Metals Rally Early In 2021

Chris Vermeulen | Jan 06, 2021 12:38AM ET

If you follow our research, you already know my research team and I have authored multiple articles related to how Metals and Miners are poised for a big rally in 2021 and beyond. But do you understand what this means for other market sectors and assets? Are you ready for one of the most dynamic investing environments we’ve seen since 1945 or earlier? Gold and Miners are showing very clear signs that the Depreciation cycle phase our researchers identified recently is strongly in place.

Precious Metals vs. Miners in a Depreciation Cycle Phase

Gold and Miners are showing very clear signs that the Depreciation cycle phase our researchers identified recently is strongly in place. Both Gold and the Mining sector have been rallying since early 2016. This rally initiated in the midst of an Appreciation cycle phase (between late 2010 and the end of 2019). The rotation between Appreciation and Depreciation cycle phases directly correlates with the underlying strength of the US dollar, precious metals, and other market sector trends. At this point, the new Depreciation cycle phase means the global markets will transition away from Appreciation phase trends and into new defensive/sector rotation trends.

If our research regarding these Appreciation/Depreciation cycle phases is correct, the new Depreciation cycle phase will usher in a period of 9+ years of very dynamic global market and sector rotation. This will happen because of two key factors: depreciation/decline of the US dollar (resulting in strong upward trending for precious metals, rare earth minerals and other key commodities) and the Capital Shift that takes place as traders/investors attempt to chase strength in various capital sectors/global markets looking to offset currency trends.

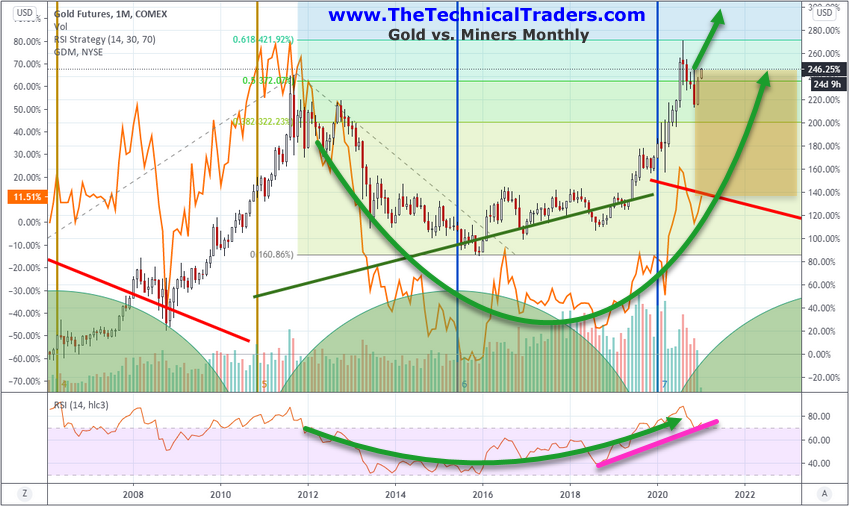

The following Monthly Gold vs. Miners chart (where Gold is displayed as Candlesticks and Miners are displayed as the gold-colored line) highlights the last Appreciation cycle phase and how both Gold and Miners collapsed within this cycle phase. What we find interesting is the strength of the trend in Gold while Miners have just recently started to broadly advance higher. We believe the transition away from Appreciation phase assets is now firmly taking place – which suggests Miners may have a lot of catching up to do over the next 12+ months while precious metals continue to move higher.

Within the last Depreciation cycle phase (1999 to late 2010), Gold rallied from $253 to $1923 – an incredible 640%. If a similar type of rally takes place from the recent $1040 lows, in November 2015, then a peak level above $7500 is not out of the question for Gold. Some analysts are suggesting $10k or more as the potential peak level. What would this do for other precious metals (like Silver, Platinum, and Palladium) and how would the mining sector react to a huge rally phase in Gold?

Miners Should Attempt To Rally 35%+ Over The Next 12+ Months

The big rally in Gold and Silver that started on the first trading day in 2021 is likely a continuation of the Depreciation cycle phase trending that our researchers identified many months ago. We are still very early in this Depreciation cycle phase and it will likely last until sometime near 2026~2029. What this means is that we can expect an unraveling of the Appreciation cycle phase investments (deployed in technology, healthcare, biotech and other broad market sectors) and new sector trends to establish in core commodities, energy, emerging markets, and sectors where a falling US dollar will likely prompt bullish trends.

Overall, it means we need to prepare for broad market rotations in nearly all market sectors and trends. This transition away from the end of the Appreciation cycle phase means that capital will eventually shift into new forms of investment opportunities – Metals and Miners being one component that we believe is just starting a big upside price trend.

The Miners vs Gold Monthly chart below, where Gold is represented as a BLUE line and the Miners Index is represented as Candlesticks, highlights the very mild uptrend we’ve seen in Miners recently. Gold has already rallied to levels above the 2011 highs where Miners are still far below the 2008~2011 high price levels. This suggests that Miners may see a big 35% to 55%+ rally over the next 12+ months to catch up with the continued price appreciation in Gold and Silver.

The key takeaway from this article should be that traders need to prepare for a global market shift away from what has been traditionally strong trending sectors over the next 12 to 24+ months. Our research suggests a broad market shift is taking place that will likely end many current trends and start new rally trends in traditionally defensive sectors.

Over 53% of the current Large Cap Index Weighting is directly tied to Technology, Healthcare and Consumers. Of that, more than 52% of that weighting is tied to Technology. If broad global sectors begin to transition away from over-weighted sectors and into undervalued and under-weighted sectors, we believe the major global market indexes may be uniquely setup for very big price rotations/declines in the near future. The weighting of these three sectors have overtaken the total weighting of the other 8~9 sectors. Thus, three unique sectors make up more than 53% of the total weighting whereas the other 8~9 sectors make up only 47% of the total weighting.

To illustrate our point, Materials make up only 2.62% of the Large Cap index. The total weighting of the Industrials, Materials, Utilities, and Real-Estate sectors is only 16.52% – which equals up to only a third of the value of the Technoilogy, Healthcare and Consumer sectors. This disparity of weighting in the Large Cap index presents a very real potential that any moderate downside price trends as capital shifts to new opportunities within the new Depreciation cycle phase may result in a very big and aggressive price decline in the US and Global major indexes.

Source: Siblis Research

2021 and beyond are going to present great opportunities for traders in the right sectors. If you are able to see these setups and prepare for them as various sectors roll in and out of favor, while properly hedging your assets, you will likely do really well over the next 5 to 7+ years. If not, you will probably chase failed trends as they continue to collapse or move into deep downward/sideways trends.

The Depreciation cycle phase will not likely end until sometime after 2027. Therefore, we have at least 5 to 7 more years of very broad market rotation to look forward to – where investment capital shifts very quickly away from overvalued risk assets and into undervalued assets and sectors. This means traders must adapt very quickly to how these trends setup and mature. Be prepared, the trending you are probably used to seeing over the past 4+ years is about to become unrecognizable.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.