My 2012 Midyear Outlook For Oil Demand

Elliott Gue | Jul 15, 2012 03:44AM ET

West Texas Intermediate (WTI) crude oil prices tumbled 30 percent from their high of $110 per barrel in late February to less than $80 per barrel toward the end of June. Meanwhile, Brent crude oil declined from a 2012 high of more than $128 per barrel to a recent low of less than $90 per barrel.

The drop in oil prices far exceeds the decline in equities: At its June low, the S&P 500 had given up almost 12 percent from its 2012 high.

In recent weeks, I’ve received a number of emails asking about my outlook for oil prices and what the decline in energy prices means for oil investing.

First, let’s look at what’s driving the recent weakness in oil prices. Investors have grown increasingly concerned that the slowing global economy will erode demand for crude oil.

Although EU oil consumption will weaken and China’s economic growth has slowed relative to prior years, the recent drop in oil prices already more than reflects these headwinds. Moreover, current prices don’t reflect the potential for emerging-market oil consumption to pick up in the second half of the year. Investors also shouldn’t discount the stimulative effect that lower oil prices will have on the US economy and demand.

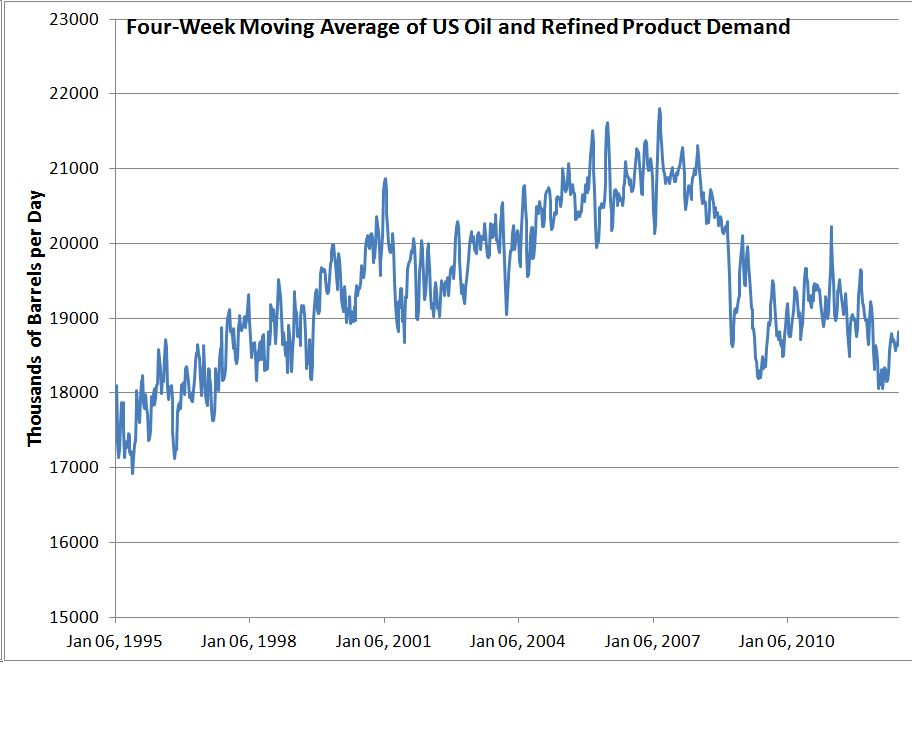

In the first 25 weeks of 2012, US crude and refined products demand has declined by 3.18 percent from year-ago levels. Some of this weakness reflects reduced demand for heating oil during the unseasonably warm 2011-2012 winter. However, other factors are at work: Through the end of April, US gasoline consumption had slipped 1.4 percent year over year, while jet fuel demand was down 0.8 percent.

The four-week moving average of US oil and refined-products demand shows a clear break in the steady uptrend in US oil consumption after the Great Recession. As the economy recovered and the credit crisis eased, US oil demand bounced off its 2009 and early 2010 lows but never regained its pre-2007 levels. In fact, the nation consumed less oil in 2011 than a decade earlier.

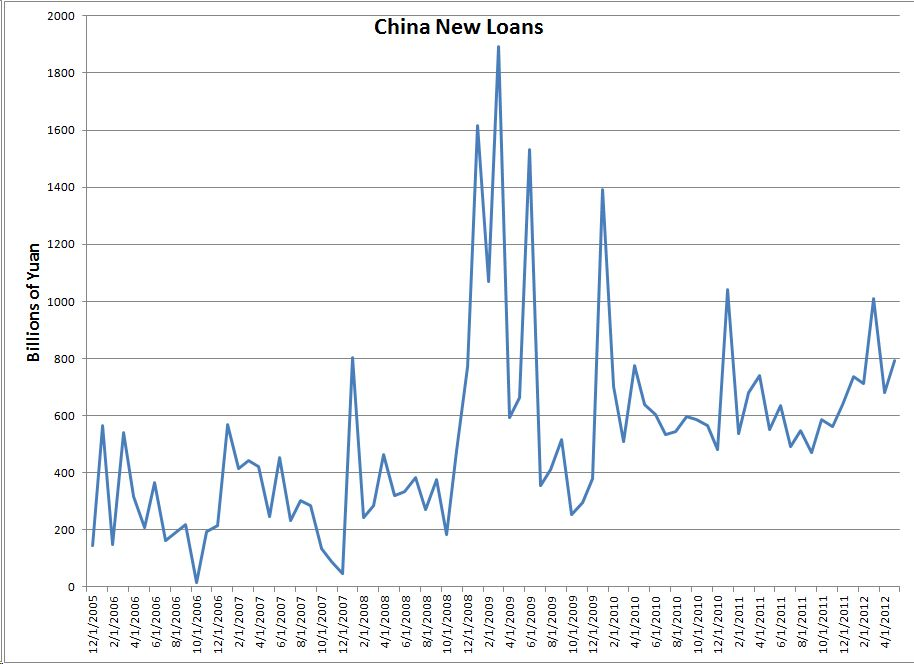

Although the US remains the world’s largest oil consumer in absolute terms, the decline in domestic consumption is neither an unforeseen development nor a major driver of oil prices. The International Energy Agency’s Dividend Investors: Don’t Worry About Europe, Keep an Eye on China , investors forget that China’s economic slowdown largely stems from Beijing’s efforts to rein in inflation. The government steadily increased banks’ reserve requirement in 2010 and early 2011. As these efforts brought inflation in check, Chinese authorities have reversed course, slashing reserve requirement ratios three times since late 2011 and reducing interest rates in June. These stimulative moves have revived residential real estate lending, with mortgage volumes in May surging 8.5 percent year over year.

As you can see, loan volumes have picked up somewhat in China since late last year, and analysts expect the data for June to exhibit another surge from year-ago levels. Policymakers have signaled their willingness to implement additional growth initiatives, likely in the form of interest rate cuts and further reductions to banks’ reserve requirements.

A stimulus similar to China’s 2008-09 spending spree probably won’t be in the cards, but Beijing could approve a smaller package if the global economy were to falter.

At any rate, China’s oil demand hasn’t slowed. Oil imports hit a record high in May.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.