Oil Bulls Run On Fear Of OPEC Production Cuts

IronFX | Feb 21, 2019 04:19AM ET

WTI jumped higher in the U.S. session on Wednesday, setting new 2019 highs, strengthened by fears of OPEC led supply cuts. Also, oil prices may have gotten a further boost, as political instability rises in Libya, Nigeria and Venezuela and at the same time US sanctions against Iran continue to trim the oil supply chain.

Analysts point out that although there is no lack of resources, access to them gets more and more difficult.

On the flip side, a soaring US oil production puts the breaks on oil prices, as it has reached a record high level of 11.9 million bpd. Another factor withholding oil prices is the global economic slowdown, with special focus on China, which could weaken demand for oil.

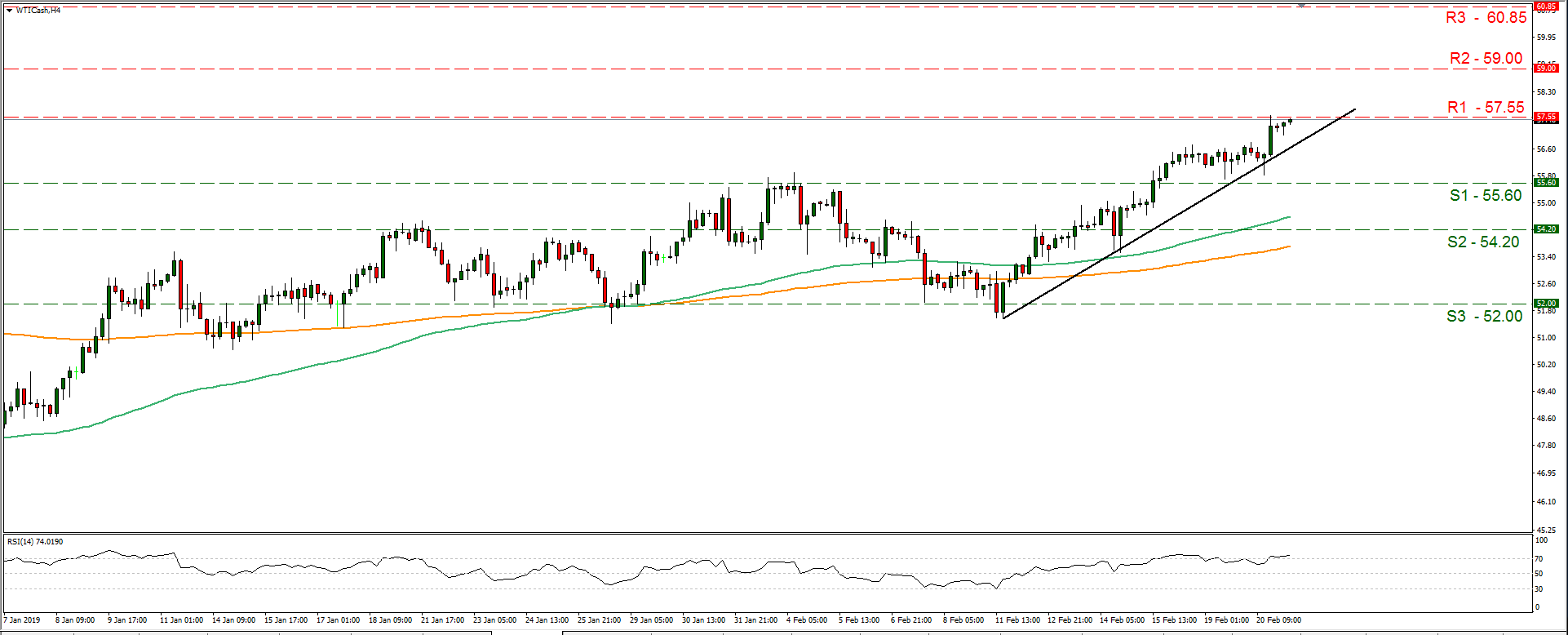

The release of API weekly crude oil inventories last night, showed an injection of 1.26 million barrels and gave oil prices a small boost, as the figure was expected by some analysts to be around 3m. We could see volatility for oil continuing today, especially as the official EIA crude oil inventories figure is due out. WTI prices rose for another session, yesterday testing the 57.55 (R1) resistance line.

The commodity’s prices may continue their bullish run in the next few days, as long as the upward trend line since the 11th of February remains intact. We would like to advise caution as some volatility is expected to occur at the release of the EIA crude oil inventories later today.

WTI H4

.

•Support: 55.60 (S1), 54.20 (S2), 52.00 (S3)

•Resistance: 57.55 (R1), 59.00 (R2), 60.85 (R3)

Also please note that the RSI indicator in the 4 hour chart is above the reading of 70, implying a rather overcrowded long position for the commodity. Should oil find fresh buying orders along its path, we could see it breaking the 57.55 (R1) resistance line and aim for the 59.00 (R2) resistance level. Is on the other hand the pair comes under the selling interest of the market, we could see it aiming if not breaking the 55.60 (S1) support line.

