Markets Focus On Greece

Swissquote Bank Ltd | Jun 15, 2015 05:24AM ET

Market Brief

This week, markets will be driven by the Greek saga after talks between Athens and its creditor broke down on Sunday evening. The deadline is approaching fast (end of June) and the eurogroup meeting on Thursday is broadly seen as the last chance for Greece to reach an agreement that will unlock the remaining €7.2bn bailout fund. In spite of last week’s highly uncertain environment, markets managed to remain relatively stable with most market participants consolidating their positions. However, we expect markets to feel the heat this week as the odds of a Greek default have increased considerably. Today, ECB President Mario Draghi will speak before the European Parliament in Brussels. We do not expect him to cover the Greek situation but rather to go over his previous comment about bond market volatility and to reiterate the ECB’s commitment to implement fully the QE.

EUR/USD had a quiet session in Asia and traded range-bound between 1.1190 and 1.1240 with a slight negative bias. On the downside, a key support stands at 1.1043 (previous highs) and the euro will need fresh boost to clear the area. The FOMC rate decision is due on Wednesday and like most market participants, we do not expect any rate hike at this meeting. We anticipate Fed Chairwoman Janet Yellen to reiterate her call for a rate lift later in 2015 and to emphasise that the timing will be data dependent. May’s CPI are also due on Thursday, followed by Philadelphia Fed Business Outlook for June. Traders remain reluctant to build long USD positions before those key events. However the combination of hawkish Fed comments and higher CPI reads (on Thursday) will likely trigger some long USD positioning, mitigating partly the focus on the Greek situation.

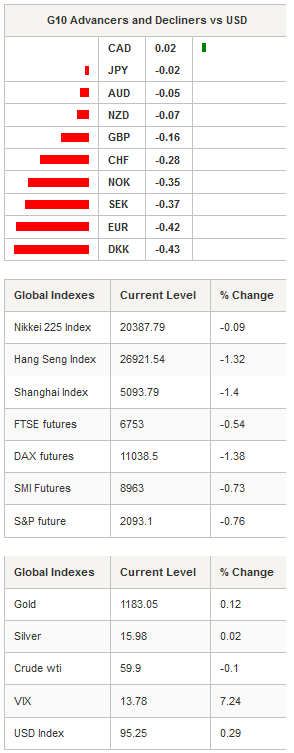

In Asia, equity returns are negative as European uncertainties spread. Hong Kong’s Hang Seng is down -1.32%, Shanghai Composite retreats -1.40% while the heavy-tech Shenzhen Composite is down -1.30%. In Japan, the Nikkei edges lower -0.09% while Australian shares retreat -0.12%. In currency markets, the dollar advances against G10 currencies. USD/JPY consolidates recent losses and moves sideways between 123 and 124. The closest support lies at 122.46 (previous low) while a strong resistance can be found at 125.86 (previous high). AUD/USD is also treading water between 0.7680 and 0.7793.

In Europe, equity futures are free falling with the FTSE 250 down -0.54%, DAX down -1.38%, CAC down -1.10% and SMI down -0.73%. EUR/CHF is recovering slightly after last week’s sharp drop. The currency is back in its 1.03-1.05 medium-term range with significant risk on the downside due to the potential Greek default.

WTI continues to move lower after having reached the top of its range around $62 and is currently trading around $59.91 a barrel while its counterpart from the North Sea can be bought at $63.86.

Today traders will be watching June Empire Manufacturing (exp. 6, 3.09 prior), May Industrial production (0.3%m/m exp., -0.3% prior) and June NAHB Housing Market index (56 exp., 54 prior read) from the US; April Manufacturing sales from Canada; May Trade balance from India.

