Monetary Data Continues To Reflect Structural Economic Weakness

Erik McCurdy | Apr 08, 2013 12:16AM ET

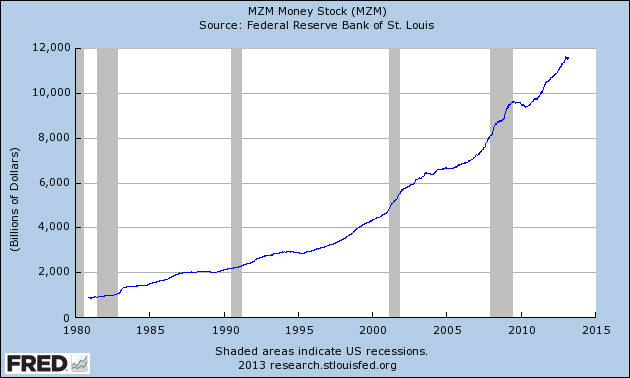

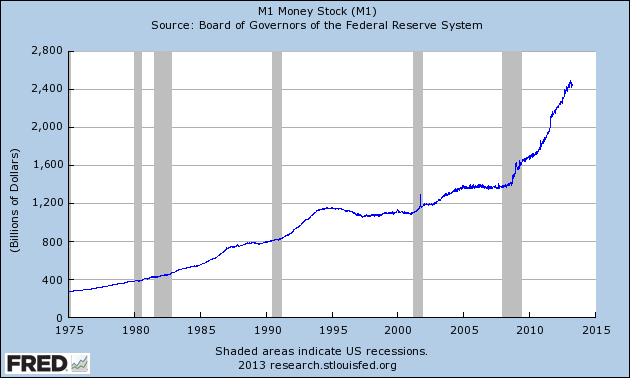

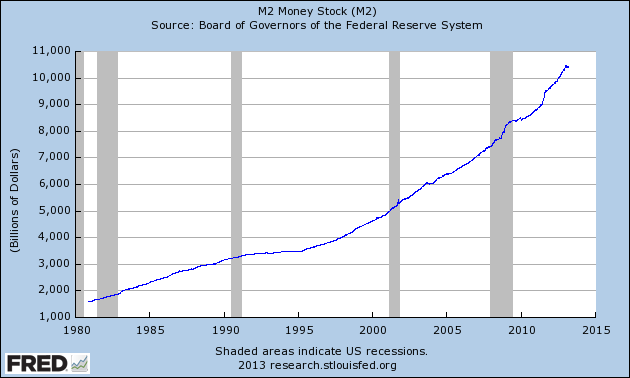

For the past several years, the US Federal Reserve has engaged in a historic liquidity operation intended to support economic recovery. As shown on the following three charts, M0, M1 and M2 have all surged to all-time highs as a result of these stimulus programs.

Unfortunately, these programs have had little positive impact on an economy that continues to be restrained by excessive debt accumulated during the last several decades. While money supply has grown substantially since the recession in 2008, monetary velocity has declined precipitously during that time period.

Essentially, velocity measures how fast money changes hands, providing a gauge of economic activity. In basic terms, when velocity declines sharply even as supply is being introduced at an unprecedented rate, the implication is that the added liquidity is not engendering economic activity.

This is precisely what “pushing on a string” looks like. Consequently, the M1 money multiplier, which essentially measures the economic impact of newly introduced liquidity, has remained below the 1.0 level since 2009. Following a gradual rebound during the past two years, the multiplier ratio has plunged during the first quarter of 2013, signaling renewed economic weakness.

Again, the Federal Reserve can attempt to spur economic activity by introducing monetary stimulus, but it cannot force banks to increase their loan and investment activity.

The velocity and multiplier data trends clearly demonstrate that the newly introduced money supply is simply remaining idle in places like bank reserves. Federal Reserve Chairman Bernanke understands the dilemma, but he would prefer to deal with any problem except deflation, so he has committed to flooding the system with liquidity for the foreseeable future and worrying about the consequences later. In fact, he has even admitted that his intention is to inflate risky asset prices.

Recall that when the second quantitative easing program was introduced in late 2010, Bernanke stated in no uncertain terms that one of the primary goals of the program was to inflate the stock market. The following quote is from an article written by Bernanke and published in the Washington Post in November 2010.

Stock prices rose and long-term interest rates fell when investors began to anticipate the most recent action. Easier financial conditions will promote economic growth. … And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.

There is no question that the measures taken by the Federal Reserve during the last three years have fueled appreciation in the stock market, so, from that perspective, the programs have been a success. However, it must be noted that equity gains fueled primarily by government stimulus can be erased as quickly as they are created. The recent liquidity operations have created massive imbalances that will continue to drive violent moves both higher and lower as the system attempts to return to a state of equilibrium.

Additionally, there is absolutely no evidence to support the assertion that higher stock prices meaningfully support economic expansion. Historically, a 1.0 percent increase in the S&P 500 index has been accompanied by GDP growth of approximately 0.04 percent during the same year, 0.04 percent growth during the next year, and it has a negative correlation during subsequent years. There is also the problem of addressing the massive imbalances created by several years of artificially low interest rates. Fund manager John Hussman monitors the future inflationary consequences of current Federal Reserve policy and the following chart and excerpt are from a recent research based on eight centuries of data has clearly demonstrated that it is impossible to solve an excessive debt problem with yet more debt. Until we stop applying superficial, temporary fixes and begin to address the root causes of our current predicament, our economy will remain structurally weak.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.