Market Guide - Monetary Policy Easing Is Back

Danske Markets | Oct 01, 2019 05:04AM ET

Market overview

Market overview

Trade war: where are we now?

Since August, markets have turned more optimistic regarding the October trade talks between the U.S. and China and USD/CNH is back around 7.10. An interim deal could be within reach because both sides seem to have an interest in this. Such a deal could include China buying some agricultural goods again in return for a further delay in tariff rates. While a small interim deal is a possibility in October, a real break-through is hard to envision at this stage.

Brexit: optimism can be fleeting

The GBP has strengthened recently due to Brexit optimism in terms of negotiations between the EU and the UK. However, from here, it may not take much of a change in politics to get a large negative impact on the GBP. We still expect the UK government to ask for an extension (and call a general election) causing the GBP to yet again come under (political and economic) pressure. Looking into 2020, we remain cautiously optimistic that the UK will not end with ‘no deal’.

Oil market: Saudi oil fields attacked

In mid-September, a drone attack on Saudi oil production facilities took place, which was at first estimated to cause a temporary loss of about 5% of the world’s oil output. This is a huge amount of oil and the market responded with a 20% jump in the oil price. However, the oil price fell somewhat back again, as the damage from the attack was not as big as first thought. We also saw limited effects in other financial markets, e.g. NOK did not move much even though it usually follows the oil price closely. However, the attack has increased attention on the geopolitical situation in the region.

Fed cut the policy rate further and we expect to see more

While the Fed cut the interest rate by 25bp again at the last FOMC meeting as expected, it made it very clear that its eyes are on ‘America first’ when it comes to policy – and that it does not commit to further easing for now. Further easing from the Fed will indeed be a help to the weaker global economy, but, at this stage, easing will likely remain half-hearted from a global point of view as the U.S. economy is set to stay ‘too strong’ for Fed to pre-commit to easing monetary policy. However, we still expect four more rate cuts from Fed, which should eventually support a weaker USD, but in a weak global environment and without precommitting to further easing, USD strength persists.

ECB delivered a big package

In September, the ECB cut the deposit rate by 10bp to minus 0.50% and introduced a tiered deposit system, which allows banks to place some of their excess deposits with the ECB at zero interest rate, while the rest will have to be placed at minus 0.50%. This system is introduced in order to cushion some of negative impact that negative interest rates have on banks’ business model, and variants of this system are already known in Denmark, Switzerland and Japan. The ECB also restarted its QE program, where it will purchase EUR20bn/month worth of bonds.

The QE program is ‘open ended’, which means it in principle can run forever or at least until the ECB sees a firm improvement in inflation (expected, and realized).

USD – Fed remains hesitant to pre-commit

The Fed has signalled that its October policy decision is largely contingent on developments in the trade war, global data and US inflation. While it has continued to refrain from pre-committing to further cuts, we expect the Fed will eventually get ahead of the curve and push EUR/USD higher.

Outlook for EUR/USD

Trade war escalation, geopolitical tensions, a downturn in global manufacturing and slow monetary policy adjustments by the Fed and the ECB are factors weighing on the U.S. and euro area. While the U.S. economy still looks relatively stronger, we consider a period of stabilisation around current weaker levels as more likely than an imminent turnaround in either economy.

In our view, the September ECB meeting could turn out to have been a game changer for EUR/USD. Even though the ECB cut its deposit rate less than expected and introduced a tiered deposit system, Draghi and co. came close to convincing markets of their commitment to easing with their strong forward guidance and an open-ended QE programme. Over time, these actions may support higher inflation expectations which, when viewed in isolation, could weigh on EUR/USD. The Fed cut rates again in September and we look for a 25bp rate cut during each of the next four meetings, which would eventually place the Fed ahead of the curve in terms of monetary easing. For now, however, the Fed remains unwilling to pre-commit.

The possibility of more forceful Fed easing in the short term represents a notable upside risk to our forecast. Given the current 50/50 market pricing of a 25bp cut in October, the next releases of ISM and non-farm payrolls will be even more important for EUR/USD in the short term. Ultimately, strong forward guidance from the ECB will give some counterweight to a continuation of Fed rate cuts in the short term. Eventually, we expect the Fed will get ahead of the curve and push EUR/USD higher. We therefore keep our forecasts unchanged at 1.10 in 1M and 3M (NYSE:MMM), 1.13 in 3M and 1.15 in 12M.

GBP – optimism to make way for uncertainty

A spout of autumn optimism has strengthened the GBP in recent weeks, with markets pricing a lower risk of a no-deal Brexit. In our view, renewed political uncertainty remains around the corner and we therefore continue to expect EUR/GBP to trade near 0.90. We anticipate further volatility in the run-up to the 31 October Brexit deadline.

