More Pain To Come For LinkedIn

David Trainer | Apr 22, 2014 02:09AM ET

We put LinkedIn (NYSE:LNKD), (~$175/share) in the Danger Zone last August when it was valued at $240/share. Despite its 30% decline since, we remain bearish on the stock. LNKD’s 2013 Form 10-K revealed that many of the issues we identified, including slowing growth, declining margins, and hidden liabilities, have worsened. These issues are significant and LNKD remains highly l overvalued even after its recent drop.

Slowing Growth

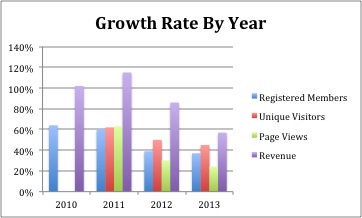

LNKD’s stock valuation embeds significant future profit growth, so it should be of great concern to investors that the company’s growth is decelerating. Figure 1 shows that LNKD is experiencing slowing growth in membership, page views, and revenue.

Figure 1: Slowdown in Growth Across Key Activities

Sources: New Constructs, LLC and company filings. Data collection for visitors and page views changed in 2009 so 2010 growth rate is not available.

Investors should be especially concerned over the slowdown in revenue and page view growth. LinkedIn’s visitors are engaging with the site less, and the company is having less success in earning revenue from them.

Quarterly numbers suggest the situation could be even worse than expected for LNKD. Unique visitors actually More and more employers are using Facebook (Facebook Inc (NASDAQ:FB), Twitter (Twitter Inc (NYSE:TWTR) and Google + (Google Inc (NASDAQ:GOOGL) to assist in recruiting employees.

Declining Margins

While LNKD’s revenue growth was slower in 2013, 57% is still nothing to sneeze at. Unfortunately, that growth in revenue has not translated into profit growth. In 2013, LNKD only grew after-tax profit (NOPAT) by 6%, from $41 million to $44 million. Its margins contracted from 4% to 3%, and its return on invested capital (ROIC) was cut in half, from 8% to 4%.

The typical justification when revenue growth fails to translate into profits is that the company is spending extra on sales and marketing to fuel further growth. However, LNKD’s sales and marketing expense only increased by 60% in 2013, just slightly faster than revenue.

The true culprits for LNKD were its administrative expenses, which increased by 76%, and depreciation and amortization, which increased by 68%. Gross margin also declined by half a percentage point. These are expenses that cannot easily be cut, and the fact that they’re growing faster than revenues is a major problem for LNKD.

Hidden Liabilities

LNKD doesn’t have any debt on its balance sheet, but that doesn’t mean there are no liabilities for investors to worry about. The company finances its office space and data centers through the use of off-balance sheet debt in the form of operating leases. LNKD has a total of $965 million in future operating lease obligations, which we discount to a present value of $750 million (28% of net assets).

LNKD also has roughly $400 million in employee stock option liabilities. The company has actually managed to reduce its outstanding options from 8 million at the end of 2012 to 5 million (5% of shares outstanding), but that still leaves a significant liability remaining.

Due to its secondary stock offering last year, LNKD has plenty of cash right now, but since it’s had a free cash flow of around -$400 million the past two years, that cash might not last very long.

Highly Overvalued

In order to justify its current valuation of ~$175/share, LNKD would need to grow NOPAT by 30% compounded annually for 23 years. Remember, this company only grew NOPAT by 6% last year. I simply don’t see a way for LNKD to achieve the growth implied by its valuation.

If we give LNKD credit for 15% compounded annual NOPAT growth for 15 years, the stock is worth around $25/share . Given the rising costs and competitive pressures LNKD faces, 15% for 15 years, is probably still being quite generous. It is hard to argue that LNKD will come close to justifying its $165/share valuation.

Insider Selling

What’s more, LNKD executives seem to agree with me, as they’ve been ditching the stock at alarming rates recently. Over the past six months, insiders have sold 2.7 million shares or 67% of the shares they held. That’s right, the company’s own executives have reduced their holdings in the stock by 2/3 in just six months. If that’s not a red flag, I don’t know what is.

Insiders are getting out of this stock, and you should to. LNKD has slowing growth, low profits, and no more market momentum to prop up the price.

Avoid These Funds

Investors should avoid the following ETFs as they allocate significant assets to LNKD and earn our Dangerous-or-worse rating.

- First Trust Dow Jones Internet Fund (FDN): 3.2% allocation to LNKD and Dangerous rating.

- Columbia Select Large Cap Growth ETF (RWG): 3.2% allocation to LNKD and Dangerous rating.

Sam McBride contributed to this report.

Disclosure: David Trainer is short LNKD. David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.