No Q.E. As Expected. 'Twist' Extended

Lance Roberts | Jun 21, 2012 01:11AM ET

Tuesday we stated that the Fed would not launch QE 3 yesterday:

For the Fed there is no impetus for launching a QE program at the current time — the market has priced in the bulk of whatever effect it may have had. Furthermore, as stated by Bernanke himself, the diminishing returns of each program are a concern and he will only want to launch further accommodative action only if absolutely necessary. That is not the case at this moment.

It is likely that the markets will be very disappointed tomorrow as Bernanke restates his position that he is aware of the weakness in employment, economy and Europe. He will also refocus attention on the current Administration stating that it is the job of Congress to act to create economic growth as the Fed's policy tools are not long term solutions. He will also reiterate his concern over the diminishing return of stimulative programs. However, he will leave the door open further stimulative action if necessary.

This outlook was exactly what we saw yesterday in the and the adverse effects that those pressures have on the economy. "Deflation, as an economic pressure, is very dangerous and once entrenched is difficult to break. For the Fed the fear of inflation is far less worrisome than the concerns of a severe deflationary bout in the economy."

For Bernanke another round of QE is inevitable, however, we can now push our original window of August-September out until after the election most likely. This was a good political move for Bernanke not to be seen as influencing the upcoming election. However, the markets and the economy may not "buy" him that much time. The size of the program is simply too small to offset the effects of the Eurozone drag on the U.S. economy which is the Fed left the door open for further actions by stating "The Committee is prepared to take further action as appropriate to promote a stronger economic recovery and sustained improvement in labor market conditions in a context of price stability."

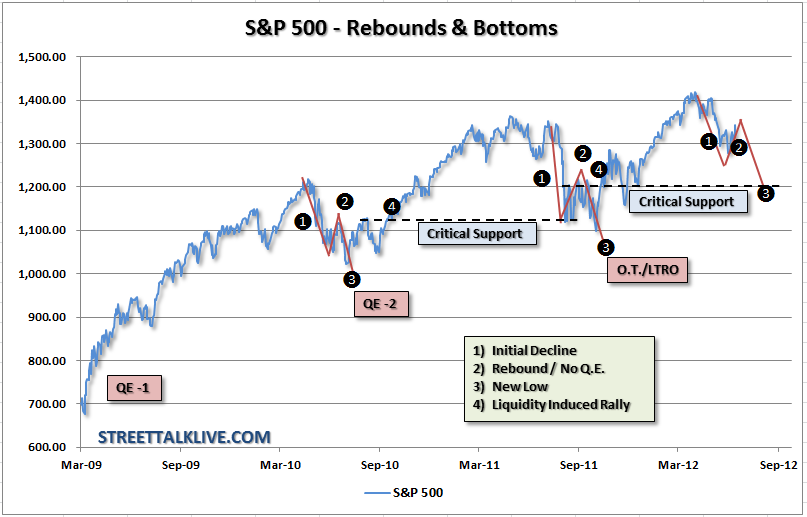

For investors it is important to consider the risk to investment portfolios in the current environment. With the crisis in Europe brewing, an upcoming election, weakening economics and a potential debt ceiling debate just around the corner it is very likely that we could see a slide in the markets into the August-September period. The current June rally has taken the markets from oversold at the end of May to very overbought currently. Each of the past two summers has played out very similarly, and in both cases, the midsummer rally led to further declines. Will this summer play out exactly the same? It is all a guess. However, from an investment standpoint, the current levels of downside risks grossly outweighs the odds of success. We continue, as we have since April, to recommend holding more cash and fixed income at the current time and wait for a better buying opportunity in the future.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.