, or importing goods manufactured using coal from China/ India is not viewed as a problem. Having economists with a mindset of BAU forever and helping businesses get ahead, doesn’t necessarily produce the best results from the point of view of taking care of the existing population. Perhaps we should be looking at our current problems from a broader perspective than the IPCC report suggests.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.