Monthly Macro Monitor: Doom & Gloom, Good Grief

Alhambra Investment Partners, LLC | Oct 11, 2019 01:29AM ET

When I first got in this business oh-so-many years ago, my mentor told me that I shouldn’t waste my time worrying about the things everyone else was worrying about. As I’ve related in these missives before, he called those things “well-worried”. His point was that once everyone was aware of something it was priced into the market and not worth your time. That has proven to be valuable advice over the years and I think still relevant today.

We continue to hear, on an almost daily basis, about all the bad things going on in the world. Trade wars, real wars, Ukraine, impeachment, blacklisted Chinese companies, retaliation for blacklisting Chinese companies, tariffs on European goods (scotch??#$%^&!), climate scolding by woke teens, manufacturing recession, pension crisis, rising government deficits and debt, cov-lite corporate debt, corporate earnings stagnation, farmer bankruptcies, Argentina (again???), the WeWork/Uber/Peloton IPO debacles, drone strikes on Saudi oil fields, deal-or-no-deal Brexit, retail apocalypse, repo market madness, wealth inequality, income inequality, and for the love of God, an impending bacon shortage. If that isn’t gloomy enough for you, AOC says we need a green new deal because the world ends in 12 years and the clock is ticking.

And the S&P 500 is down….3% from its all-time high. As Charlie Brown would say, good grief!

Last month’s big worry was the inverted yield curve, a for sure recession indicator that is so widely known now that I’m becoming skeptical of its usefulness (see The Yield Curve and What it Means ). Even the Duke professor who “discovered” the yield curve indicator says that widespread knowledge and awareness of its inversion “increases the probability of a soft landing”. His research shows that when economic slowdowns are sudden, the shock causes businesses to react by slashing investment and jobs. Although most everyone now thinks the onset of the last recession was pretty obvious, at the time there were plenty of very smart people saying as late as the summer of 2008 that recession might still be avoided. When the crisis hit in the fall, it caught a lot of people off guard and the reaction of businesses was rapid and extreme.

By contrast, if we fall into recession soon, it might be the most anticipated recession of all time. The Duke University CFO survey, taken in September, shows that 53% of CFOs expect a recession by the end of 2020 and over a third think it will start by the second quarter. By contrast, in December of 2007, nearly 2/3s of CFOs in the survey thought the odds of recession in 2008 were less than a coin flip – and we were already in recession at the time. They also predicted earnings growth of 6.7% for 2008 which turned out to be just a tad optimistic. Today’s CFOs only expect 3.3% earnings growth next year so expectations are already muted (although one can make a case that even that low bar is too high).

With a majority of CFOs expecting a recession next year, they are already acting to mitigate the impact. But this isn’t being done in a panic as it was in 2008 when few were prepared for what happened in the fall of that awful year. It may not mean firing a lot of people but it could mean hiring fewer than otherwise. It probably isn’t coincidence that we’ve seen a slowdown in hiring this year. It may not mean slashing capital spending but it might mean delaying some investments. That is reflected in the survey with median expectations for capital spending growth falling from 5.0% in March to just 2.2% in September.

The economic statistics we review in these monthly reports are not recessionary. The US economy is obviously slowing, but at least right now that is all we can say. Manufacturing in particular is having a tough time right now and that is probably due – to some degree – to the ongoing trade negotiations. Capital investment is sluggish, partially for the reasons stated above, and also due to the uncertainty created by the chaotic nature of the administration’s approach to trade. There is a monetary element at work here too, as our Jeff Snider has made very clear in his research (If you’re a Snider fan, you’ll want to download the first issue of his Follow The Money report).

I’ve been writing for over a year, as has Jeff, that we should expect a slowdown back to trend growth. That’s exactly where we are right now, with growth in Q3 probably right around the 2% mark. That doesn’t mean the economy won’t slow further and it may but there are some good things going on too. Housing has been a drag on GDP growth for 6 straight quarters and 8 of the last 9, but it appears that it will be a positive this quarter. New home sales, housing starts, and permits are all up double digits year over year. Inflation is under control (well, “control” probably overstates it a tad) and the job market is slowing but still pretty healthy. Income and spending – admittedly lagging indicators – are still chugging along at the same pace as most of this expansion.

The big problems in the economy are in the manufacturing sector and to some degree, in the oil patch. Both of those are, in a way, related to the monetary and trade problems. Unfortunately, I don’t see a quick solution to either of those issues. But right now, neither has put the economy in imminent danger of recession. We aren’t there – yet.

