Markets Calmer Following Major Moves Across GBP And JPY Pairs

Littlefish FX | Feb 09, 2016 11:58PM ET

New York Forex Report: Following the big moves we saw yesterday across the GBP and JPY pairs, driven by an aggressive sell-off in oil and equities, markets have been calmer across early European trading so far today. Concerns for the European financial sector, alongside a renewed drop in oil, led global equities lower yesterday and whilst for now the selling has been stemmed, concerns hang heavy over the state of the global economy leading to a surge in safe-haven demand for the Japanese Yen. A quiet data calendar for the US session today leaves no clear directional drivers though USD remains weak today.

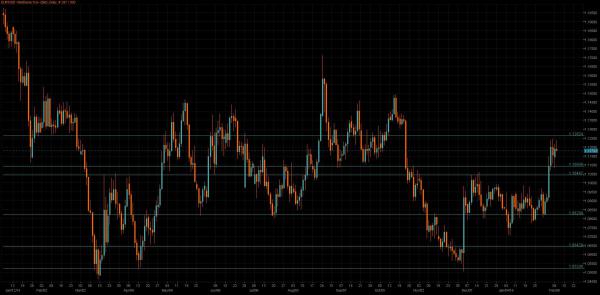

EUR/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR grinded higher over the European morning as European equities and the US dollar remain weak. German Trade Balance and Industrial Production data both printed below expectations.

Technical: While 1.1050/30 remains intact as support expect rotation through last weeks highs en route to test 1.14 symmetry objective. Below 1.0950 suggests false upside break and opens retest of range lows.

Interbank Flows: Bids 1.11 stops below. Offers 1.1250 stops above

Retail Sentiment: Bearish

Trading Take-away: Long

GBP/USD

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Fundamental: A choppy session for GBP which strengthened on improved Trade Balance data which showed a narrowing of the deficit, though the move was tempered as commodity and equity markets came under pressure again heading into the NY session.

Technical: Testing base support of last weeks advance failure at 1.4350 suggests false upside break and resets bearish trend to attack and break 1.40 as the primary downside objective. Over 1.45 re- establishes bullish bias and targets retest of last weeks highs

Interbank Flows: Bids 1.4350 stops below. Offers 1.45 stops above.

Retail Sentiment: Neutral

Trading Take-away: Neutral

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: JPY has broken important technical levels, and, bar a BoJ ‘intervention’, markets will be wary of further downside, which keeps pressure on the USD/JPY bounces are very limited, as broader market trades poorly, and sentiment hit as attention refocuses on signs of stress across certain products. The inability to hold key support despite IOER move, Kuroda comments on further easing stance, was a sign in itself and clearly reflects instability and unforeseen concerns

Technical: USD/JPY breaches major neckline support overnight. While 116.70 caps intraday upside reactions expects a grind lower to test 113.90 as the next downside objective.

Interbank Flows: Bids 114 offers below. Offers 116 stops above

Retail Sentiment: Bullish

Trading Take-away: Short

EUR/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Choppy flows in EUR/JPY as JPY pulls back slightly from yesterday's highs on talk that BOJ might be forced to intervene if strength continues.

Technical: While 130 continues to cap upside reactions expect tests of 127.70 bids next, failure through this level opens 126 as the next downside objective. Only a close over 130 eases immediate downside pressure.

Interbank Flows: Bids 128 stops below. Offers 130 stops above.

Retail Sentiment: Bullish

Trading Take-away: Short

AUD/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: AUD comes under renewed pressure today as commodity and equity markets see fresh selling with Copper down sharply on the session. NAB business survey today in Australia demonstrates softening in commercial conditions as renewed concerns of global growth / China and financial market volatility begin to be borne out in the data.

Technical: AUD is testing pivotal .7000 support a failure here resets the bearish bias and targets a test of .6950 en route to a retest of year to date lows. Only a close over .7150 eases immediate downside pressure

Interbank Flows: Bids .70 stops below. Offers .7150 stops above.

Retail Sentiment: Bullish

Trading Take-away: Neutral

USD/CAD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bullish

Fundamental: Fresh oil weakness today has the Canadian dollar under pressure again with USD/CAD grinding higher despite USD weakness also.

Technical: While 1.3630/50 survives as support potential for broader correction to the recent decline to 1.40 offers from below. A failure at 1.3630 opens1.3430 test on the downside.

Interbank Flows: Bids 1.3630 stops below. Offers 1.39 stops above.

Retail Sentiment: Neutral

Trading Take-away: Neutral

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.