The markets have been waiting patiently for several days now for Janet Yellen to make her first Congressional appearance. The testimony, on most counts, was as expected. Goldman Sachs gave a brief synopsis of key comments as follows via Zero Hedge:

"Fed Chair Yellen's prepared remarks for her semiannual monetary policy testimony before the House Financial Services Committee were brief and did not contain any major surprises.

1. Yellen's remarks highlighted the cumulative progress made in the labor market recovery, but also noted that 'recovery in the labor market is far from complete' and that it is important to 'consider more than the unemployment rate when evaluating the condition of the U.S. labor market.' These remarks suggest that Yellen views the labor market as having ample remaining slack.

2. She stated that inflation should move back towards 2% over coming years, and that some of the recent softness reflects factors that 'seem likely to prove transitory, including falling prices for crude oil and declines in non-oil import prices.'

3. Yellen indicated that as long as incoming information is broadly consistent with the Committee's expectations, it will likely reduce the pace of asset purchases in further measured steps at future meetings, although purchases are not on a preset course. She also reiterated that the 6.5% threshold is not an automatic trigger for higher rates, as Fed officials have often emphasized in the past.

4. With regard to recent developments, Yellen did not explicitly address the soft patch in US economic data since the start of the year, but did state that recent volatility in global financial markets did not seem to pose a substantial risk to the U.S. economic outlook 'at this stage'"

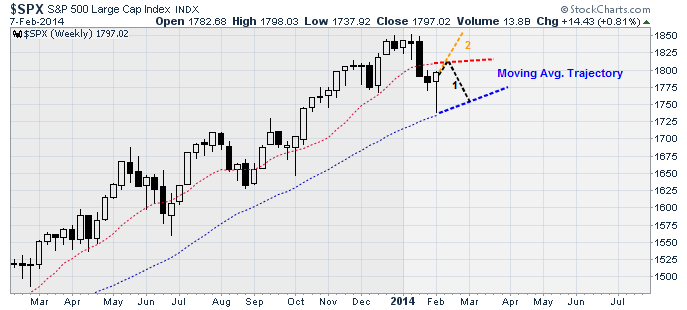

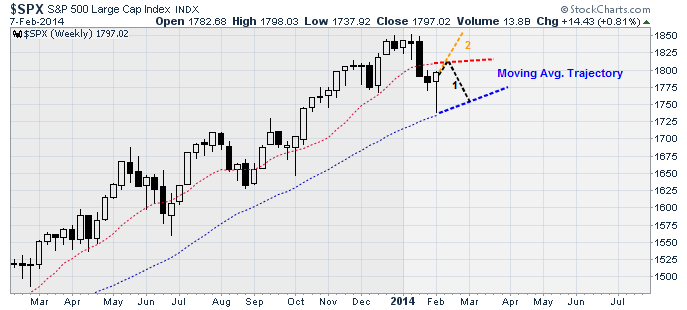

With the threat of a more aggressive "tapering" removed, and confirmation that she will not depart from Bernanke's preset course, the markets were cleared for a rally back into key resistance levels as shown below.

However, our intermediate term indicators, as discussed in last week's newsletter, remain on solid "sell signals" currently. However, I also stated that it was indeed possible that the recent correction was a "head fake." To wit:

"With the Federal Reserve still currently pumping $65 billion a month into the financial markets it is certainly a possibility that the current sell off could be a 'head fake' with the markets continuing its bull cycle rally. While this is what is hoped for by the mainstream media; it is only one of two possible outcomes as shown in the chart below.

Get The News You Want

Get The News You Want

Read market moving news with a personalized feed of stocks you care about.

Get The App

Option 1: The market rallies to the underside of the short term moving average and fails. The market declines to the longer term moving average.

Option 2: The market rallies to a new high reversing the current sell signal and the bull market trend remains intact for the time being.

In the event of Option 1, which has the higher probability currently, then the reduction of risk in portfolios will be advantageous by having provided sufficient cash within portfolios to hedge against a further market decline.

In the event of Option 2, portfolios will need to be quickly rebalanced back to full equity allocations in the days ahead. While the quick reversal of the sell signal would generate additional portfolio turnover, it is less damaging to long term returns than the impact of an unhedged decline.

As with all buy/sell disciplines, there are times that markets can behave irrationally. This is particularly the case when there are artificial interventions into the market.

However, the importance of strictly following a discipline is that it will result in the correct actions being implemented more often than not. As in baseball, it is the team that gets on base more often that wins games."

As I discussed previously in "Yellen Promises More," the correlation between the increases in the Fed's balance sheet and the stock market remains very consistent. The chart below shows the Fed's balance sheet both before and after the recent reductions in bond purchases.

When the Federal Reserve was purchasing $85 billion a month, the target on the S&P 500 by 2016 was pushing 2400. Today, after the reductions to $65 billion, it would suggest a target of 2200 on the index. Of course, the more liquidity that is drawn from the system, the lower the future returns will likely be.

The reason, as I discussed previously , is the effect of the "carry trade" that is induced by the excess liquidity that is injected into the markets.

"Hedge funds have been borrowing money in Japan (again) at very low Japanese interest rates, obviously denominated in yen. They then convert those yen to, say, the Brazilian real, Argentine peso, Turkish lira, etc. and buy Brazilian bonds or Turkish bonds using 10:1+ leverage. Accordingly, when such countries jacked up interest rates overnight, their bond markets collapsed.

Concurrently, their currencies swooned, causing the 'hot money' investors to not only lose on their leveraged bond positions, but on the currency as well. If you are leveraged when that happens, the losses add up quickly and those positions need to be sold. So the bonds were sold, and the pesos/lira/real that were freed up from those sales had to be converted back into yen (at currency losses) to pay back the Japanese loans. And as the bonds/currencies crashed, the 'pile on' effect exaggerated the downside dive."

Currently, there is little evidence that the recent crisis in the emerging market economies is over. Most likely we are just in the "eye of the storm." The recent correction took the markets to deeply oversold short term levels which was created the opportunity for a "short covering" bounce that we have witnessed over the last few days.

On a longer term basis, the markets remain very extended, overly bullish and excessively valued. Such conditions are not resolved by a short term "dip" but rather longer term market reversions. However, it is also important to remember that markets can remain irrational longer than logic would suggest. As discussed previously , mid-term election years have a nasty tendency of summer swoons. Furthermore, the recent economic soft-patch may worsen in coming months, along with continued weakness in corporate revenues, which could put a damper on bullish outlooks. But, for the time being, the "bull market is dead, long live the bull market."