Measuring The Market's Expectations For China

Cam Hui | May 25, 2014 12:21AM ET

The news out of China continues to be mixed. On one hand, the

Measuring market expectations

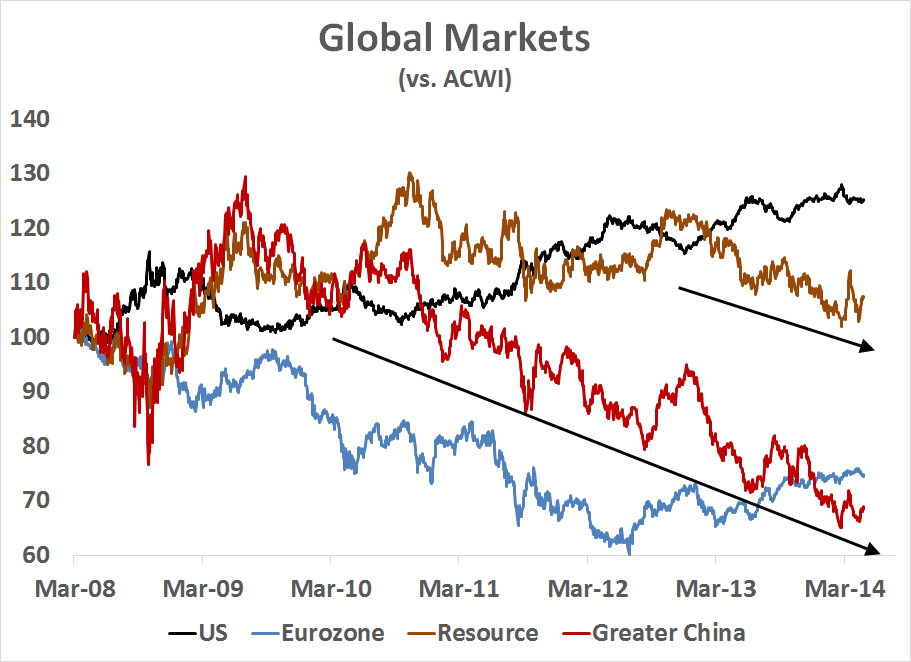

Rather than try to prognosticate myself, I thought that I should ask Mr. Market what he thought of what is happening in China. For the long-term view, I measured the relative performance of several equity market indices against the MSCI All-Country World Index (NASDAQ:ACWI). All returns are total returns and measured in USD, so we have an apples-to-apples comparison in a single currency. The countries and regions that I measured are:

- US (SPDR S&P 500 (ARCA:SPY))

- Eurozone (SPDR DJ Euro STOXX 50 (NYSE:FEZ))

- Resource markets, as they are sensitive to both world growth and Chinese demand: Canada (iShares MSCI Canada (NYSE:EWC)), Australia (iShares MSCI Australia Index (ARCA:EWA)) and South Africa (iShares MSCI South Africa (NYSE:EZA)) on an equal-weighted basis.

- Greater China, defined as China (iShares FTSE/Xinhua China 25 Index (ARCA:FXI)), Hong Kong (iShares MSCI Hong Kong (ARCA:EWH)), Taiwan (iShares Taiwan Index (ARCA:EWT)) and South Korea (iShares South Korea Index (ARCA:EWY)), as a way of better measuring China than just analyzing FXI, which is a somewhat narrow index.

If we were to zoom in further, the next chart shows the relative performance of the Resources basket relative to the Greater China basket and Old China (FXI) to New China (FXI), which is heavily weighted in financials, against New China (Golden Dragon Halter USX China (NYSE:PGJ)), which is heavily weighted towards the consumer-oriented internet and technology sector (see my previous post

Based on the last two charts, I can conclude the following about the general level of market expectations:

- Chinese growth has been slowing for years and continues to slow; but

- The latest uptick is expected to be led by the same-old-same-old formula of another round of macro infrastructure spending led stimulus, despite all the official rhetoric.

Indeed, China turns Japanese? ).

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. (“Qwest”). The opinions and any recommendations expressed in the blog are those of the author and do not reflect the opinions and recommendations of Qwest. Qwest reviews Mr. Hui’s blog to ensure it is connected with Mr. Hui’s obligation to deal fairly, honestly and in good faith with the blog’s readers.”

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this blog constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or I may hold or control long or short positions in the securities or instruments mentioned.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.