No Time To Bask In Glow; Weak Start Seen Despite Netflix, Tuesday Rally

TD Ameritrade | Oct 18, 2018 01:15AM ET

(Wednesday Market Open) Despite glowing results from Netflix (NASDAQ:NFLX), it looks like the market might pull back early Wednesday after Tuesday’s huge advance. Profit taking could be a factor, and investors also might have their eyes on a slight uptick in Treasury yields.

The big story today is arguably NFLX earnings, which we’ll get to in a moment. There are items on Wednesday’s calendar, including the release of Fed minutes this afternoon and earnings from Abbott Labs (NYSE:ABT) and US Bancorp (NYSE:USB). Earnings season is in its infancy, but so far nearly 90% of reporting companies have topped Wall Street analysts’ expectations.

Still, the bias appears to be mostly lower for now, in part due to slightly higher Treasury yields and the dollar advancing vs. the euro and pound. A sharper than expected drop in United Kingdom inflation reported Wednesday might be helping prop the dollar, leading to some commodity market weakness. Crude appears to be one of the victims, falling slightly in the early going.

At the moment, it’s unclear if Tuesday’s rally was a “dead cat bounce,” or the the market setting a base. We’re coming off of an incredible day, so it wouldn’t be unusual to see some profit taking, especially from investors who bought the dip and now might be taking a little off the table. The market might give back some ground early and we’ll see what happens after that.

However, unlike the major losses in February—when things relaxed relatively quickly—this back-and-forth pattern we’re in appears like it might last a while, with continued volatility. The VIX was under 18 early Wednesday after climbing above 25 last week, but consider keeping a close eye on it for any move back above 20.

NFLX Engineers a Reversal

To reverse a call in football, a coach has to throw a red flag onto the field. Well, Netflix (NFLX) arguably did its version of flag throwing Tuesday and reversed the prior quarter’s subscribership miss. The video streaming giant reported 3Q subscriber growth of nearly 7 million, far surpassing management’s guidance for 5 million, and up from 5.15 million in Q2.

It definitely looked like a reversal from last time out when NFLX over-promised and under-delivered on subscriber numbers and the stock got smacked. This time shares rose 11% in pre-market trading, and could help give the NASDAQ Composite a boost. These were strong results.

Earnings of 89 cents a share for NFLX easily beat the third-party consensus estimate of 68 cents, while revenue of $4 billion matched expectations. So the FAANGs look to be off to a positive start, with one company down and four to go.

IBM (NYSE:IBM) Revenue Growth Back in Red

The news didn’t look so buoyant over at International Business Machines (NYSE:IBM), where revenue fell after rising the previous quarter for the first time in years. Shares dropped 4% in the immediate aftermath of the earnings report after IBM reported overall revenue of $18.76 billion, below third-party consensus expectations for $19.1 billion. Earnings per share of $3.42 did beat estimates by two pennies, however.

Perhaps more importantly, the company’s share of revenue from its Strategic Imperatives businesses—which includes cloud computing and data analytics—shrank in Q3 to less than 50% of total revenue at $9.3 billion, down from $10.1 billion in Q2.

On the other hand, IBM’s woes aren’t necessarily the entire industry’s, and could be positive for other companies in the space if they're gaining share from IBM. Demand for cloud computing isn't going away, just a possible shift from IBM to competitors. Shares of ADBE, another company in the cloud market, climbed nearly 10% after the company forecast 20% year-over-year revenue growth.

Out of the Woods? Not Necessarily

So does Tuesday’s 2% rally in the major U.S. indices mean the fallout is over from last week’s sell-off? Probably not, for a variety of reasons we’ll discuss below. Still, the biggest single-day surge since March did seem to indicate that investors might be starting to focus more on earnings and less on the geopolitical and rate issues that helped drag things down earlier this month.

It’s probably too early to get sanguine. Moves like the ones the market is in typically take three to five days to play out. Volatility, while lower than at its peak, remains elevated. Many investors still don’t seem sure where to plant their flag as the shifting sands from last week remain unsettled. Tuesday might end up being one of those upside days that helps set up where the market trades from here, but to think it’s “ding dong, the witch is dead” as far as volatility and sharp market swings are concerned would probably be a mistake.

