May FOMC Minutes: Patience

Cumberland Advisors | May 28, 2019 03:03PM ET

In advance of the release of the FOMC’s May minutes, speculation in the press and by financial market participants was that the Committee might cut the federal funds target rate. The main line of conjecture centered on how long the FOMC could continue to miss its inflation target on the downside before a rate cut was warranted.

Clearly, given the lowest unemployment rate in 50 years but with inflation still running persistently below target, current economic conditions present a policy dilemma for the FOMC that is reflected in the widely differing views of FOMC participants. For example, President Rosengren, FRB Boston Bank president, notes that the current conditions are arguably sending conflicting signals, with the unemployment situation implying that there is a case for raising rates, while below-target inflation suggests that a rate cut would be appropriate.

Temporary And Accommodative

On balance, however, Rosengren views the below-target inflation situation as temporary and financial conditions as accommodative. Thus, he sees no need for a further rate move at this time. In contrast, FRB St. Louis Bank President Bullard said on Wednesday, May 22, that a rate cut might be appropriate: Finally, Governor Brainard’s recent observation is symptomatic of the puzzlement over why inflation has been persistently below target: “Of course, it is not entirely clear how to move underlying trend inflation smoothly to our target on a sustained basis in the presence of a very flat Phillips curve. One possibility we might refer to as ‘opportunistic reflation’ would be to take advantage of a modest increase in actual inflation to demonstrate to the public our commitment to our inflation goal on a symmetric basis.”

Clearly, this is just a musing on her part, since inflation has not been above target for any relevant period of time. Hence the view that the FOMC cleaves to a symmetric view of inflation policy (and thus deems it sometimes acceptable for inflation to be somewhat above or below target) is at this point conceptual rather than a reflection of recent history. The FOMC’s reference to its pursuit of a symmetric inflation policy raises addition complications, considered below.

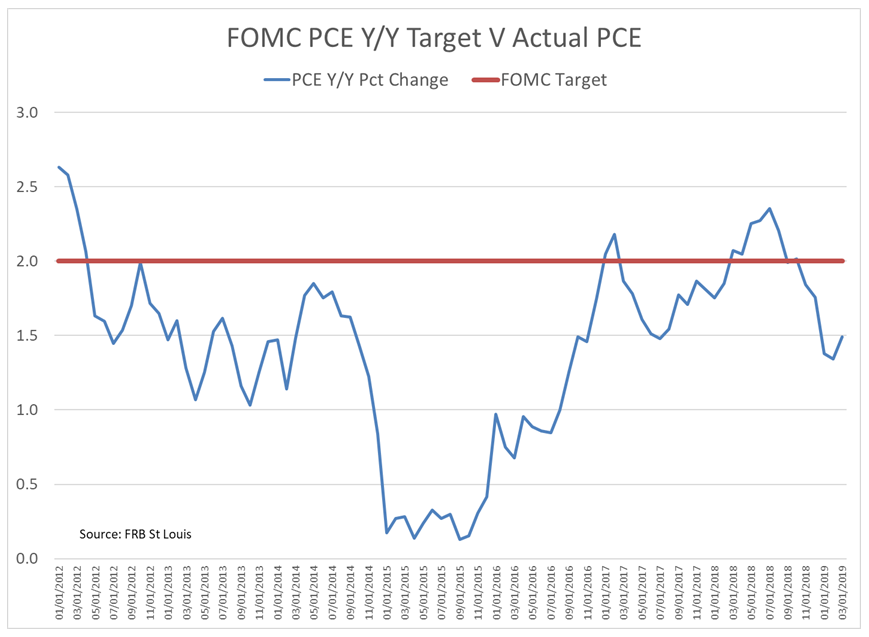

But first, it is useful to illustrate just how long inflation has been below target. The following chart shows the year-over-year percentage change in the FOMC’s preferred inflation metric (headline PCE) since it was adopted in early 2012, relative to the 2% target. The chart demonstrates that inflation was continually below target until it briefly exceeded 2% in January 2017, but it did not subsequently exceed 2% until early 2018, and then dropped again to the present level. That persistence doesn’t appear to the layman’s eye to reflect the temporary pattern that FOMC participants seem to see – notwithstanding their recent references to current component price movements that are presently below target and viewed as transitory.

The constant speculation about likely rate increases or decreases is rooted partly in the FOMC’s communications policies and the market’s lack of understanding of what the FOMC’s reaction function is to deviations from its inflation target and unemployment objectives. The FOMC does not have an explicit unemployment objective, since its position is that it can’t affect real outcomes in employment or long-term economic growth through the use of monetary policy. But given the Committee’s specific inflation target, it is reasonable for markets to ask the following set of questions.

- If inflation is below or above target, how long must that condition persist before a rate move is contemplated?

- Is there a critical value in terms of the deviation of actual inflation from target that will trigger a policy response, and is the response at all related to the rate of growth or decrease in the inflation rate?

- Is the reaction function different if inflation is above target as opposed to below target?

- Is the reaction function different if both inflation and unemployment are low, rather than inflation being low and unemployment increasing?

- Similarly, how does the Committee view its policy decision-making when inflation and growth are accelerating?

Absent a clear understanding of how the FOMC views its policy choices, markets are left to speculate. Revealed preference on the part of the Committee at least provides circumstantial evidence about the FOMC’s reaction function. In the current conflicting-signal environment, the FOMC has proved willing to tolerate inflation’s remaining persistently below target for an extended period of time (i.e. many years), given that growth is about on trend and consistent with the Committee’s forecasts. The watchword in this case, reiterated many times and again in the May minutes, is that the Committee can be “patient.” What it will do in other circumstances we don’t know. We suspect, given the Committee’s ongoing review of its policy framework and balance-sheet normalization, that it will deal with the circumstance when it is time. It is probably unrealistic to expect the Committee to be willing to commit to policy reactions in advance. Hence, the speculation will continue.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.