Monday Higher If ES Pivot Holds

The Night Owl Trader | Jul 29, 2013 01:23AM ET

Actionable ideas for the busy trader delivered daily right up front

- Monday higher only if ES pivot holds, else lower..

- ES pivot 1682.00 . Holding above is bullish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias higher.

- ES Fantasy Trader remains short at 1643.00.

It may not be the greatest comeback since Lazarus, but it sure was close. On Friday the Dow opened down big time. Then it got worse, hitting a low of 15,405 just before 11 AM. Then the little market that could started chugging higher, and higher ... and higher finally ending 154 points up from the lows to finish the day up all of three points. That's pretty impressive in my book. And it painted an interesting candle. So without further ado, let's take a closer look and see where Monday might be headed.

The technicals (daily)

The Dow: We just detailed the Dow's gyrations last Friday so all that's left is to discuss the candle - a giant hanging man, in fact the second in a row with an even bigger tail. And oddly enough, the Dow has been putting in lower intraday lows for four days in a row now even as the closing price remains essentially unchanged. This is quite unusual. I scanned the daily chart back two years and was unable to find anything even remotely close to this. While some interpret this as bearish, I note that Friday gave us a bullish descending RTC exit and a narrowing of the stochastic spread that precedes a bullish crossover. However, the indicators remain a long way from oversold so this chart picture is mixed at best. We'll just have to see how it resolves on Monday.

The VIX: Last Thursday's dark cloud cover on the VIX paid off on Friday with a 1.93% decline and an exit from the rising RTC for a bearish setup. Indicators remain fairly low but it looks now like the rally attempt from last week has been quashed. This does not look like a chart getting ready to run.

Market index futures: Tonight all three futures are lower at 12:51 AM EDT with ES down by 0.21%. ES has now given us five daily reversal candles in a row without really reversing direction. And while the overnight appears to be guiding lower, the pattern so often this year has been for overnight losses to turn into gains the next day, so I'm not putting too much faith in this. Like the Dow, this chart is far from clear.

ES daily pivot: Tonight the pivot inches up from 1680.75 to 1682.00 even. We were above the old number most of Friday afternoon and remain above the new pivot, but now by only a point and a quarter. With ES drifting lower in the overnight, that puts the pivot in play. How ES behaves around the pivot in the wee hours of Monday morning will dictate the rest of the day.

Dollar index: The dollar continued its zig-zag trek lower on Friday with a gap-down loss of 0.35% that .punched under the 200 day MA. With a lower BB rapidly falling away, this bodes ill for any move higher on Monday.

Euro: Last Thursday night I wrote "odds favor a higher euro on Friday" and sure enough we got a nice gap up doji star to close at1.3279 and keep us inside the rising RTC. The Sunday overnight is a different story though, as the euro has given up early gains to return to unchanged. It is now testing the pivot as I write. If we bounce off, the euro goes higher Monday but if we break under, watch for a lower close.

Transportation: Last Thursday night I wrote "I'm now more confident that we'll see a move higher here on Friday". And that confidence paid off with a 0.53% advance that confirmed the tall doji star. It also moved the stochastic close to forming a bullish crossover and pushed us just out of the descending RTC for a bullish setup. I'd be looking for further advances on Monday.

We have sort of a mixed picture tonight with a number of bullish signs but not terribly convincing. Therefore I'm going to make another conditional call: if ES manages to stay above its pivot by mid-morning Monday, we'll close higher. However, if we fall convincingly through the pivot, then watch for a lower close.

ES Fantasy Trader

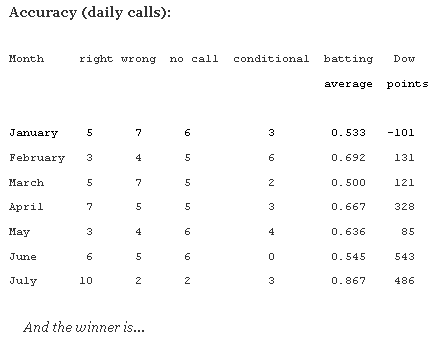

Portfolio stats: the account remains at $115,000 even after 14 trades (11 for 14 total, 6 for 6 longs, 5 for 8 short) starting from $100,000 on 1/1/13. Tonight we remain short at 1643.00. I'm at the stage of not even wanting to look at this trade anymore.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.