Tuesday’s rally was led by info tech, health care, and communication services, but every sector rose and the markets ended near their highs. It’s also perhaps worth noting that neither crude nor bond yields really moved too much as the stock market rallied. The benchmark 10-year yield seems to be stuck in neutral near 3.15% this week, and crude has descended into the low-$70s a barrel after jumping above $75 recently. Rallies in both of those markets arguably helped put the brakes on stocks last week.

Earnings Mostly Solid To Date, But It’s Still Early

So far this young earnings season, reporting companies are delivering earnings beats at a higher than historic rate. That said, we’ll only be about 20% done with S&P 500 earnings by the weekend, so there’s a long way to go.

Investors do seem to finally be rewarding the big banks for their strong quarters. Morgan Stanley (NYSE:MS) rose more than 5% Tuesday after beating Wall Street’s estimates and coming up with robust investment banking results. Goldman Sachs (NYSE:GS) shares rose 3% after a similar strong Q3 performance. Financials still remain down for the year and well behind the broader market, but Tuesday might have helped reinforce an industry picture that looks pretty good.

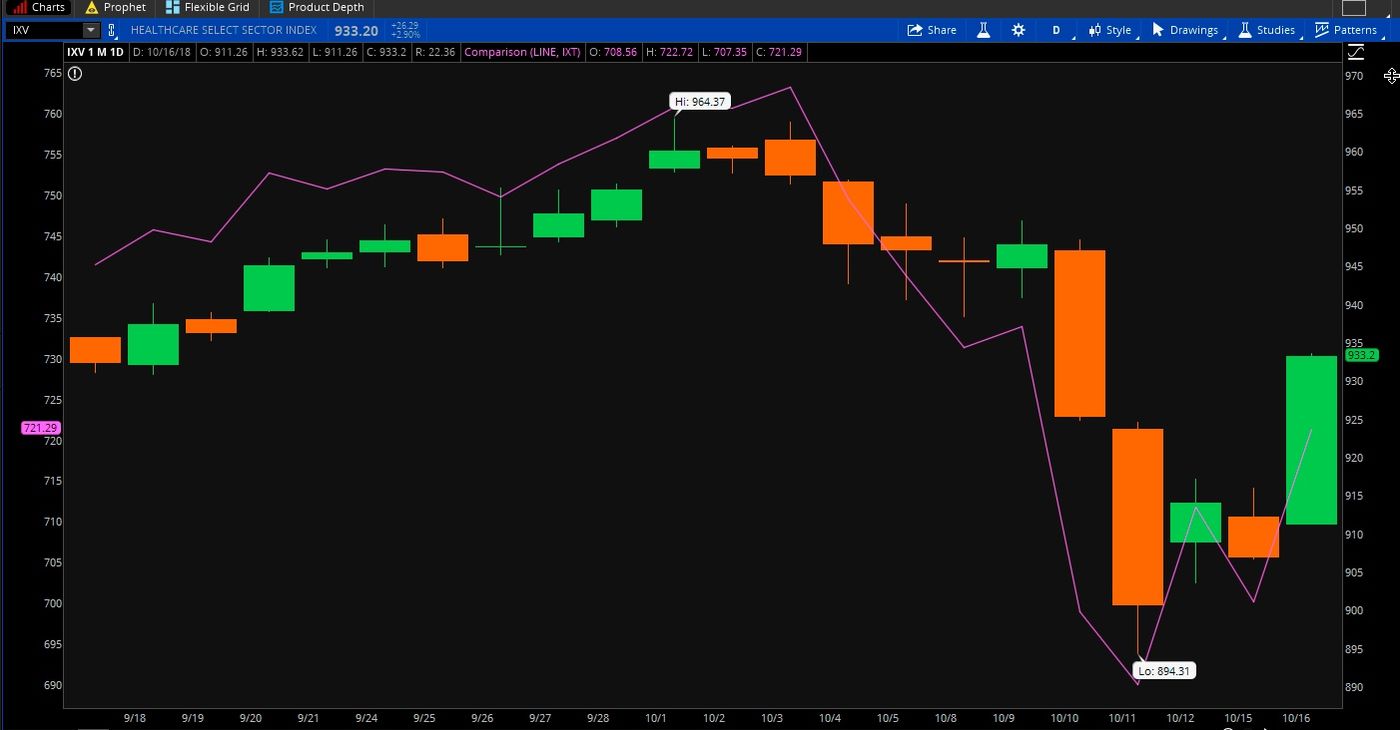

Health care came in second among the sector leaders after info tech Tuesday, climbing nearly 3% on the coattails of strong Q3 showings by Johnson & Johnson (NYSE:JNJ) and UnitedHealth Group (NYSE:UNH). Biotech shares out-performed health care as a whole with Tuesday gains of well over 4%, but the biotech sector remains well off last month’s highs. Some analysts are concerned about the chance of new pressure from Washington on drug pricing in coming months possibly weighing on biotech stocks, but that didn’t seem to get in the way Tuesday, at least.

FIGURE 1: FIGURE 1: Healthier Climate? Healthcare, which went into the sick bay last week along with the rest of the stock market, helped lead the way higher Tuesday with a nearly 3% gain. That was only topped by info tech (purple line), which rose just over 3% after slumping the last two weeks. Data Source: S&P Dow Jones Indices. Chart source: The thinkorswim® platform from TD Ameritrade . For illustrative purposes only. Past performance does not guarantee future results.

Trail of Breadcrumbs: If you want to get “technical” about it, the S&P 500 (SPX) has arguably left a trail of key levels in its wake as it rapidly plunged through technical support last week. These levels could be like proverbial breadcrumbs for investors to watch if the market finds a way to keep climbing out of the valley. The SPX has already pushed through what might be called “level one,” or the 200-day moving average, which stood at 2767 heading into Tuesday. That average has been a key support level most of the year. The next stop could be the 100-day moving average of 2823, followed by another resistance point at 2872—the reading where the market topped back in late January before correcting.

