Momentum Still Dominates For US Equity Factor Performances

James Picerno | Nov 09, 2017 06:59AM ET

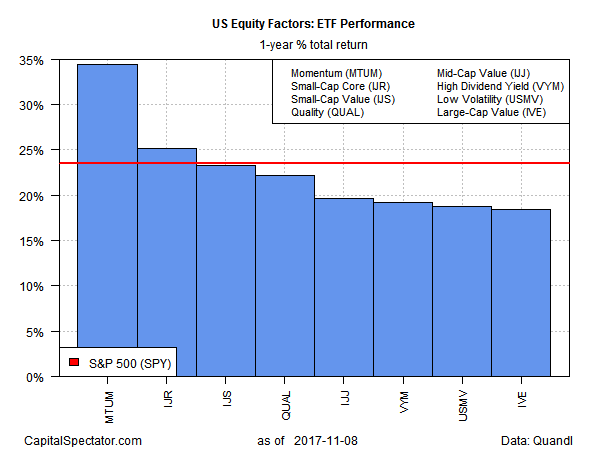

As horse races go, this one’s not even close. The momentum factor continues to leave the rest of the field in the dust for the major US equity factor strategies, based on the one-year trend via a set of ETFs.

Although all the factor funds are posting solid gains through yesterday’s close (Nov. 8), the gap in favor of momentum is conspicuously wide for trailing one-year total returns.

The iShares Edge MSCI USA Momentum Factor ETF (MTUM) is current posting a red-hot 34.3% advance for the past 12 months through Wednesday. That’s a dramatic lead over the returns for the broad US equity market and other factor ETFs.

The SPDR S&P 500 (MX:SPY (NYSE:SPY)), a proxy for US stocks overall, is up 23.5% for the year through Nov. 8. Meantime, the core small-cap factor holds the second-strongest one-year result for the factor ETFs: iShares Core S&P Small-Cap (IJR) is up 25.2% for the trailing one-year period. The softest gain for US equity factor ETFs: large-cap value stocks via iShares S&P 500 Value (IVE), which is posting an 18.4% total return for the one-year change.

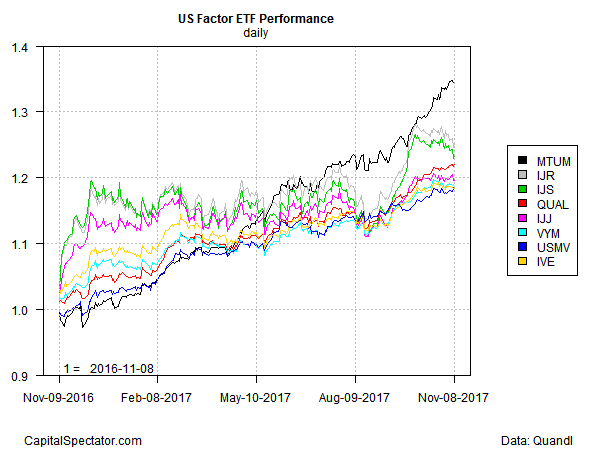

Note that MTUM’s upside bias remains strong in terms of recent price action (black line at top of chart below). Meanwhile, the second- and third-strongest factor ETFs for one-year results (small-cap core and small-cap value, respectively) have suffered setbacks recently (grey and green lines). In other words, momentum’s dominance has strengthened significantly in recent weeks in relative terms.

At some point, momentum’s extraordinary bullish tide will fade. For the moment, however, this factor is red hot and the would-be successors to the throne are on the defensive.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.