More Benefits From Overconfidence

Eric Falkenstein | Jun 03, 2013 02:13AM ET

Overconfidence may cause people to invest too much in volatile stocks because such stocks have a greater diversity of beliefs, and so if people dismiss the objectively bad odds of beating the market, such people will be drawn to stocks where they are in the extremum, and highly volatile stocks have the most biased extremums. One might think these people are irrational, but in the big picture people with this bias actually have a huge advantage, why Danny Kahneman said it's the bias he most wants his children to have.

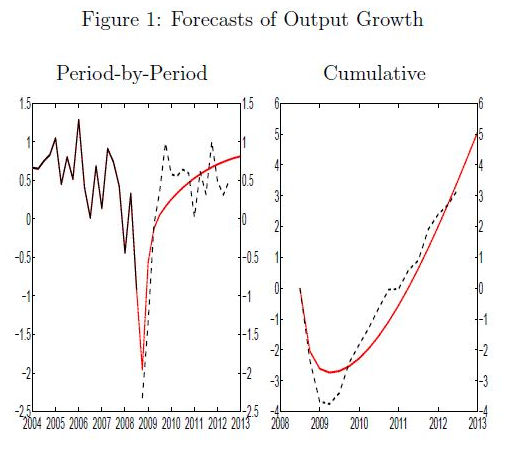

Two economists at Washington State University looked at New York Fed economists find that a particular DSGE model predicted the 2008 fiasco just about perfectly.

This is all 'out of sample', in the same way the test data for neural nets is out-of-sample: if you exclude all the hundreds of functional forms that were tried that didn't work, one of them was fit to only prior data and predicted the out-of-sample data. That is, the projection from 2008 is being done in 2013. The degrees of freedom in this model would make a technical analyst blush. I can understand the allure of this approach (economics is about modeling), but anyone who has been around a while should cop to the patent overfitting that goes on 'outside the model'. I would bet anyone that if they set this model up in real time, it will miss the next turning point...and there will be another DSGE model that would have worked.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.