Month-End Model Points To Possible USD Buying

Matthew Weller | Mar 30, 2015 04:51PM ET

Background

Traders often refer to the impact of ‘month end flows’ on different currency pairs during the last few days of the month. In essence, these money ‘flows’ are caused by global fund managers and investors rebalancing their currency exposure based on market movements over the last month. For example, if the value of one country’s equity and bond markets increases, these fund managers typically look to sell or hedge their now-elevated exposure to that country’s currency and rebalance their risk back to an underperforming country’s currency. More severe monthly changes in a country’s asset valuations lead to larger portfolio adjustments between different currencies.

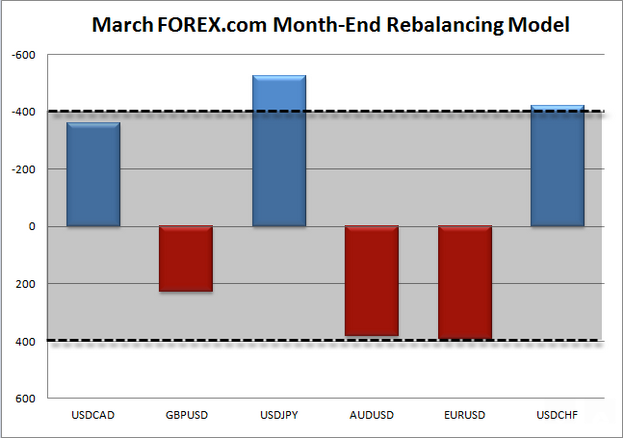

In order to predict these flows and how they impact FX traders, we’ve developed a model that compares monthly changes in the total value of asset markets in various countries. In our model, a relative shift of $400B between countries over the course of a month is seen as the threshold for a meaningful move, whereas monthly changes of less than $400B are often overwhelmed by other fundamental or technical factors. As a final note, the largest impact from month-end flows is typically seen heading into the 11am ET fix (often in the hour from 10 & 11am ET) as portfolio managers scramble to hedge their overall portfolio ahead of the European market close.

As hard as it is to believe, the first quarter of 2015 is already coming to an end. Volatility was relatively subdued throughout March and market performance was certainly more nuanced than we saw in February. As of writing, US equities are trading slightly lower on the month, while European equities (beyond the UK’s FTSE index) are trading generally higher, boosted by the beginning of the ECB’s Quantitative Easing program. Meanwhile, bond yields are across the board, with the yield on Germany's 10-Year bund hitting a record low at 0.14% midway through the month.

Overall, US markets lagged their European counterparts, meaning that global portfolio managers will have to sell European investments and buy US assets to rebalance back to their target allocations. This means that we could see some demand for the US dollar ahead of Tuesday's European close. As the chart below shows, these signals generally don’t quite reach the +/- $400B threshold for a significant move. But in otherwise slow, pre-holiday trade, the month-end flows could still have a notable impact on markets. Perhaps these flows, if they emerge, could reinvigorate the dollar uptrend ahead of Friday’s Non-Farm Payrolls report.

Source: FOREX.com

For more intraday analysis and market updates, follow us on twitter (@MWellerFX and @FOREXcom)

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.