Markets Anticipate Euro Zone CPI And Canadian GDP

FXeeda | Mar 31, 2014 04:28AM ET

Stock markets fell last week as traders booked profits on a number of big performers and tensions in Ukraine continued to cause concern.

Technology and biotechs were the week’s poorest performers as the Nasdaq dropped 2.8%, the most since 2012. Facebook fell at least 11% after the company said it would pay $2 billion for virtual reality headset maker Oculus, while Citigroup sank over 5% after failing a Fed stress test.

In FX, the US dollar moved lower on Friday and the euro climbed as European inflation concerns wilted following positive inflation data out of the area’s biggest member, Germany.

German inflation came in at 0.9%, below the ECB target but only a tiny 0.01% drop from last month. With the ECB set to meet next week, the data will have slightly reduced calls for more policy action.

So far, traders have been bearish on the euro and have been expecting stronger policy moves from the ECB, but ECB Chief Mario Draghi has failed to bring anything to the table as yet. Because of this, traders will likely forecast no change again at next week’s meeting.

The US dollar was also not helped by words out of China and this saw most commodity linked currencies advance across the board. Chinese Premier Li Keqlang spoke of Chinese reform bills and dismissed fears of an economic slowdown saying that officials would step in if needed, although there is speculation as to what intervention could actually be proposed.

Week Ahead

Traders will have plenty to analyse this week including Eurozone CPI and Canadian GDP numbers on Monday before a rate decision from the Reserve Bank of Australia and German unemployment on Tuesday. Later on Tuesday, traders will see the first of two US ISM manufacturing reports before US factory orders on Wednesday.

Thursday will see this month’s ECB meeting before the second ISM manufacturing report out of the States. Euro analysts currently see no change to the underlying 0.25% benchmark Eurozone rate so more significant could be the proceeding press conference.

On Friday, traders will watch US non-farm payrolls which could end up being the key event of the week. Analysts are currently expecting a monthly advance of 200k compared to the previous month’s 175k number.

FXeeda results

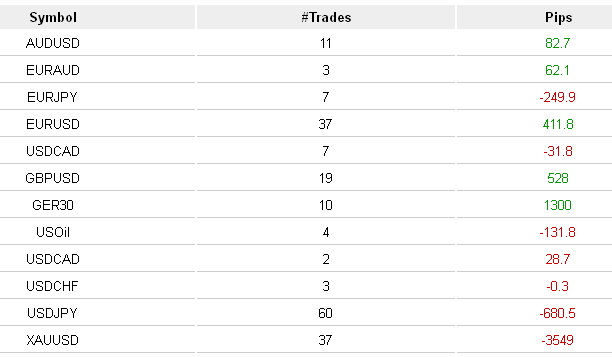

Our forex signals continued last week’s good run of form, taking pips from the AUD/USD, EUR/AUD and USD/CAD. However, our biggest profits came from the EUR/USD (411.8 pips from 37 trades) and the GBP/USD (528 pips from 19 trades) as we correctly predicted a number of moves versus the greenback.

It was not all green though and our signals gave back around 680 pips in the USD/JPY. Meanwhile, we captured 1300 points profit in Ger30.

EUR/USD

As mentioned above, the ECB meet this week to discuss interest rates and whether to use any of the policy tools that officials have at their disposal. Currently, the EUR/USD is reeling after a week of heavy losses, although the currency did manage to eke out a gain on Friday.

In fact, the EUR/USD bounced sharply off the first support in response to German inflation and ended the week around 1.375.

Even so, the majority of traders are preparing for more losses this week as we run up to the ECB meeting. The currency has dropped for four out of the last 5 days and traders have no reason to bet against the trend with the ECB coming up.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.