Markets Staying In Risk-on Mode; Dollar Turned Into Consolidation

ActionForex | Aug 07, 2017 05:05AM ET

The financial markets are trading in risk-on mode as another week starts, boosted by last week's record run in US equities. In addition to being supported by the set of solid job data, comments from White House economic adviser Gary Cohn also provided some optimism to investors. Nonetheless, in the currency markets, Dollar has turned into consolidative mode instead and is waiting for fresh inspirations. Euro, on the other hand, is regaining some growth. New Zealand Dollar and Yen are trading as the weakest ones so far. In other markets, gold failed to stand firm above 1280 handle last week and retreated on Dollar's rebound. it's hovering in tight range of 1260/5 for the moment. WTI crude oil is also struggling to regain momentum for another attempt of 50 handle yet.

US Cohn: Tax bill to be completed "early in the fall"

Comments from White House economic adviser Gary Cohn raised hopes of better US growth outlook. Cohn noted that the current US corporate tax rate, at 35%, is too high when compared with the average of 23% in OECD economies. Cohn reiterated that the government's timetable of getting a comprehensive tax bill completed "early in the fall", adding that top priority "for now until the end of the year is taxes". Recall that pro-growth tax plan outlined by the Trump administration in April proposed a 15% rate. Trump also proposed to reduce the number of individual income tax bracket from seven to three, with the highest marginal tax bracket dropping from 39.6% to 33%.

Kiwi lower ahead of RBNZ

New Zealand Dollar trades notably lower today as RBNZ's survey showed inflation expectation eased. The survey showed that respondents expect 1.77% annual inflation in 1 year and 2.09% in 2 years. That's much lower than the survey result three months ago, at 1.92% in 1 year and 2.17% in 2 years. For growth, firms expected GDP to grow 2.7% in 1 year and 2.64% in 2 years, comparing to prior 2.81% and 2.58% respectively.

The data comes just head of RBNZ meeting this week on August 9, which is a major focus of the week. RBNZ is widely expected to stand pat and keep OCR unchanged at 1.75%. The central bank will likely maintain a dovish tone and keep its own forecast that rates would be on hold until September 2019.

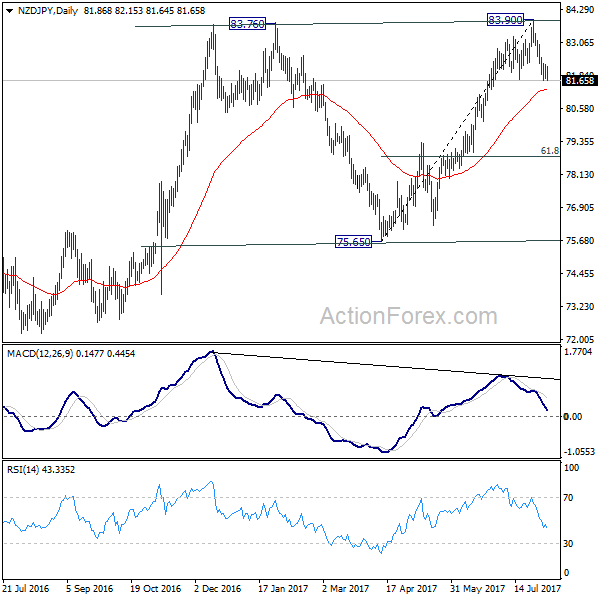

NZD/JPY's breach of 81.66 support last week indicates short term topping at 83.90, after failing to sustain above 83.76 resistance. Bias is back on the downside for 55 day EMA (now at 81.29). Sustained break there should confirm completion of whole rise from 75.65. And deeper fall would then be seen back to 61.8% retracement of 75.65 to 83.90 at 78.80 and below before getting support for rebound.

Elsewhere, Japan leading index rose to 106.3 in June. German industrial production dropped -1.1% mom in June. Swiss foreign currency reserves rose to CHF 714b in July. Swiss CPI rose slightly to 0.3% yoy in July. Eurozone Sentix investor confidence is the only feature for today.

US CPI as main focus of the week

Looking ahead, US CPI is the most important data to watch. The July report, due Friday, probably shows that inflation improved to 1.8% yoy, from 1.6% in June. Core CPI probably stayed unchanged at 1.76. Both readings are expected to stay below the Fed's target of 2%. Recall that the Fed delivered a dovish tone at the July meeting statement, noting that "on a 12-month basis, overall inflation and the measure excluding food and energy prices have declined and are running below 2%". In June the Fed only noted that inflation has "declined recently". It is advised to pay attention to the upcoming FOMC minutes and see if the Fed would continue to describe weak inflation as "transitory".

Here are some highlights for the week ahead:

- Tuesday: China trade balance; Australia business confidence; Swiss unemployment rate; German trade balance; Canada housing starts

- Wednesday: China PPI and CPI; Australia home loans; Canada building permits; US non-farm productivity

- Thursday: RBNZ rate decision; UK RICS house price balance; Japan domestic CGPI, tertiary industrial index; UK productions, trade balance; US jobless claims, PPI

- Friday: German CPI final, US CPI

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.