McDonald's (MCD) Sharpening Competitive Edge: Here's How

Zacks Investment Research | Oct 06, 2021 10:30PM ET

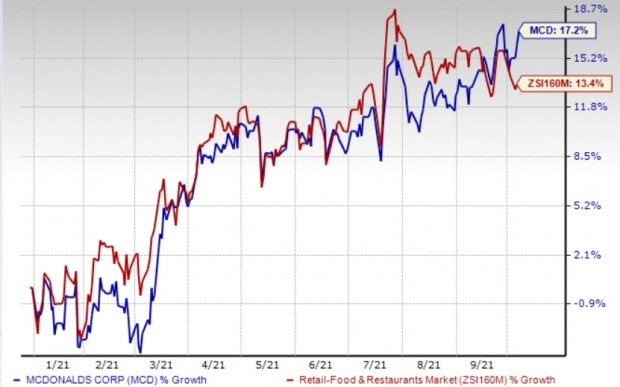

McDonald's Corporation (NYSE:MCD) industry ’s growth of 13.4%. Let’s delve deeper and analyze the factors keeping McDonald's ahead of the curve.

Loyalty Program Bodes Well

McDonald's launched its first-ever loyalty program in the United States. It is worth mentioning that the company started testing its loyalty program in November last year. The company’s customers will get 100 points for every one dollar spent. Customers will get 1,500 points once they join the loyalty program. Items like hash browns, vanilla cone, McChicken or a cheeseburger will cost just 1,500 points. Once customers have accumulated 6,000 points, they can be redeemed for Big Mac or a Happy Meal. The new loyalty program will not only help in retaining its customers but also aid in expanding the customer base. We believe this loyalty program will drive sales. The company’s loyalty program is likely to contribute to average checks as well.

Robust Digitalization

Amid the coronavirus pandemic, the company has been focusing on drive-thru, delivery & take-away. Prior to the coronavirus crisis, drive-thru accounted for about two-thirds of all sales in the United States. Drive-thru now accounts for approximately 90% of sales. McDonald’s continues to roll out mobile order and pay, with a new curbside check-in option. To provide enhanced experience and convenience to customers, the company has been increasingly focusing on delivery.

The Zacks Rank #2 (Buy) company informed that more than 80% of its restaurants across 100 markets globally provide delivery. In the United States, 95% of its restaurants provide drive-thru facility. Over the past year, delivery sales mix has doubled in Australia, Canada and the United States. It announced that across its major six markets, digital sales crossed $10 billion or nearly 20% of system-wide sales in 2020. During first-half 2021, the company recorded approximately $8 billion in digital sales in its top six markets, a 70% gain compared with the last year.

Solid Expansion Efforts

McDonald’s believes that there is a huge opportunity to grow all its brands globally by expanding presence in existing markets and entering new ones. The company’s expansion efforts continue to drive performance. Despite the pandemic, the company inaugurated about 500 restaurants across the market in 2020. In 2021, it is planning to open more than 1,300 restaurants globally. In China, the company surpassed the 4,000 restaurants mark in June and is on track to open 500 new restaurants in the country this year.

Comps Growth Back on Track

After reporting dismal comps in the trailing four quarters due to the coronavirus pandemic, the company posted robust comps in first and second-quarter 2021. In second-quarter 2021, global comps advanced 40.5% against a decline of 23.9% in the prior-year quarter. In the second quarter, comps at the United States, international operated markets and international developmental licensed segment rose 25.9%, 75.1% and 32.3%, respectively.

Other Key Picks

Some other top-ranked stocks in the same space include Domino's Pizza (NYSE:DPZ), Inc. the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here .

Domino's has a three-five year earnings per share growth rate of 12%.

Chipotle's 2021 earnings are expected to rise 137.3%.

Jack in the Box has a trailing four-quarter earnings surprise of 26.4%, on average.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $2.4 trillion by 2028 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Recommendations from previous editions of this report have produced gains of +205%, +258% and +477%. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Zacks Investment Research

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.