Political Uncertainty Drives The Euro

MarketPulse | Feb 09, 2017 12:21AM ET

More active than it appears

The U.S. equity market was very low spirited overnight, but the Dow closed above the psychological 20,000 barriers for the fourth successive day. The Trump trade is the primary focus for equity markets and without any further guidance on U.S. tax policies, investors stay on the sidelines, annoyed and concerned about the unknown.

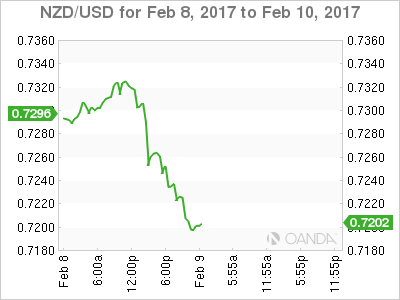

New Zealand dollar

The kiwi gapped lower on the RBNZ statement when the central bank stated that “Monetary policy would remain accommodative for a considerable period” [1]; indicating concerns for a slower return to their inflation target.

The comments were overtly dovish, and with an active element in the market that were long NZD for it to outperform on the crosses, in particular on the AUD/NZD, as inflation trajectories were diverging; hence monetary policies also appeared to be heading in polar opposite directions, the bottom fell out. I suspect this morning’s drop was initially driven by position unwind, which has now gathered steam as the Kiwi tracks towards .7200 level. So much for getting the parity party outfit dusted off, back to the closet it goes.

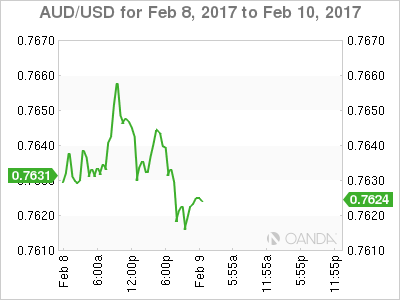

Australian Dollar

The Australian dollar is trading quietly ahead of Governor Lowe’s speech later today, as was the case with the broader market overnight. The Australian dollar had a rather uneventful session.

Japanese Yen

U.S. fixed income continues to lead the way, and with a steady bid in the UST 10 years trading down to 2.35%, USD/JPY dove below the critical 112 level and remains offered in early APAC trade.

With a possible event risk looming, the meeting between Japanese PM and President Trump this weekend, U.S. bond yields will likely give the cleanest picture for the USD/JPY trend into this week’s end. The event risk is clearly the downside if this meeting does not go as expected on trade negotiations

Euro

With a sparse economic calendar, the focus remains on yield spreads in the EZ (Italy/France vs. Germany) and the assortment of scandal sheet politics coming out of France. European Bond Markets have been extremely busy overnight rallying sharply in concert with UST’s.

Despite the USD trading with a softer bias overnight, EUR/USD remained capped at 1.07, as political uncertainty remains the primary driver in the Euro space. Perhaps in a move to ease investor’s nerves, Draghi reportedly said at a “not so ” at a private ECB dinner meeting yesterday, inferring that the ECB will continue to be accommodative throughout his mandate, which ends in October 2019.

Yuan

The PBOC held off from offering Reverse Repos in the market for the fourth consecutive day, draining liquidity in hopes of defending the CNH and halting capital outflow. However, interestingly enough, we are starting to see the more two-way flow in the CNH than we saw in some time. I would not go as far as calling it bullish CNH momentum, but rather with the U.S. dollar energy all but sapped, we have gone from extreme pessimism to one of the mixed views, as investors are becoming less confident about a USD bull run.

Reserve Bank of India

Time to reload the INR carries trade after the RBI surprised the markets with another unexpected interest rate pause. This should bring to a close all the speculation about interest rates cuts for the medium term. The RBI shift to a neutral stance should all but cement that view.

Bank of Thailand

No surprises from the Bank of Thailand which kept rates unchanged as expected. If anything, by the currency reaction, dealers were expecting a more accommodative stance from the BOT.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.