North Korea Pledges To Denuclearize?

IronFX | Mar 28, 2018 05:23AM ET

North Korea pledges to denuclearize?

- After Kim Jong Un’s visit to Beijing, the Chinese side stated that N. Korea is willing to denuclearize. North Korea’s state media made no comment on a possible denuclearization of the peninsula. Political analysts seem skeptical about the sudden shift in North Korea’s policy, however, consider it a positive step. Chinese officials seem willing to brief their South Korean counterparts. Should there be further headlines and developments about the issue, South East Asian markets could prove sensitive to it.

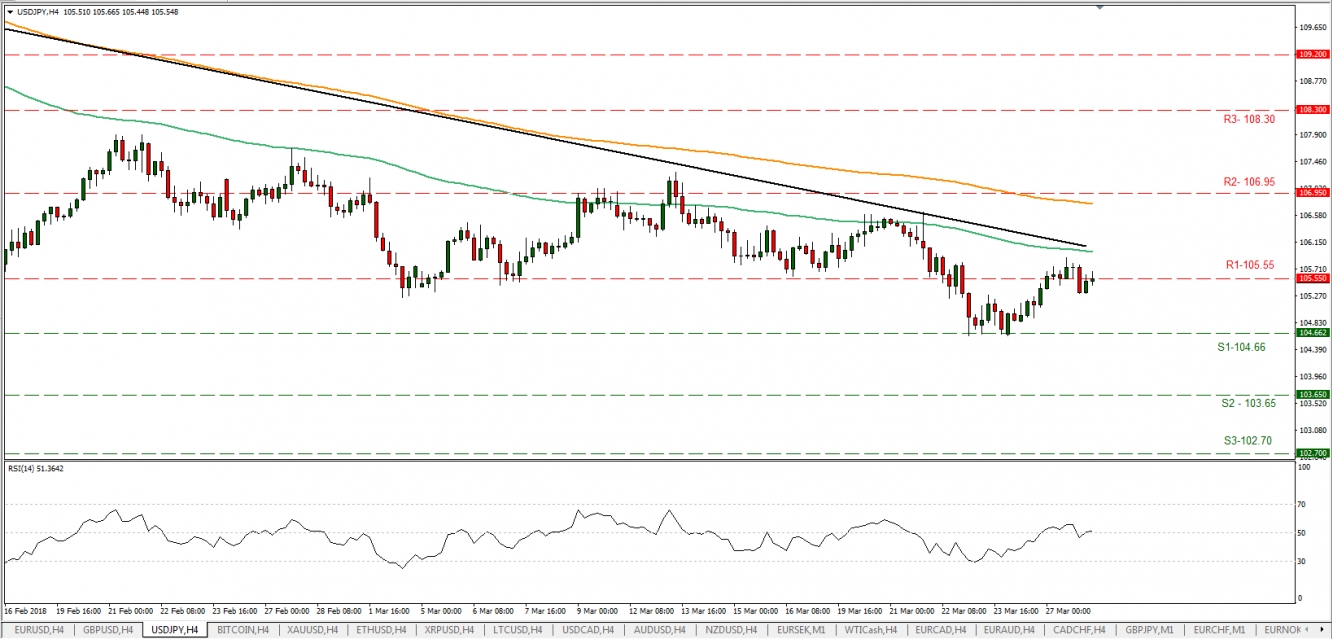

- USD/JPY traded in a sideways manner yesterday around the 105.55 (R1) resistance line. We see the case for the pair to continue to trade in a sideways manner with some bullish tones as today’s financial data releases could support the USD side. Should the bulls take the reins we could see the pair breaking the 105.55 (R1) resistance line and aim for the 106.95 (R2) resistance hurdle. On the other hand, if the bears take the driver’s seat, we could see the pair reaching and breaking the 104.66 (S1) support line.

5 Star Movement approaches Northern League in Italy:

- Italy’s strongest party, 5 Star Movement (5SM) could try to formulate a government, in coalition with the right-wing Northern League. Media cited statements of 5SM officials which mentioned that N. League seems to get closer to 5SM positions regarding a possible income support for the poor as well as on a number of other issues. The leaders of the two parties will meet in parliament next week and there could be further developments. A possible coalition between the two parties could prove to be a headache for Brussels as their positions contradict the mainstream political lines in Brussels in a number of issues. Any further headlines about a possible coalition could weaken the EUR.

