Natural Gas: Prices Could Jump in the Short-Term

Satendra Singh | Aug 01, 2024 06:32AM ET

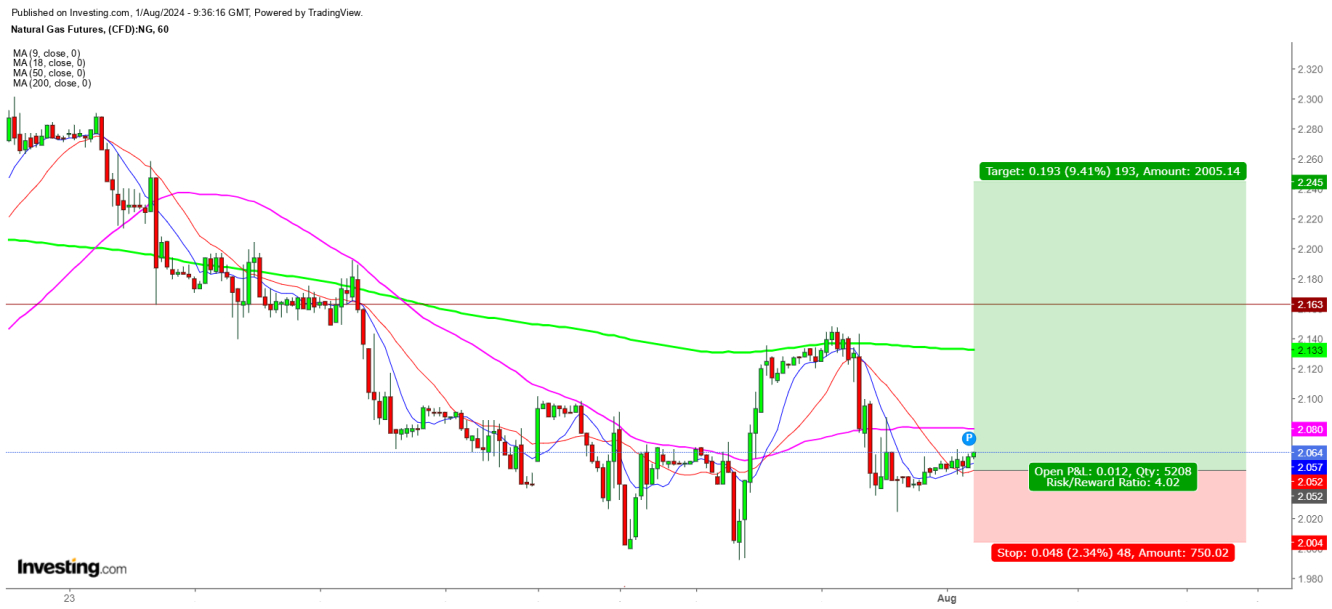

On analysis of the movements of the Natural Gas futures in different time frames, The current formations in an hourly chart indicate a bumpy move awaits here, as the natural gas inventory announcement tonight could change the sentiments here.

Undoubtedly, the expected injection level tonight is 31 Bcf; which was 22 Bcf last week could find a surprisingly lesser injection this time of approx. 12 Bcf. If this comes according to the expectations the, bulls could run upward to pounce upon the bears.

In a 1 Hr. chart, 9 DMA has come above 18 DMA, indicating the advent of price reversal. In such a case, natural gas futures could hit $2.245 before Aug. 5, 2024. A long position at the current level along with a stop-loss at $2, could be the best option for the short term.

In a Daily chart, bulls are struggling to hold the current indicating a limited downside in natural gas prices. Undoubtedly, the announcement of a lesser injection tonight could result in a rally likely to continue during the first half of this month.

I conclude that any downward move by the natural gas futures up to $2 could provide an opportunity to go long.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.