Natural Gas Bears Have Only One Escape Route Before Advent Of Winter

Satendra Singh | Nov 24, 2017 01:57PM ET

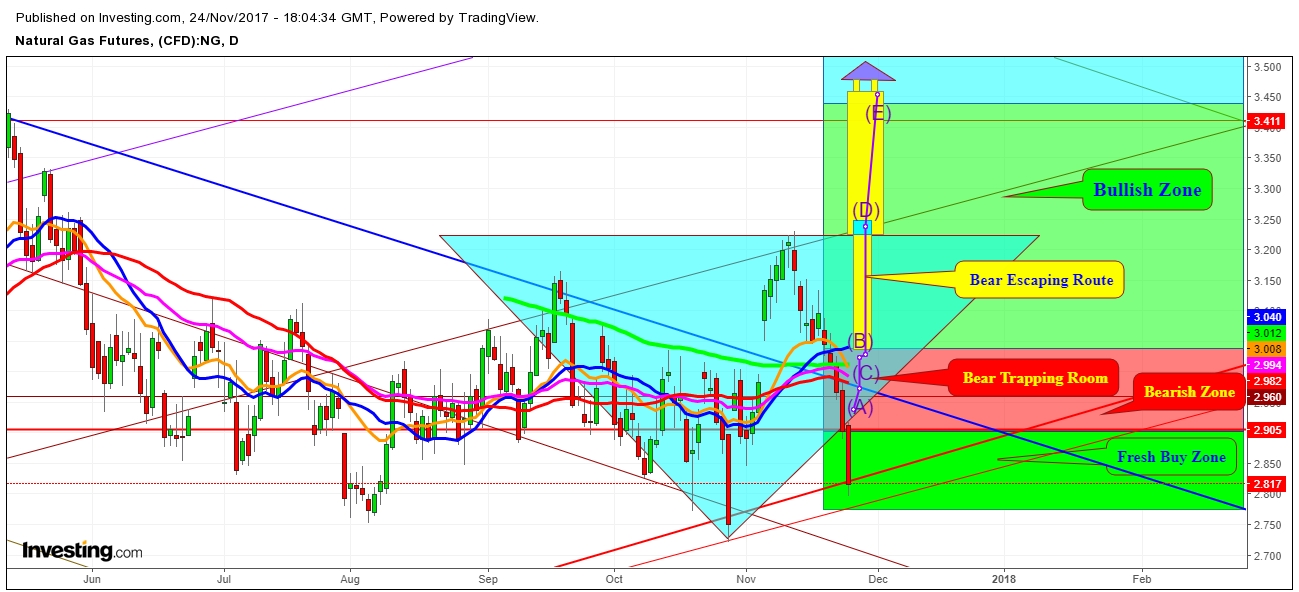

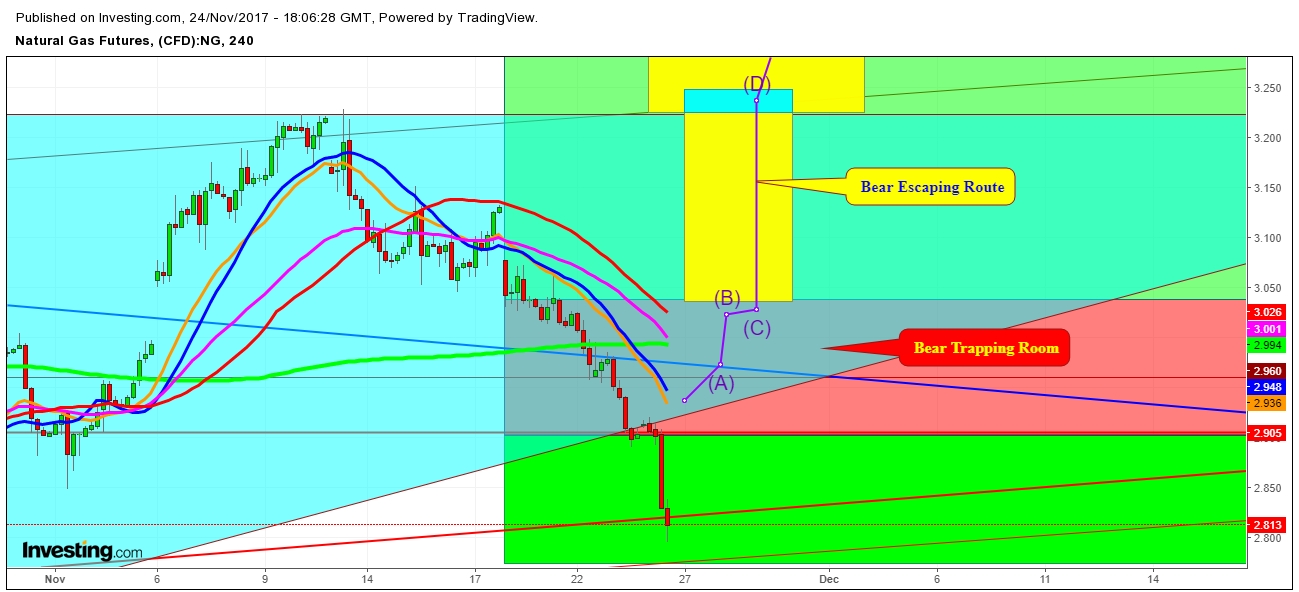

On analysis of the movement of Natural Gas futures price in the same chart pattern which I noted in my last analysis, I find that although,the bears have tried their best to drill a hole in the ground on the last trading session of the Week on November 24th, 2017 but remained unsuccessful.

And, now they have no option after being trapped inside a tight compartment in large numbers, except running upward towards the ventilation hole in the roof for breathing fresh air. I define the expected escaping route for the bears to reach up to the ventilation hole before the advent of winter, and before the heating demand start growing like wild fire. Weekly injections have turned into withdrawals, which are definitely a warning signals for bears to use empty chimney as a good way to come out on the roof, otherwise they would have no choice.

I find a sustainable move above $2.947 on November 27th, 2017 will confirm the Natural Gas bears’ retreating march to adopt the best option for their safe retrieval.

Disclosure: This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.