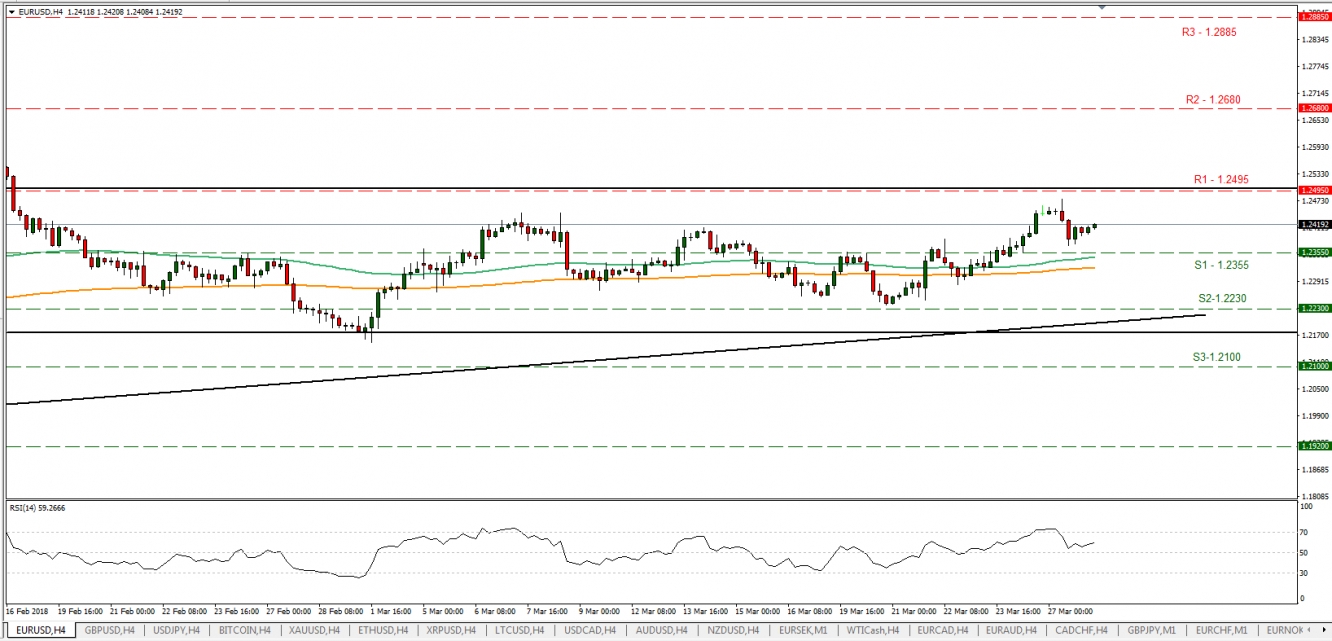

- EUR/USD traded in a sideways manner yesterday with some bearish, however, remained well between the 1.2495 (R1) resistance line and the 1.2355 (S1) support line. We see the case for the pair to continue to trade in a sideways manner with some bearish tones as the financial data released today could favor the USD side. Should the pair find fresh buying orders along its path, we could see the pair breaking the 1.2495 (R1) resistance line and aim for the 1.2680 (R2) resistance hurdle. Should it come under selling interest we could see it breaking the 1.2355 (S1) support line.

In today’s other economic highlights:

- During today’s European morning we get Germany’s Gfk Consumer Confidence for April and in the North American session we get the final GDP for Q4, the Pending Home Sales growth rate and last but not least this week’s Crude Oil Inventories from EIA.

- As for speakers, FOMC member Bostic speaks.

USD/JPY

·Support: 104.66(S1), 103.65(S2), 102.70(S3)

·Resistance: 105.55(R1), 106.95(R2), 108.30(R3)

EUR/USD

·Support: 1.2355(S1), 1.2230(S2), 1.2100(S3)

·Resistance: 1.2495(R1), 1.2680(R2), 1.2885(R3)

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.