Nasdaq 100 Could Target $9500

Dr. Arnout ter Schure | Sep 23, 2022 02:13PM ET

Three weeks ago (see here) I was tracking a possible impulse move down for the Nasdaq 100 from the mid-August high (i.e., five waves lower as per the Elliott Wave Principle (EWP)). I wrote then:

Today's reversal candle suggests wave-iii completed, and wave-iv should now be underway, targeting ideally $12400+/-100. The index should not move above last week's low of around $12900, or it would invalidate this possible impulse path. Once wave-iv completes, wave-v should ideally target about $11400-11600.

The index had indeed bottomed for wave-iii, and wave-iv ended the next day at $12451. However, wave-v failed to travel the total distance and only reached as low as $11928 on September 6. This miss shows markets do not always have to follow text-book paths. That would be too easy. Regardless, that low completed an impulse lower.

The subsequent rally was a countertrend bounce, and now the index is impulsing lower again, following along the bearish path I recently shared for the S&P 500. Now that the market has stepped through this bearish door, the NDX's impulse path lower is shown in Figure 1 below.

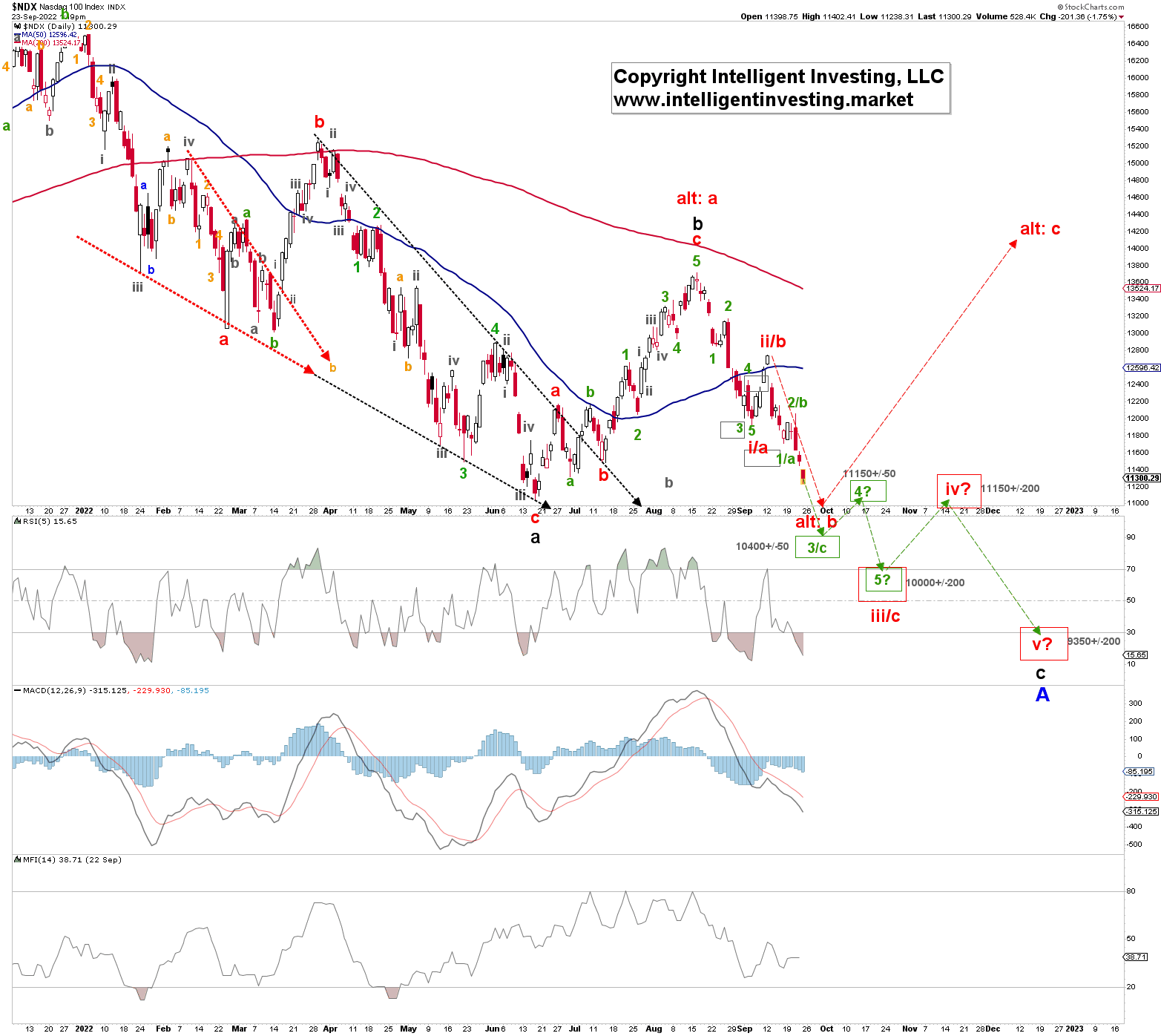

Figure 1. NASDAQ100 daily candlestick chart with detailed EWP count and technical indicators

Black W-c comprises ideally five smaller red W-i, ii, iii, iv, and v. Those, in turn, are made up of smaller waves as well: green W-1, 2, 3, 4, 5 for red W-iii/c. The progress of these waves is shown in Figure 1 with the green dotted arrows and their associated Fibonacci-based ideal price target zone. This (green) path remains the focus until proven otherwise.

The otherwise, in this case, is presented as the red "alt: a, b, c" EWP count (red dotted arrows). It would mean the index bottoms around $11000+/-200 over the next few days and then stages a rally back to or potentially even exceeding the August highs. It would require a break above the green W-2/b level (Wednesday's high at $12062) to suggest this will happen. But, for now, the red path remains an alternative, although it can be used to place appropriate stops, etc., and thanks to the EWP, we have an excellent general road map to help us navigate the markets.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.