Massive Spike In Tight Oil Output

Sober Look | Dec 06, 2012 02:22AM ET

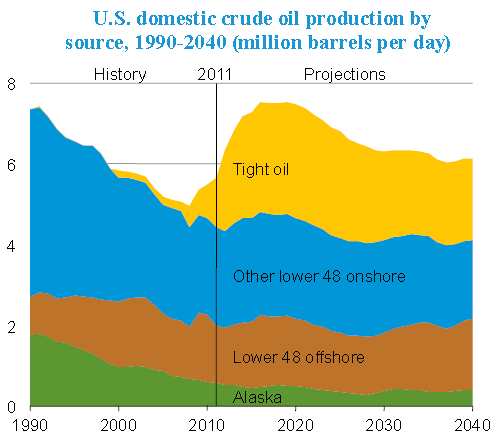

Periodically the US Department of Energy publishes a long-term forecast on the state of energy fundamentals in the US. Their current projection looks as far out as 2040 (whatever that's worth). Here are some key aspects of the forecast. The tight oil (EIA : 1. Crude oil production, especially from tight oil plays, rises sharply over the next decade. Domestic oil production will rise to 7.5 million barrels per day (bpd) in 2019, up from less than 6 million bpd in 2011.

2. Motor gasoline consumption will be less than previously estimated ... reflecting the introduction of more stringent corporate average fuel economy (CAFE) standards. Growth in diesel fuel consumption will be moderated by the increased use of natural gas in heavy-duty vehicles. [This involves the use of compressed natural gas (CNG) in trucks, particularly municipal vehicles such as garbage trucks.]

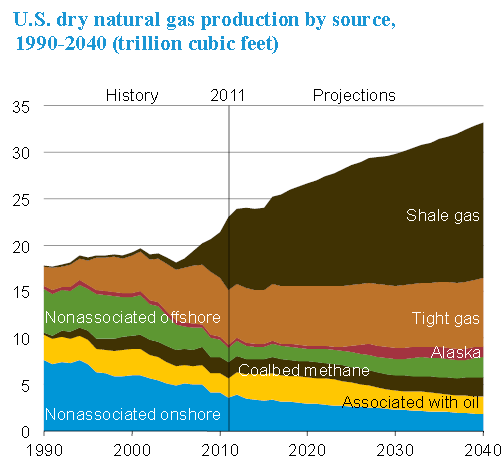

3. The United States becomes a net exporter of natural gas earlier than estimated a year ago. Because quickly rising natural gas production outpaces domestic consumption, the United States will become a net exporter of liquefied natural gas (LNG) in 2016 and a net exporter of total natural gas (including via pipelines) in 2020. [Nat gas production growth looks impressive.]

4. Renewable fuel use grows at a much faster rate than fossil fuel use. The share of electricity generation from renewables grows to 16 percent in 2040 from 13 percent in 2011.

[Here is the chart of the overall consumption forecast by fuel - note that this is not just for electricity, its total usage.]

5. Net imports of energy decline. The decline reflects increased domestic production of both petroleum and natural gas, increased use of biofuels, and lower demand resulting from the adoption of new vehicle fuel efficiency standards and rising energy prices. The net import share of total U.S. energy consumption falls to 9 percent in 2040 from 19 percent in 2011.

[The chart below shows the production/consumption growth. Note that this is total energy, not just oil. The gap in oil is expected to drop from 45% in 2011 to 37% in 2040.]

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.