Mining Stock Index

Sunshine Profits | Feb 08, 2019 02:04AM ET

HUI Vs. XAU

The main difference between the HUI and XAU is that the former includes only gold stocks, while the latter takes into account both gold and silver miners. Actually, it also includes companies that mine other metals, such as copper, and for whom gold is only a byproduct. Thus, the XAU Index is a less reliable indicator of stocks’ sensitivity to movements in gold prices than the HUI Index.

Moreover, the HUI excludes companies that hedge their production beyond 18 months, while the XAU includes all hedgers.So, the former may appeal to traders burned by companies hedging their gold production in the last bull market (on the other hand, companies which hedge their production should outperform during bear market).

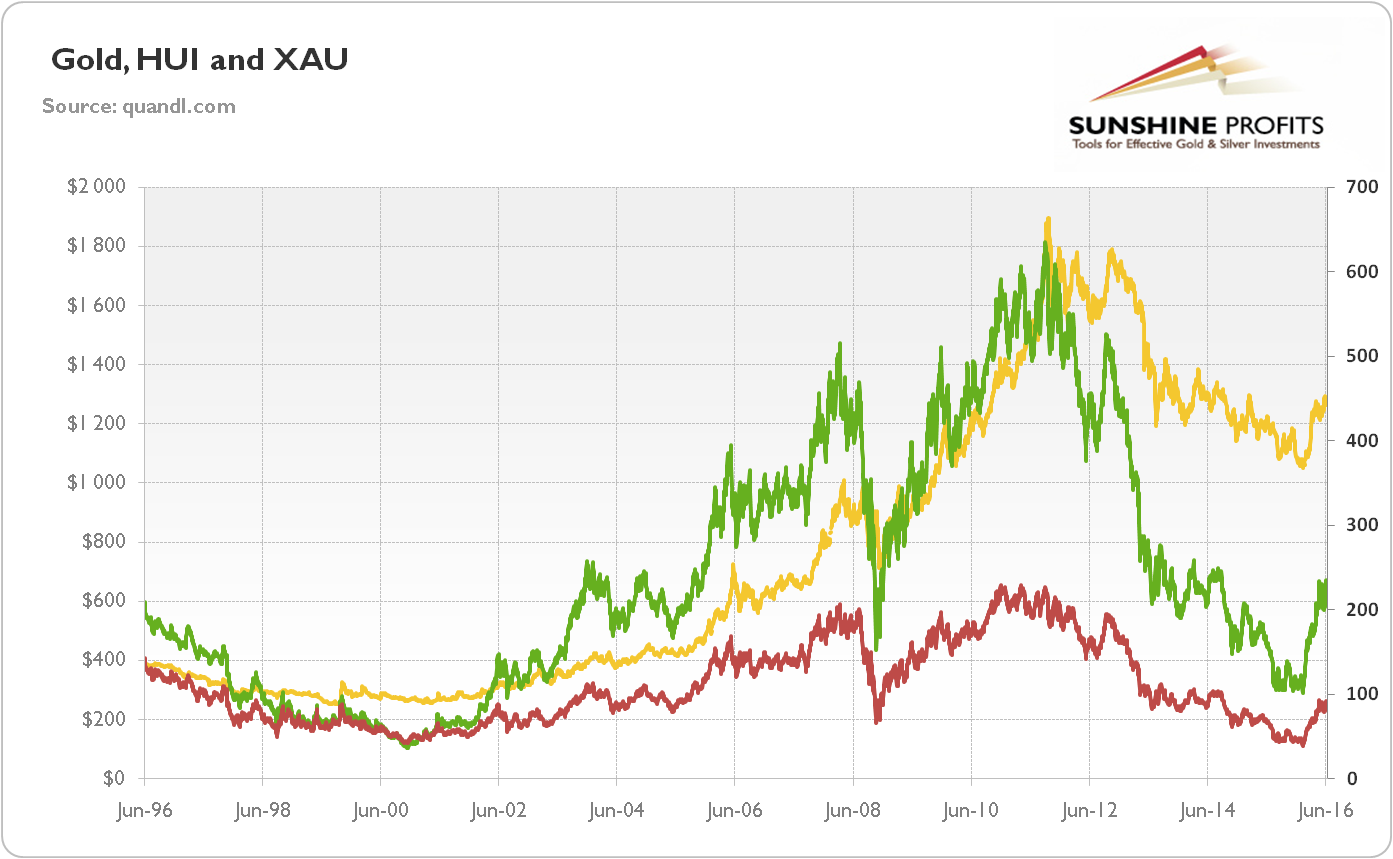

Hence, the indices do not take the same miners into account, which is why they perform differently. Indeed, the chart below compares the historical performance of these indices against gold.

Chart 1: The price of gold (yellow line, left axis, London P.M. Fix), the HUI Index (green line, right axis), and the XAU Index (red line, right axis) from 1996 to 2016.

As one can see, both indices performed much worse than gold between 1996 and 2016. However, the HUI Index gained 8.7 percent in that period, while the XAU Index lost almost 40 percent of its value. The conclusions is that bullion was the best, but the HUI was better than the XAU, at least in the period of 1996-2016, for which we have data series.

