Market Movers of the Week: Nvidia, Walmart Push Stocks to New Worrisome Levels

Investing.com | Feb 23, 2024 11:59AM ET

- Benchmark indexes are set to conclude the week positively, driven by bullish surges in key stocks.

- So in this article, we will take a look at the top four stocks in terms of performance this week and use InvestingPro to analyze their prospects going ahead.

- Nvidia, and Walmart are some of the names we intend to analyze in this article

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool.

- Moderna (NASDAQ:MRNA) +9.11%

- Nvidia (NASDAQ:NVDA) +8.09%

- Walmart (NYSE:WMT) +3.60%

- Tenaris (NYSE:TS) +7.75%

Benchmark indexes Dow Jones, Nasdaq, and the S&P 500 are poised to finish the week on a positive note. We have seen notable performances from four key stocks:

What's Driving These Stocks?

Moderna's Q4 earnings per share of $0.55 and revenue of $2.8 billion exceeded consensus estimates, attributed to reduced expenses and payment delays.

Nvidia reported record revenues of $22.10 billion, up 22% from the third quarter and 265% from a year earlier, beating expectations. Earnings per share were $5.16, up 28% from the previous quarter and 486% from a year earlier, surpassing consensus estimates.

Walmart exceeded analyst estimates with earnings per share of $1.80 and revenue of $173.4 billion for the quarter, along with a quarterly dividend increase of 9.2% to $0.6225 per share.

Tenaris saw 2023 revenues of $14.869 billion, a 26% increase from 2022, and net income rose to $3.958 billion, a 55% improvement over 2022. The board intends to propose a dividend payment of $0.60 per share at the upcoming shareholders' meeting on April 30.

In this piece, we will analyze each stock using InvestingPro's Fair Value. The Fair Value is determined for each stock based on various financial models tailored to the stocks' specific metrics.

1. Moderna

For Moderna, InvestingPro's Fair Value, which summarizes 12 investment models, stands at $105.98.

Source: InvestingPro

Analysts are strongly bullish on the stock, with a target price of $134.03 and consequently far from the average Fair Value.

While analysts and Fair Value disagree on the possibility of bullishness and target price, the low-risk profile is positive. It has good financial health, with a score of 3 out of 5.

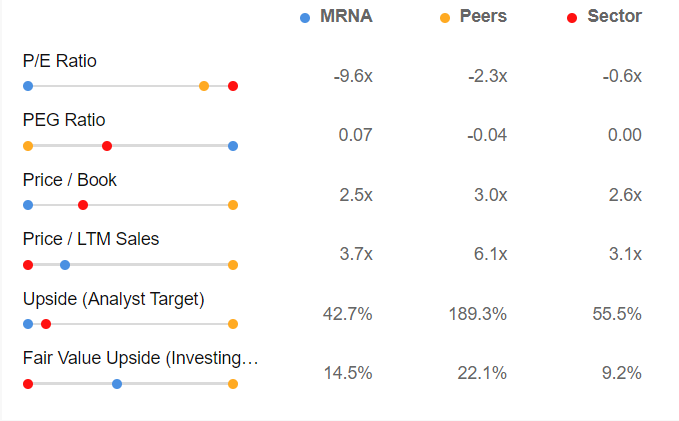

Delving deeper into the stock with the market and competitors, the stock is currently undervalued.

Source: InvestingPro

Moderna is now worth more than 2.5x its revenues compared to the 3x sector average.

The Price/Earnings ratio at which the stock is trading is -9.6x against an industry average of -0.6 percent, which again stands to confirm its current undervaluation.

2. Nvidia

For Nvidia, InvestingPro's Fair Value, which summarizes 13 investment models, stands at $638.68, which is 20.2% less than the current price.

Source: InvestingPro

InvestingPro subscribers closely tracked analysts' forecasts, and they are optimistic about the stock, setting a bullish target price of $856.16.

While there's a current disparity between analysts and Fair Value regarding the potential for a rise, the positive aspect lies in the low-risk profile. The stock exhibits excellent financial health, earning a score of 4 out of 5.

Upon closer examination, when compared to the market and competitors, there are indications that the stock might be potentially overvalued.

Source: InvestingPro

Looking at well-known indicators, Nvidia's current value is 37 times its revenue, significantly higher than the industry average of 2.1x.

The Price/Earnings ratio for the stock is 87.9X, while the industry average is 11.2x, indicating a substantial overvaluation.

3. Walmart

For Walmart, InvestingPro's Fair Value, which summarizes 15 investment models, stands at $159.18, or -9.2% from the current price.

Source: InvestingPro

Analysts project a bullish target price for the stock at $193.44.

Despite a disparity in views between analysts and Fair Value regarding the likelihood of a rise, the positive aspect is the stock's low-risk profile. The company demonstrates good financial health, scoring 3 out of 5.

A comparison with the market and competitors reinforces the notion that the stock may currently be overvalued.

Source: InvestingPro

We can see that Walmart is now worth 0.7x its sales compared to 0.9x in the industry, and the Price/Earnings ratio at which the stock is trading is 30.4X against an industry average of 11.8x, which stands to confirm its overvaluation.

4. Tenaris

For Tenaris, InvestingPro's Fair Value, which summarizes 15 investment models, stands at $46.20, or +31.7% higher than the current price.

Source: InvestingPro

InvestingPro subscribers tracked analyst forecasts, which are optimistic about the stock, projecting a target price of $41.47.

The risk profile is also encouraging, with a strong financial health rating of 4 out of 5.

However, when comparing the stock to the market and competitors, we don't find the expected confirmation. Currently, the stock has a potentially inflated valuation.

Source: InvestingPro

We can see that Tenaris is now worth 1.3x times its revenue compared to 1.1x in the industry, and the Price/Earnings ratio at which the stock is trading is 5.3X against an industry average of 4.2x, which stands to confirm its overvaluation.

Conclusion

In conclusion, analysts suggest that Moderna might rebound soon despite the Fair Value indicating that the prices are at a fair level with limited upside. The stock's downtrend could potentially come to an end soon.

As for Nvidia and Walmart, although they boast a strong financial status and well-defined strengths, there's a cautious outlook.

Nvidia has seen impressive gains of +278% over the past year, while Walmart has recorded +22%. These strong gains could lead to a correction sooner or later, even though investors currently have confidence in their bullish trends.

Regarding Tenaris, despite its solid financial status and bullish Fair Value, certain indicators suggest that it might be overvalued. Investors should keep this in mind while considering their investment options.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.