After Friday's Payrolls, Markets Craving Clarity

IG | Sep 07, 2015 01:48AM ET

Friday’s US payrolls report seems a distant memory now with Chinese equity markets resuming trade in a seemingly optimistic mood. There was always a chance it could have been another ugly Asian trading session.

Whether or not we have realistically seen the lows in the various Chinese markets is yet to be seen, but the belief and assurance provided by the Chinese authorities over the weekend suggests we may see better days ahead.

Of course, one day doesn’t make a bull market. However, when you hear that power usage, train freight and property markets are showing signs of improvement, domestic traders listen. This comes at a time when the central bank governor Zhou suggested the stock market sell-off was close to an end, while the CSRC (the regulator) also pledged to stabilise the stock market.

I’m not sure exactly what new measures will eventuate, but the trading public seems to have bought into it, with the futures markets actually going limit-up in the early part of trade. Cash markets have been a little more sanguine but volumes in both cash and futures have been notably poor.

US futures have pushed higher as a result of stability in Chinese markets and I would imagine we could see the probability of a September hike increase a touch when the fed funds futures open. Clarity is what the world wants, and clarity was clearly what we didn’t get in Friday’s payrolls. The fact the two-year treasury yield was largely unchanged at 70 basis points highlights that the script didn’t change. It’s this lack of clarity in the jobs number that caused 96% of corporates to finish lower on the day.

What is clear now, though, is that the Fed would be moving the funds rate higher this month if they simply looked at employment as their sole mandate. However, the inflation aspect of the mandate and the unofficial third part of the mandate - stability at an asset level - is absolutely holding them back. Still, the Fed simply can’t be dictated to by market; they are supposed to guide rather than being guided. They will simply have to commit by signaling they are ready to hike in October or December, otherwise there will be an outright credibility issue at hand.

The credibility issue is something to be genuinely concerned about.

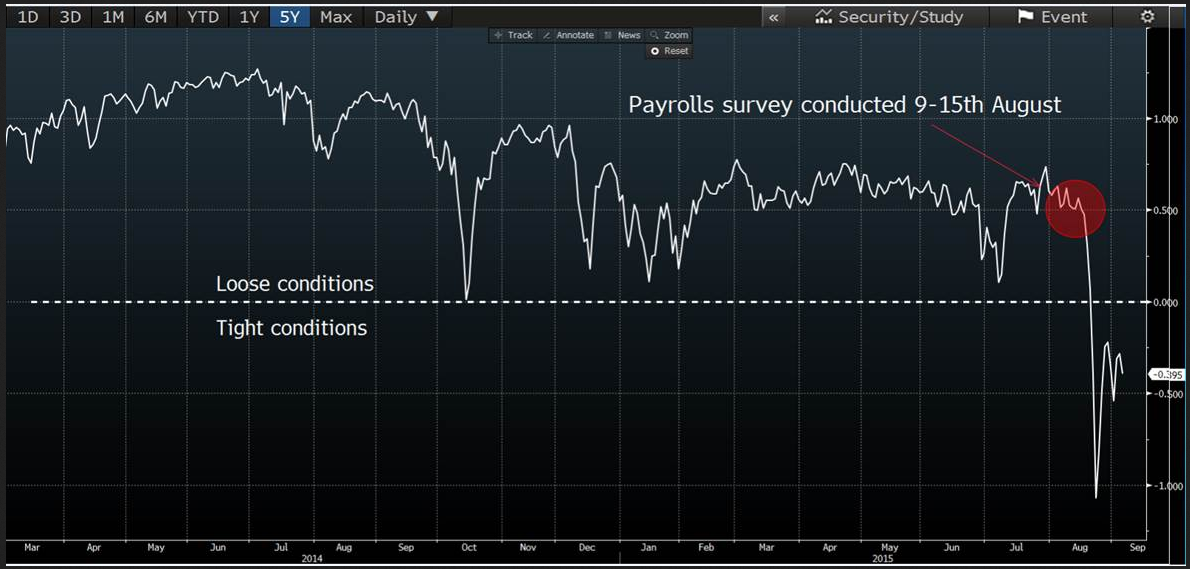

I also feel traders will be keeping an eye on the US financial conditions index (see below) in the lead up to the FOMC meeting on 17 September. This index tracks various factors, such as credit spreads, the S&P 500, volatility, bond yields and inter-bank rates, and gives a sense of how tight or loose financial conditions are. As things stand, financial conditions are fairly tight and this is part of the reason why Fed member Bill Dudley suggested the August jobs report was a tad stale, as the employment survey was taken prior to the stress seen in economic conditions.

The Fed will be watching this closely and it could really dictate whether we see a near-term hike. It’s interesting that 62% of economists surveyed by Bloomberg still expect a September hike. Given the current pricing structure, shorting Eurodollar September futures could be a very profitable short-term trade if one genuinely believes they will start hiking in September.

Back to Asian trade, on the whole there has been a negative tone. The Hang Seng and Nikkei are lower, while the USD is mixed on the day, with the AUD having a modest rebound based on very oversold conditions. Oil prices are also modestly lower, while copper seems to be finding support within its channel trend, although it is looking decisively like a bear flag continuation pattern. One can expect a retest of the recent lows and a continuation of the downtrend.

We’ve seen the ASX 200 trade to a session low 4973 pre-China open, but better buying was seen when the Chinese futures opened on a strong note. In a similar vein as Chinese markets, volumes have been lacklustre.

I guess when you see implied volatility so elevated (the ASX VIX is currently 27.8%), one can expect to see 1-2% moves fairly often, with vicious reversals occurring at any stage. When volatility is this elevated, traders have to adapt and alter risk and money management if they are to survive the market.

Ahead of the open we are calling the FTSE 6099 +57, DAX 10141 +103, CAC 4571 +48, MIB 21737 +265, IBEX 9938 +117

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.