HUI Vs. GDX

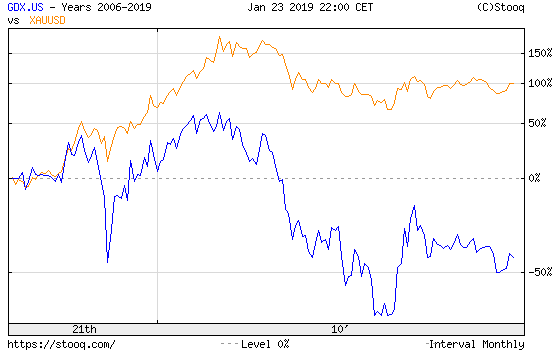

VanEck Vectors Gold Miners (NYSE:GDX) is the exchange-traded fund established in 2006, which tracks the performance of the NYSE ARCA Gold Miners Index (GDM), which is similar to HUI, but it take into account only highly capitalized companies and it includes hedgers. The GDX is managed by Van Eck Global and, as ETF, is easy way to gain exposure to gold miners. However, since its inception until January 2019, the GDX is down 42 percent, while gold more than doubled over during the same time period, as one can see in the chart below.

Chart 2: GDX (blue line) and XAU/USD (orange line) from 2006 to 2019.

The divergence is counter-intuitive, as gold miners’ revenues are related to gold prices, after all. However, mining companies expanded operations just as gold prices peaked, which is why they underperformed relatively to bullion.

But how the GDX compares to other indices? Let’s take a look at the chart below, which paints the HUI versus the GDX.

Chart 3: HUI (blue line, left axis) and GDX (green line, right axis) from May 2006 to June 2016.

As one can see, both indices performed quite similar in the period of 2006-2016. However, the former was slightly better, as it dropped ‘only’ 29 percent, while the latter declined about 32 percent.

XAU Vs. GDX

Last but not least, let’s compare XAU with the GDX. So, please take a look at the chart below. As one can see, both indices disappointed in the analyzed period. However, the GDX fell about 32 percent, while the XAU lost more than 35 percent of its value. It means that although GDX is worse than HUI, it performs better than XAU.

Chart 4: XAU (red line) and GDX (green line) from May 2006 to June 2016.

Choosing The Best Gold-Stock Investment Proxy: HUI Vs. XAU Vs. GDX

What can one do with the above information? It depends on why one was looking for it in the first place. One thing is choosing something to which individual stocks can be compared, for comparing performances of sectors etc. – overall, for research purposes. The other thing is looking for an asset in which one could invest in order to easily gain exposure to the entire sector.

If you want to see how the gold stocks were doing in the past and compare it, for instance to copper stocks or tech stocks, the HUI Index seems to be the best way to go.

If you want to see how the precious metals stocks (thus both: gold stocks and silver stocks) performed and it’s important not to exclude the silver stocks’ exposure out of data, then the XAU Index seems the way to go.

But, if you want to actually invest in the mining stocks sector, GDX is the clear choice out of the above trio. Why? Because it’s not possible to simply buy an index. It is only possible to buy individual mining stocks that comprise it. If one can and wants to invest in gold stocks and can dedicate more capital to it, then duplicating the HUI Index instead of purchasing GDX shares seems to be a good idea. Many investors, however, will prefer the ease of use of the GDX ETF and the fact that once purchased, people can just wait for the end of a particular trade or apply the buy-and-hold strategy (by the way, did you know that there’s a version of the buy-and-hold strategy that might greatly increase gains ?) without the need to rebalance their portfolio to ensure that the weights in their portfolios have not deviated too much from their initial structure.

So, is GDX really the best investment choice?

Not necessarily. The GDX ETF (and the same goes for the XAU and HUI indices), includes multiple mining stocks and while diversification is definitely something useful, one doesn’t necessarily want to invest in the worst performing stocks, just for the sake of it. Moreover, the benefits from diversification decline along with adding more stocks. Moving from just one stock to three stocks greatly reduces the overall risk, but,moving from 21 to 23 stocks has barely any implications. Therefore, copying the index to the letter might be an overkill.

If one wants to gain exposure to the entire precious metals mining stock sector with long-term investment in mind, they might for instance go with 5 gold stocks and 5 silver stocks.The total of 10 stocks provides a decent diversification and at the same time it allows to keep only the best gold stocks and best silver stocks in the portfolio. Naturally, it’s not easy to determine which gold and silver stocks will be the top performers, but there are several ways to increase the odds of picking the winners. One would be to analyze the financial statements of the companies and conduct technical analysis of their price charts. Another way would be to subscribe to a newsletter that provides this kind of service. Accredited investors might also be able to invest in special investment funds that provide sophisticated mining stock selection services.Our preferred method that’s available for most investors is using our own in-house developed tools: Golden StockPicker and Silver StockPicker. They are designed to pick the miners that provide the greatest leverage, while providing the biggest exposure to the gold and silver prices at the same time.

It’s not as easy as simply buying ETF shares and holding them, but the burden of purchasing 10 stocks is not that significant and the gains that this might result in seem to more than compensate for the additional hassle. Also, we know that at least one fund is using our tools for mining stock selection.

In case of trading transactions (the ones that would be held for days or weeks), our mining stock selection tools might still be a good choice. This time, using for instance top 2 gold stocks and top 2 silver stocks might be preferred – the diversification potential will be smaller, but still present, and at the same time, the above – just 4 stocks – should not result in significant transaction (brokerage) fees and it should not be too annoying to open and then close 4 trades instead of just one. The extra leverage that this might provide should be well worth it.

Naturally, the above is just our opinion with regard to the mining stock selection and you are free to use your capital as you wish.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.