NASDAQ 100 Should Still Target High 14000s.

Dr. Arnout ter Schure | Apr 14, 2021 04:19PM ET

Two weeks, I showed using the Elliott Wave Principle (EWP) the Nasdaq 100 had reduced its option from four to two.

I concluded:

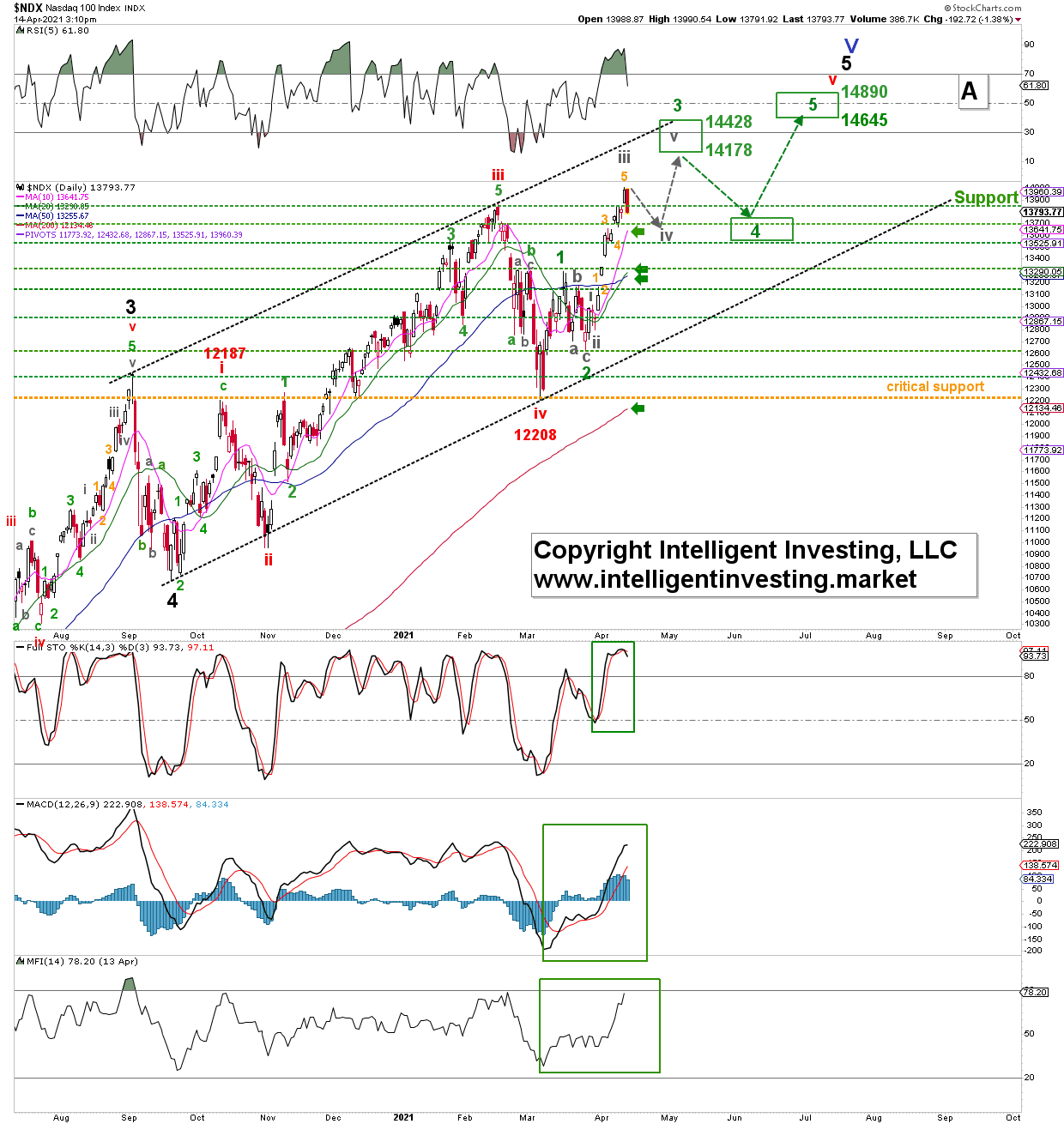

"I prefer to look higher per an EWP impulsive move to NDX 14,178-14,428 for a minor 3rd wave, then a retrace to ideally NDX 13,533-13,733 for a 4th wave, followed by the last move higher – a 5th wave- to ideally NDX 14,645-14,890 to complete the impulse that started March 2020.

So far, so good, as the NDX reached a new all-time high. But it is seeing some red today. So is the preferred EWP count to the high-14,000s still on track?

Figure 1 below says yes, but as long as the index can stay above 13,540 on a closing basis. If not, then that would be a severe warning to the bulls that the decline from yesterday's all-time high is not the grey minute wave-iv, but something else.

Figure 1: NDX100 daily candlestick chart with EWP count and technical indicators.

Hence, for now, I prefer to view the index in a small degree 4th wave, which should last a few days, and to fall back to ideally the 13,540-13,720 zone, which is the 23.60-38.20% retrace of the length of the last grey minute wave-iii, which would be normal 4th wave behavior. From that zone, I then expect a rally to the NDX 14,178-14,428 for minute wave-v of green wave minor 3, as shown already two weeks ago. The up-pointing technical indicators (green boxes) support higher prices as well. Besides, the index is well above its rising 10d, 20d, 50d, and 200d SMA as pointed out by the horizontal small, green arrows, which add weight to the evidence of the index being in a 100% bull run.

Bottom line: The NDX took the "impulse move to the upside" road map a few weeks ago, and my preferred view back then "to look higher per an EWP impulsive move to NDX 14,178-14,428 for a minor 3rd wave, then a retrace to ideally NDX13533-13733 for a 4th wave, followed by the last move higher – a 5th wave- to ideally NDX 14,645-14,890," was so far correct and as such remains my preferred point of view. It would take a close below 13,540 from current levels to put pressure on this impulse pattern. I view the decline that started today as a minute-degree 4th wave. One can see it as some profit-taking after an over 7% gain since my last update and an 11% run since the late-March low.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.