Moving Closer To The Edge

Blaine Rollins | Jun 23, 2015 12:52AM ET

Risk On! The Fed would like you to move closer to the edge for an even better view…

Stocks rose last week, lifted by signals from the Federal Reserve that interest-rate increases might come more slowly than previously thought. Nevertheless, for the second week in a row, the market gave up a portion of the gains on Friday, this time over intensifying worries that Greece might default on its debt or be forced out of the eurozone. The Fed’s dovish comments on Wednesday brought the “risk on” trade back, and investors piled on Thursday into highflying, high-momentum biotechnology stocks such as Celgene (NASDAQ:CELG), up 5%, among others. The Nasdaq managed to take out its previous intraday high set back in 2000, before easing back slightly. Pessimism over a Greek bailout got the upper hand on Friday, and stock prices faded. With little in the way of big domestic news expected this week, the market’s focus is likely to stay on the small nation teetering on default

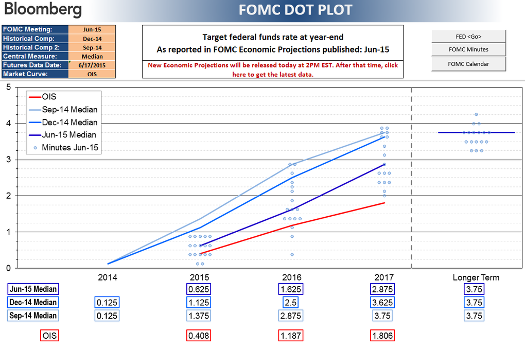

So the Dovish Optimists at the Federal Reserve updated their interest rate guidance last week. As has been the trend, they again lowered their rate increase expectations while throwing out many comments that want you to believe this rate hike cycle will be as enjoyable as a never-ending massage.

U.S. Equities took the RISK ON cue and ran with it, but fell short of making all time new highs. However, bases are being built in a low volatility environment, suggesting there is plenty of money buying on the dips…

But RISK is being taken in U.S. Equities, as seen by the new highs being made in Small Caps (ARCA:IWM), the Nasdaq Comp, Health Care (ARCA:XLV), Consumer Cyclicals (ARCA:XLY), Financials (ARCA:XLF) and Biotechs (NASDAQ:IBB)…

Within Large Cap stocks, the consumer must be feeling good with Nike (NYSE:NKE), Starbucks (NASDAQ:SBUX) and Jurassic Park all setting new all-time highs…

Also sparking the market to new highs is the insane number of Corporate Weddings occurring this summer. Although, a Roman Orgy might better describe what is happening over in the Managed Care industry…

- Anthem (NYSE:ANTM) bids for Cigna (NYSE:CI)

- Aetna (NYSE:AET) throws flowers at Humana (NYSE:HUM)

- United Healthcare is also winking at Humana

- Texas Instruments (NASDAQ:TXN) is feeling lonely after being rejected by Maxim Integrated (NASDAQ:MXIM)

- AMD is exploring all options

- Cypress Semi (NASDAQ:CY) is still wooing Integrated Silicon (NASDAQ:ISSI)

- Fox wants to own all of Sky

- Jana is upset at Conagra (NYSE:CAG), so wants to control all of it

- The owners of Duff & Phelps want to marry it off

- Ryland Homes and Standard Pacific (NYSE:SPF) decide to move beyond just being friends

- Williams Companies (NYSE:WMB) is now thinking of dumping Williams Partners (NYSE:WPZ) and jumping into the arms of Energy Transfer (NYSE:ETE)

- Martha Stewart (NYSE:MSO) decides to cater her own wedding and sells out

- Home Properties (NYSE:HME) also sells out

- And for French proposals, Numericable (PARIS:NUME) gets one from Bouyues Telecom

And this is only one week of activity, so don’t expect any investment bankers or finance lawyers to make it to your own wedding this summer.

For the week, health care and the consumer sector drove the gains…

Out of the ACME-box thinking from Eric Peters this week…

ACME Traps: “Volumes are picking up,” said Roadrunner, the market’s top volatility trader. Greece has been the catalyst; activity jumped in Bunds and currencies. “But there was no real bleed into the S&P vol,” said the savvy character, looking left, right, up. “There are lots of concerns in this market, but prices keep moving higher.” The cost of S&P puts is near historical highs relative to the cost of calls. “It is difficult for markets to fall in a material way when the skew is this high; it’s hard to generate downside velocity.”

ACME Traps II: “Everyone’s certain this will go horribly wrong; it’s just a matter of when,” continued Roadrunner, dodging falling anvils. “When people are this scared, they prefer to be early.” New highs are greeted with condemnation, not celebration. Leveraged money had no problem buying European bonds at negative yields, in the hopes that rates would fall further below zero. But that same insanity is absent in equities. “People are not positioned for upside, yet the path of least resistance continues to be up."

Greece, okay, I said it. Yes, it is still a country on the Mediterranean that is impacting the European markets. Especially 2nd tier Euro bond spreads…

As well as the volatility of the German stock market (VDAX). But no visible impact on the volatility of the U.S. stock market (VIX)…

In the U.S., the butterflies in the stomach can be seen in the performance of High Grade Corporate Bonds, which are continuing to underperform U.S. Treasuries. As we have seen in the fund flows, a significant amount of money is leaving fixed income funds and ETFs, so hopefully, this is a temporary fund flow effect and not a leading indicator of credit risk in the U.S. economy. But so far, this has had little impact on the Equity Markets…

Another area of concern in the U.S. can be seen in energy stocks (ARCA:XLE), which have now declined for 7 straight weeks…

China also decided to pause sharply last week after going vertical for 6 months…

Looking through the weekend reads, Barron’s builds a case for buying the Airline stocks on this 20-30% pullback. Investors have sold the stocks off on capacity addition concerns, but Barron’s thinks the valuations more than discount the increased capex worry…

So Google (NASDAQ:GOOGL) just took over the smoke detector alarm business. Next up, Home Security and Monitoring?

Nest, a business owned by Google that makes connected home products, refreshed its line of three devices today, but it was the firm’s deal with insurance companies that’s really exciting. Nest said it has established partnerships with American Family Insurance and Liberty Mutual Insurance to offset the costs of a Nest Protect smoke detector, and establish a monthly discount for homes that link their Nest smoke detectors to the insurance firms. American Family is the first insurer to have the program up and running, but it’s only doing so in the state of Minnesota. The insurer will send the customer the Protect (which costs $99) at no cost, and the customer hooks the Protect up via the ‘Works with Nest’ program. That will enable the Protect to share some data with the insurance firm, so it knows if the customer’s house has working smoke detectors. This is great for the insurance company, since smoke detectors help reduce the damage done by fires, and can lower the insurance payouts. It’s akin to the discounts that home insurance providers offer for people who install security systems.

31m subscribers, $5.4b in Revenues, $1.8b in Operating Income and 100+ projects in development. A great long read on HBO…

Finally, enough about the Financial Markets… get back to your Summer Music Festival!

The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful. The hyperlinks included in this message provide direct access to other Internet resources, including Web sites. While we believe this information to be from reliable sources, 361 Capital is not responsible for the accuracy or content of information contained in these sites. Although we make every effort to ensure these links are accurate, up to date and relevant, we cannot take responsibility for pages maintained by external providers. The views expressed by these external providers on their own Web pages or on external sites they link to are not necessarily those of 361 Capital.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.