Economic Reports

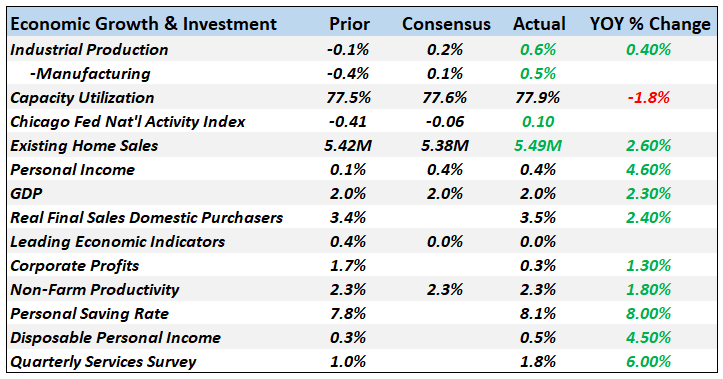

Economic Growth & Investment

ProductionThese sentiment style surveys have mostly been less than expected and some outright negative. The ISM manufacturing report got a lot of headlines because it dipped further below 50, but any reading over 42.9 is consistent with overall economic expansion. My experience has been that the ISM is more useful at bottoms than tops in any case. Lots of false negatives but few false positives.

Consumption & Distribution

InventoriesInventory to sales ratios have been climbing and are definitely something to worry about.

Orders

TradeAll this trade disruption and the trade deficit is unchanged? I’ve said it time and time again, you aren’t going to “solve” the trade deficit with tariffs or fracking. The current account deficit is directly linked to the budget deficit and we’re going the wrong direction on that score.

Here’s something to ponder. As recently as 2011 we were running a petroleum trade deficit of nearly $350 billion annualized. Today that has been reduced to $31 billion. And yet our total trade deficit has grown since then. A lot of the change is due to the drop in oil prices but not all of it. Outside of recession, we won’t balance trade without reducing the budget deficit. It will, as now, just shift around. President Trump thinks that reducing the trade deficit will reduce the budget deficit. He’s got it exactly backwards.

Inflation

EmploymentThe first crack in the employment market may have just opened with the fall in job openings. And although it isn’t reflected in this chart, openings fell further in August (these reports run late). Quits and hires were still trending higher in July but openings peaked in January so this is starting to look like a trend. Openings are still at a very high level but the trend is worrisome.

In the monthly report, the unemployment rate got the headlines by falling to 3.5% but that doesn’t tell anywhere near the whole story. The headline wasn’t terrible at +136K (but below estimates) but average hourly earnings were flat and the workweek is down year over year. Those things do not point to a labor shortage in any way.

Jobless claims have not risen much off the lows but they are up slightly year over year. I am not sure if we will see the same kind of surge in claims in this recession as we have in the past due to the prevalence of gig workers. 1099 employees do not pay unemployment insurance and so aren’t eligible for benefits if their contract gets terminated. Still, I would expect to see a decent rise in claims as we enter recession.

Construction

OtherConsumer confidence/sentiment has slipped a bit recently. As you might expect though, these numbers are quite volatile so I don’t know if you can make much of this yet. Of more concern is the drop in Small Business Optimism. The biggest issue is uncertainty up 6 points in the last 3 months. 30% of firms in the survey reported negative effects from tariffs. These are Trump’s biggest supporters and if this continues we might start to see the President soften his stance on tariffs.

International

Outside the US is where we continue to see a more severe slowdown. Europe is probably not in recession – yet – but good numbers are hard to find. Like the US though Germany’s issues are mostly in manufacturing. Japan’s outlook hasn’t changed materially, slow growth seems embedded at this point. It will be interesting to see the impact of the sales tax hike in the coming months. I don’t think it will have the impact we’ve seen from past hikes as it is fairly small. We also didn’t see a big surge in spending before the hike so maybe the hangover will be milder. China is slowing. How much is anyone’s guess.

The global economy is slowing but this is not, for now anyway, a recession. The slowdown is coming from two main areas in my opinion: trade and monetary policy. I have no idea what will happen with the China trade negotiations but I think everyone ought to just get accustomed to trade being a contentious area for the immediate future. The Democrats running for President may, in fact, be worse on trade than the current administration. If I were the Chinese I’d be looking to make a deal with Trump. If they have to negotiate with say, President Warren, climate change and labor standards are going to head to the top of the US demand list. The point is that even if there is some short term deal between the US and China, trade will continue to be a problem area for the global economy.

On the monetary policy, I will just say that the recent turmoil in money markets (repo, fed funds, etc.) is an issue of the Fed’s competence. To be blunt, this shouldn’t have happened. That it did, that the Fed didn’t see this coming, means – to me at least – that the Fed can’t perform its most basic function. Ensuring the smooth operation of the money markets is the Fed’s job. They failed. One can’t help but wonder how they’d perform in a more urgent situation. Let’s hope we don’t find out.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.