Not So Safe: What Does Slide In Real Estate And Utilities Mean For The S&P?

Mike Zaccardi, CFA, CMT | Oct 18, 2022 07:17AM ET

- Two defensive sectors had performed better than the broad equity market

- But recently endured significant selling pressure

- Important signals might be visible in sector rotation

- Washout in market hideouts puts S&P 500 one step closer to a tradeable low

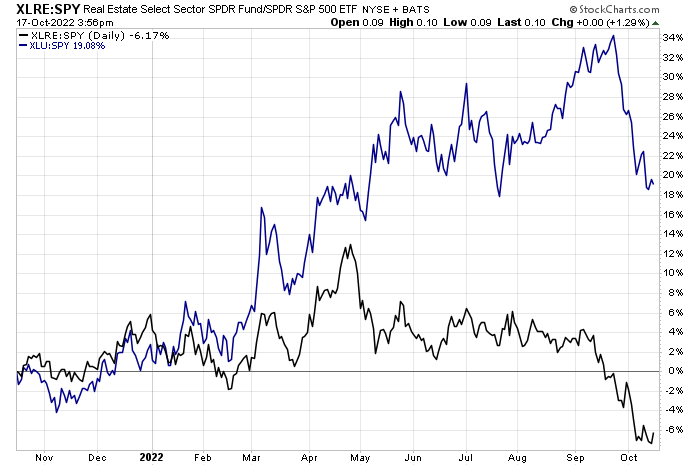

Two sectors that had been outperforming the S&P 500 through much of 2022 were Real Estate and Utilities. The narrative made some sense—hard assets should do well during inflationary times and the consumer was still strong, so housing prices and rents should fare relatively better than say, cyclical chip stocks or industrial plays.

In the utility space, steady and reliable—some might say boring—electricity providers and firms owning important energy transmission lines should not be slammed by an economic downturn. So those groups did fine as other stocks plunged. Real estate and Utilities feature better returns until September.

Source: Stockcharts.com

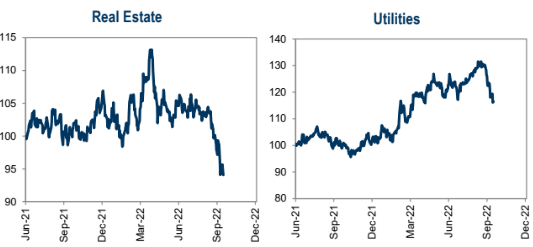

Massive Relative Collapses in Real Estate and Utilities

Source: Goldman Sachs Investment Research

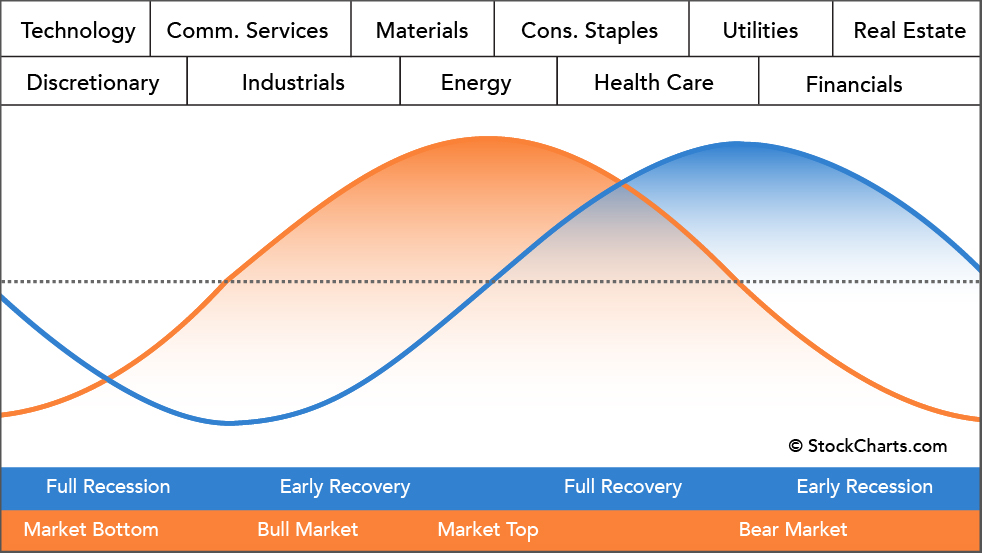

New variables have thrown a wrench into that thesis. First, the highest mortgage rates in 22 years—above 7% as of Monday afternoon—will surely lead to at least a short-term depression in real estate transactions, harming some REITs. Moreover, history shows that even real estate firms can be just as volatile as the S&P’s Guide to Sector Rotation . That outperformance is gone. Are we nearing the market bottom as a result? Unknowable, but keep your eye on the Financials sector (which is now outperforming) and then the Information Technology and Consumer Discretionary sectors for new leadership before we can have confidence in a true low.

Sector Rotation: Past the Peak in Utilities and Real Estate Relative Strength

Source: Stockcharts.com

The Bottom Line

While everyone focuses on earnings season, the Fed, and what the mega-cap growth stocks do over the coming weeks, keep your eye on what’s going on with two small and somewhat defensive spots of the market. Real Estate and Utilities, which were positive from a year ago on a relative basis through much of the third quarter, are now rolling over. It could be a sign that the market cycle has taken another step toward a market low.

Disclaimer: Mike Zaccardi does not own any of the securities mentioned in this article.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.