Market Overview: Waiting For A Correction?

Blog of HORAN Capital Advisors | Nov 24, 2013 12:20AM ET

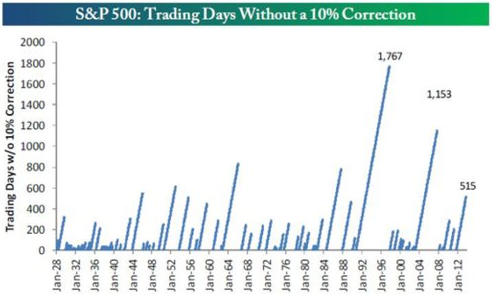

One interesting aspect of this bull market run for the S&P 500 Index has been the absence of a 10+% correction.

It seems on a daily basis the talking pundits on business news channels and in print are certain an equity market correction is just around the corner. For those investors under-invested in equities, a correction would certainly be a welcome event. Market corrections, however, are hard (if not impossible) to predict and when they do occur, they tend to surprise investors. As the below chart of market advances without a 10% correction shows, it is not uncommon for the market to move higher without significant pullbacks.

As noted in the Bramesh article,

- from March 2003 to October 2007 (the entire length of the last bull market), the index went 1,153 trading days without experiencing a 10% correction.

- the longest streak on record without a 10% correction was from October 1990 to October 1997, and that lasted 1,767 trading days.

- if the current streak matched the 1990 to 1997 streak, this bull market would run to October 1, 2018, nearly five years from now.

The other factor that seems to be preventing a so called market "melt up" is investor sentiment has not become overly bullish. In the sentiment survey release by the American Association of Individual Investors earlier this week, bullish sentiment actually feel 4.8 points after falling 4.3 points in the prior week. Investors should keep in mind though, sentiment indicators are most predictive at their extremes.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.