I have personally benefited in two direct ways from the insane multi-trillion dollar credit-creation that we’ve seen happen over the past half decade: one, a private investment I made in a startup has been blossoming very nicely, and two, the house in which I live is worth nine times what I paid for it. It’s this latter phenomenon I wanted to touch on this holiday, since it’s quiet, and Slopers outside the Silicon Valley might find perverse comfort in the relative bargains of their neighborhood.

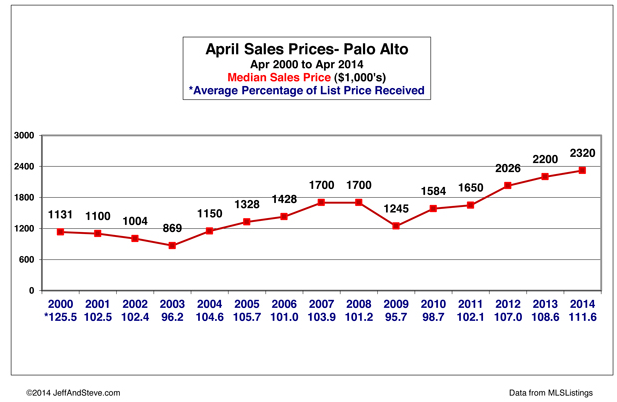

Below is a simple chart showing the median sales price of Palo Alto houses and – helpfully – the percentage of the list price received. It’s a pretty interesting litte chart. At first, it gently descends, as the Valley dipped from the Internet bubble bursting. Next, it began a steady ascent, as interest rates plunged (thanks to Greenspan) and the housing bubble went into full swing. The financial crisis took the froth out (although Palo Alto didn’t suffer the 50%+ drops of less attractive areas, like Stockton) and, most recently, we have soared into unchartered territory, both in terms of median sales price and price received (as you can see, the price being paid is actually averaging 11.6% above the already lofty asking price).

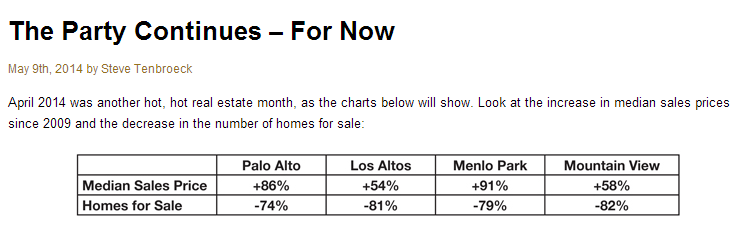

The same realtor who put together the chart above also keeps a blog, and they showed the amazing jump higher in prices since the financial crisis (Palo Alto +86%) combined with the plunge in available inventory (Palo Alto -74%). Personally, I think the poor souls buying at today’s prices are going to find themselves underwater in a big hurry and, just to add salt to the wound, will be paying 1.1% property taxes on the purchase price every year until they manage to sell the house, irrespective of the mark-to-market value (my own taxes, thanks to Prop 13, are pegged at a value 80% less than the actual present value).

For those of you who figure I’m just being a pessimist and are eager to jump on board this gravy train, I can bring to your attention a couple of plum properties. Here’s one in Los Altos – not quite as expensive as Palo Alto, but still a nice town – for $2 million (probably more like $2.1 million+, given the bidding wars). Just look at that curb appeal, ladies and gentlemen! Ever see such a sweet garage? And, yes, this is the actual color newspaper ad. This is the very best “face” they could put on the property.

If that’s too low-end for you – - that is, if you’ve got something along the lines of $3 million you want to spend instead – - fear not, I’ve got you a listing. It is shown below. As you can see, it hasn’t been on the market in 91 years (nor, apparently, has it been cleaned in the same timespan). Something tells me the family who owns the property decided, after nearly a century, it would be a good time to cash out.

Get in line. Sign right here on this line. Could you possibly write it in blood?