Month-End Model Hints At Dollar Weakness

Matthew Weller | May 29, 2015 10:27AM ET

Background:

Traders often refer to the impact of ‘month end flows’ on different currency pairs during the last few days of the month. In essence, these money ‘flows’ are caused by global fund managers and investors rebalancing their currency exposure based on market movements over the last month. For example, if the value of one country’s equity and bond markets increases, these fund managers typically look to sell or hedge their now-elevated exposure to that country’s currency and rebalance their risk back to an underperforming country’s currency. More severe monthly changes in a country’s asset valuations lead to larger portfolio adjustments between different currencies.

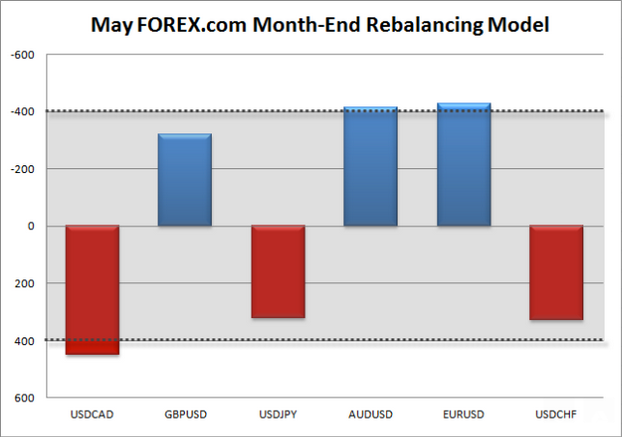

In order to predict these flows and how they impact FX traders, we’ve developed a model that compares monthly changes in the total value of asset markets in various countries. In our model, a relative shift of $400B between countries over the course of a month is seen as the threshold for a meaningful move, whereas monthly changes of less than $400B are often overwhelmed by other fundamental or technical factors. As a final note, the largest impact from month-end flows is typically seen heading into the 11am ET fix (often in the hour from 10 & 11am ET) as portfolio managers scramble to hedge their overall portfolio ahead of the European market close.

As we stand on the precipice of a new month, it’s easy to look back and retroactively explain the trends and themes of May: Of course the dollar would resume its longer-term rally, the euro would be hit by fears surrounding Greece’s debt, the UK would fall into deflation, USD/JPY would break out from its unsustainably tight range and the commodity dollars would fall in sync with the rising US dollar. The problem is that we must live life looking out the windshield, not the rear view mirror.

Peering through the fog of the future, one immediate move we may see is a bout of US dollar weakness heading into the official end of this month this weekend. US bourses generally rose over the course of the month (the NASDAQ in particular tacked on over 3%), while most European and Asian indices were essentially unchanged (two exceptions: Spain’s IBEX index edged lower in May, while Japan’s Nikkei index rose over 1,000 points). In fixed income, bond yields rose sharply across the world, with the biggest relative move in Germany’s DAX index.

Given the slight outperformance of US equities, our model shows that global portfolio managers will have to sell US investments and buy other assets to rebalance back to their target allocations. As a result, we could see a bit of dollar weakness over the course of today’s trade, with EUR/USD, AUD/USD, and USD/CAD all reaching the +/- $400B threshold for a significant move in our model. The dollar selling, if seen, is expected to be more limited in GBP/USD, USD/JPY, and USD/CHF as a result of the smaller relative shifts between those countries’ asset markets.

Source: FOREX.com

For more intraday analysis and market updates, follow us on twitter (@MWellerFX and @FOREXcom)

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.