Way up above that is the late September all-time high of just under 2941 recorded just a few short weeks ago. That’s still a long hike, and there’s no guarantee that the market won’t once again test last week’s low of 2710. Though past isn’t necessarily prelude, remember that stocks rebounded sharply at first in February from their lows before retesting them and actually carving a new low point for the year (so far) in April. We’re not necessarily out of the woods yet, so let’s hope the breadcrumbs don’t run out.

Looking to Hire? Normally, job openings hitting an all-time high might be a cheerful sign for stock market investors, but that’s not necessarily the case this time. The August Job Openings and Labor Turnover Survey (JOLTS) climbed to 7.14 million, according to Labor Department data released Tuesday. To get a sense of just how that number has surged this year, consider that there had never even been a month with 6 million until mid-2017. This demand for workers probably underscores the hardy corporate environment, and might speak to companies expanding their businesses.

All this is arguably positive for the economy and the market. The one thing to possibly worry about is that the number of unemployed people per job opening keeps on falling. Just four years ago, there were two unemployed people for every job opening. In August, there was less than one, the Labor Department said. Companies facing a hard time filling positions might have to pay up for the right worker, or might not be able to find the right worker at all. Higher wages and a shrinking worker base can sometimes translate into inflation, or stifle companies’ plans to grow.

Risk Embrace: As the stock and Treasury markets slumped last week, investors also pulled billions of dollars out of corporate bonds, The Wall Street Journal notes. However, the paper noticed what looks like a discrepancy: Investors sold more investment-grade bonds than high-yield, or “junk” bonds. That, the newspaper reported, might signal lack of “systematic flight from risk.” All year, The Wall Street Journal noted, investment-grade bonds have performed worse than higher-risk debt. Bonds rated BBB—the lowest for investment-grade debt—make up half the investment-grade index, the most in more than 15 years. For investors, that means greater risks of downgrades to junk status and possible losses, The Wall Street Journal pointed out. A lot of really risky companies have been borrowing in booming loan markets. With interest rates still rising, investors might want to re-assess positions in corporate bonds to make sure their portfolios remain properly balanced and not weighted too heavily toward higher-risk assets, which would conceivably find it harder to pay back their loans if the economy slows due to rates going up.

TD Ameritrade® commentary for educational purposes only. Member SIPC. Options involve risks and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options .

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.