USD Gets Some Support From FOMC’s Minutes

The USD got some support yesterday, as the FOMC minutes renewed the possibility of a rate hike near the end of the year among investors. The minutes showed that the bank considers that the US economy and its labor market remain strong, appeasing the markets somewhat.

The main issue seems to remain trade and market focus seems to remain on the US-Sino negotiations as their result is expected to have a significant impact on US trade and growth. It should be noted though that analysts point out that the bar for the Fed to restart rate hikes in the near term remains high.

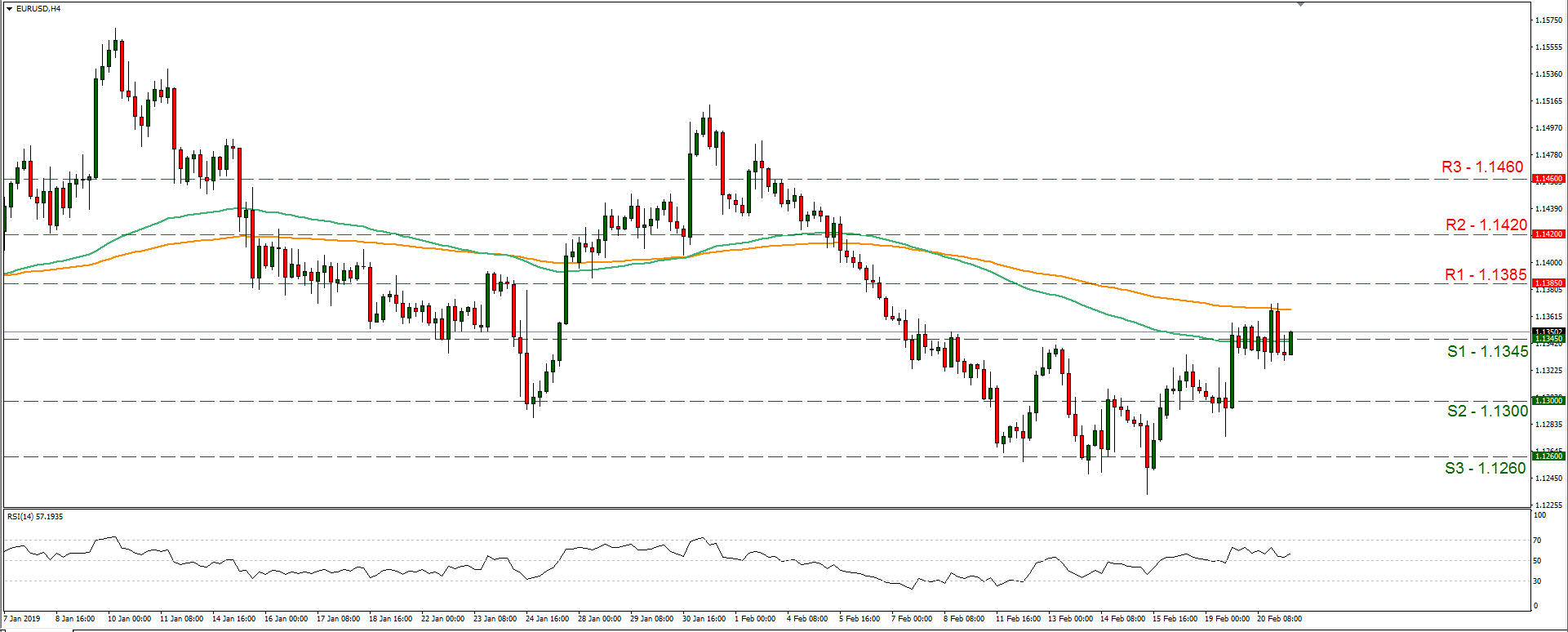

EUR/USD continued it’s struggling around the 1.1345 (S1) support line, continuously braking it back and forth. We could see the pair trading in a bearish market today, as financial releases could provide some support for the USD while at the same time weaken the EUR.

We would like to underscore the release of ECB account of monetary policy meeting, which could have a substantial effect on the common currency. Should he bears take over, we could see the pair breaking the 1.1345 (S1) support line and aim if not break the 1.1300 (S2) support level.

On the other hand, should the bulls dictate the pair’s direction, we could see it breaking the 1.1385 (R1) resistance line.

EUR/USD H4

• Support: 1.1345 (S1), 1.1300 (S2), 1.1260 (S3)

•Resistance: 1.1385 (R1), 1.1420 (R2), 1.1460 (R3)

Today’s other economic highlights

During the European session today, we get Germany’s preliminary manufacturing PMI for February as well as the final HICP rate for January. Also from France we get the final HICP rate for January and later on Eurozone’s preliminary composite PMI for February.

The ECB is to release its account of monetary policy meeting minutes just before the American session and could create volatility for the EUR.

In the American session we get from the US the durable goods orders growth rates for December, the Philly Fed Business Index for February and the EIA crude oil inventories.

From Canada we get the wholesale trade growth rate for December. Please note that ECB’s Peter Praet and Atlanta Fed President Raphael Bostic will be speaking today.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.