Today's CalendarEstimatesPreviousCountry / GMT NZ May Performance Services Index - 56.5 NZD / 22:30 UK Jun Rightmove House Prices MoM - -0.10% GBP / 23:01 UK Jun Rightmove House Prices YoY - 2.50% GBP / 23:01 SW May PES Unemployment Rate 3.70% 3.80% SEK / 06:00 IN May Wholesale Prices YoY -2.50% -2.65% INR / 06:30 EC Bloomberg June Eurozone Economic Survey (Table) - - EUR / 06:30 GE Bloomberg June Germany Economic Survey (Table) - - EUR / 06:35 FR Bloomberg June France Economic Survey (Table) - - EUR / 06:40 IT Bloomberg June Italy Economic Survey (Table) - - EUR / 06:45 SP Bloomberg June Spain Economic Survey (Table) - - EUR / 06:50 DE May PPI MoM - -1.80% DKK / 07:00 DE May PPI YoY - -4.30% DKK / 07:00 TU Mar Unemployment Rate 10.90% 11.20% TRY / 07:00 SZ SNB Sight Deposits - - CHF / 07:00 EC ECB's Weidmann Speaks in Frankfurt - - EUR / 07:00 SZ May Producer & Import Prices MoM 0.10% -2.10% CHF / 07:15 SZ May Producer & Import Prices YoY -5.10% -5.20% CHF / 07:15 SZ Apr Retail Sales Real YoY - -2.80% CHF / 07:15 SW May Unemployment Rate 7.90% 8.30% SEK / 07:30 SW May Unemployment Rate Trend - 7.80% SEK / 07:30 SW May Unemployment Rate SA 7.70% 7.80% SEK / 07:30 IT May CPI FOI Index Ex Tobacco - 107.1 EUR / 08:00 IT May F CPI EU Harmonized YoY 0.20% 0.20% EUR / 08:00 IT Apr General Government Debt - 2184.5B EUR / 08:30 EC Apr Trade Balance SA 19.0B 19.7B EUR / 09:00 EC Apr Trade Balance NSA 22.5B 23.4B EUR / 09:00 NO Norway's Finance Minister Presents Housing Market Strategy - - NOK / 10:30 IT Bank of Italy Deputy Director General Speaks on Derivatives - - EUR / 12:00 CA Apr Manufacturing Sales MoM -0.50% 2.90% CAD / 12:30 US Jun Empire Manufacturing 6 3.09 USD / 12:30 CA May Existing Home Sales MoM - 2.30% CAD / 13:00 EC ECB President Mario Draghi Speaks at EU Parliament in Brussels - - EUR / 13:00 US May Industrial Production MoM 0.20% -0.30% USD / 13:15 US May Capacity Utilization 78.30% 78.20% USD / 13:15 US May Manufacturing (SIC) Production 0.30% 0.00% USD / 13:15 EC ECB Publishes Weekly QE Details - - EUR / 13:45 CA Jun 12 Bloomberg Nanos Confidence - 56.3 CAD / 14:00 US Jun NAHB Housing Market Index 56 54 USD / 14:00 EC ECB's Coene Speaks on EU Investment Plan in Brussels - - EUR / 16:00 BZ Jun 14 Trade Balance Weekly - $1976M BRL / 18:00 US Apr Net Long-term TIC Flows - $17.6B USD / 20:00 US Apr Total Net TIC Flows - -$100.9B USD / 20:00 BZ May Formal Job Creation Total -50000 -97828 BRL / 22:00 BZ May Tax Collections 94396M 109241M BRL / 22:00 SW Apr Service Production MoM SA - -0.10% SEK / 22:00 SW Apr Service Production YoY WDA - 2.90% SEK / 22:00 IN May Exports YoY - -14.00% INR / 22:00 IN May Imports YoY - -7.50% INR / 22:00 CH May Foreign Direct Investment YoY CNY 8.00% 10.50% CNY / 22:00 IN May Trade Balance -$11000.0M -$10992.3M INR / 22:00

Currency Tech

EUR/USD

R 2: 1.1534

R 1: 1.1385

CURRENT: 1.1235

S 1: 1.0882

S 2: 1.0521

GBP/USD

R 2: 1.5879

R 1: 1.5800

CURRENT: 1.5534

S 1: 1.5191

S 2: 1.5090

USD/JPY

R 2: 135.15

R 1: 125.64

CURRENT: 123.46

S 1: 122.03

S 2: 118.18

USD/CHF

R 2: 0.9712

R 1: 0.9573

CURRENT: 0.9316

S 1: 0.9072

S 2: 0.8986

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.