NFP Preview: Are the Fed’s Fears of a Jobs Market Slowdown Justified?

Matthew Weller | Aug 02, 2024 02:55AM ET

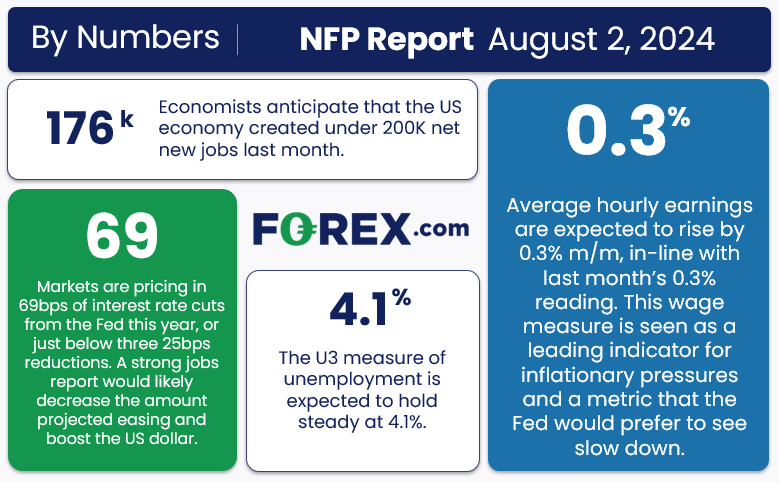

- NFP report expectations: +176K jobs, +0.3% m/m earnings, unemployment at 4.1%.

- Leading indicators point to a below-expected reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 125K-175K range.

- The US Dollar Index (DXY) is consolidating in the middle of its 4-week range – see the key levels to watch below.

- The ISM Manufacturing PMI Employment component dropped to 43.4 from 49.3 last month, hitting the lowest level since June 2020.

- The ADP Employment report showed 122K net new jobs, down from 155K last month.

- Finally, the 4-week moving average of initial unemployment claims held steady at 238K, near the highest level in 11 months.

Coming a mere two days after the FOMC meeting, you might expect Friday’s nonfarm payrolls report to have a more limited impact on markets; after all, the Fed will get another jobs report (not to mention another round of inflation data) before making its September monetary policy decision.

In this case, though, there may be more potential for volatility than meets the eye at first glance. In the Fed’s monetary policy statement and Chairman Jerome Powell’s press conference, policymakers were clear to emphasize the “balanced” risks between a slowing labor market and elevated inflation. Specifically, Powell noted,

"If the labor market were to weaken unexpectedly or inflation were to fall more quickly than anticipated, we are prepared to respond."

At the same time, the “Sahm Rule” that looks at how much the unemployment rate has risen off its 12-month low as a sign of an incoming recession has nearly triggered, so the often-ignored unemployment rate may be more significant this month, especially if it ticks up to 4.2% from the current/expected 4.1% reading.

In terms of the NFP report, traders and economists are anticipating a slight moderation from last month’s jobs growth, with wages and the unemployment rate expected to come in roughly in line with recent trends:

Source: StoneX

NFP Forecast

As regular readers know, we focus on four historically reliable leading indicators to help handicap each month’s NFP report, but due to the vagaries of the economic calendar, we won’t get access to the ISM Services PMI report until after the NFP report:

Weighing the data and our internal models, the leading indicators point to a below-expected reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 125K-175K range, albeit with a big band of uncertainty given the current global backdrop.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). As always, the other aspects of the release, prominently including the closely-watched average hourly earnings figure which came in at 0.43 m/m in the most recent NFP report.

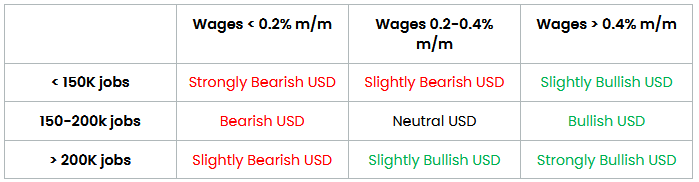

Potential NFP Market Reaction

After drifting lower this week, the US Dollar Index is near the middle of its 4-week range, leaving a balanced outlook for the world’s reserve currency heading into NFP. With traders already pricing in nearly a full 25bps interest rate cut at each FOMC meeting for the rest of the year, there maybe a slight lean toward upside potential in the greenback if a solid jobs report opens the door for the Fed to hold in November or December.

US Dollar Technical Analysis – DXY Daily Chart

Source: TradingView, StoneX

As the chart above shows, the US Dollar Index (DXY) saw a big selloff Wednesday as the Fed emphasized the downside risks in the labor market. Moving forward, the key level to watch will be the 4-month low near 103.65.

If we see a soft jobs report, traders could increase bets on a more aggressive 50bps interest rate cut from the Fed, taking the greenback below its key support zone in the mid-103.00s. Meanwhile, a solid jobs report could alleviate some of those immediate fears and take DXY back toward the weekly highs in the upper-104.00s.

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.