Outlook for EUR/GBP

GBP weakened somewhat after Theresa May stepped down and Boris Johnson took office, with additional weakening stemming from a decline in domestic demand. Since August, however, the mood has turned around and markets now price a lower risk of a no-deal Brexit with EUR/GBP back to hovering around 0.88. We think that optimism will prove short-lived. GDP expectations are currently running around 1%. Although downside risk is prevalent in light of Brexit uncertainty, as of today the numbers out of UK remain decent.

The Bank of England continues to be quite passive. In practice, monetary policy is unlikely to change before either 1) we see a much stronger worsening in UK data, or 2) the completion of a dramatic (or peaceful) Brexit, after which policy may move in either direction.

In the run-up to the Brexit deadline in October, EUR/GBP will remain volatile. Our base case continues to be an extension of Brexit and a new election. We expect EUR/GBP will settle around 0.90. In the case of a decent deal or cancellation of Brexit, we believe EUR/GBP will move to around 0.85. In the case of no deal outcome, we look for EUR/GBP approach but remain below 1.0. In terms of our EUR/GBP forecasts, we keep these unchanged at 0.90 throughout the forecast horizon.

SEK – Riksbank challenged by economic outlook

A deteriorating economic outlook and disappointing inflation prints are challenging the Riksbank’s plans for a year-end rate hike, and increasing the prospects of a policy reversal.

Outlook for EUR/SEK

GDP growth is slowing at a faster pace than the Riksbank expected, as an already weak preliminary Q2 was revised down to 1.0% y/y. The global outlook seems to deteriorate by the day, not least on key export markets. In addition, the labour market has been a clear disappointment over the last couple of months. In our view, these developments will make it difficult for the Riksbank to deliver on its repo rate forecast. The economic slowdown is a headwind for the SEK.

In our view, the Riksbank will have to back down from its plan to raise rates around year-end for the following reasons: (i) inflation and inflation expectations are dropping, (ii) GDP growth is lower, (iii) the labour market is very weak and (iv) other central banks are cutting rates. Such an environment is more conducive to a policy reversal and rate cutting. As such, we look for a -25bp cut around February next year. Since pricing is close to flat, growing expectations of a cut will weigh on the SEK.

Based on the cyclical economic slowdown and a subdued inflation outlook that will continue to challenge the Riksbank, we stick to our bearish medium-term view on the SEK. Moreover, the upcoming wage round will, in our view, not make it any easier for the Riksbank to achieve its target.

As such, we do not expect a rate hike by year-end, but rather expect a policy reversal leading to a rate cut in Q1 20. The market is currently pricing in a flat repo rate path for the coming year, providing room for a SEK-negative re-pricing of the Riksbank in the coming months. Although SEK is likely to remain data dependent, we remain comfortable with an upward-sloping medium-term trajectory for EUR/SEK and leave the forecast profile unchanged at 10.70 in 1M, 10.80 in 3M (NYSE:MMM), 10.90 in 6M and 11.00 in 12M.

NOK – weakness persists despite NB rate hike

With its rate hike this month, Norges Bank remains the sole G10 central bank hiking policy rates. Relative rates continue to have little impact on EUR/NOK movements, however, and we suspect a substantial change to the external environment is required for NOK weakness to abate.

Outlook for EUR/NOK

Recent economic releases out of Norway confirmed that the mainland economy remains insulated against weaker global growth impulses. The reasons are: 1) oil investments, 2) building and construction, 3) strong public demand, and 4) rising real disposable income stemming from rising employment, higher nominal wages and lower inflation. The latest Regional Network Survey indicated average mainland growth of 2.7% y/y over the next 6M. While down from the previous signal of 3.1%, it remains above peer growth and, importantly, above the economy’s trend potential.

As expected, Norges Bank hiked policy rates by 25bp at the September meeting, which again highlighted NB’s emphasis on domestics and a weak NOK. Notably, NB signalled that this was most likely the last hike in the hiking cycle, even if the rate path actually implied a 40% probability of another hike in 2020. As we are slightly more upbeat on the labour market and the mainland economy than NB, we project another hike in March 2020.

The disconnect between relative rates and the spot exchange rate remains firmly entrenched in Norway. While NB again beat market pricing in September and hiked policy rates for a fourth time in a year, both the trade and import weighted NOK are at weaker levels than a year ago. Indeed, the persistency of NOK weakness has been a key reason behind the Norwegian economy’s outperformance. That said, we think a substantial change to the external environment (in terms of USD strength, China deleveraging and broad commodity performance) is required for persistent NOK strength. As we do not expect such a change in 2019, we raise our forecasts to 9.90 in 1M, 10.00 in 3M (NYSE:MMM), 9.70 in 6M, but keep our 12M forecast at 9.50.

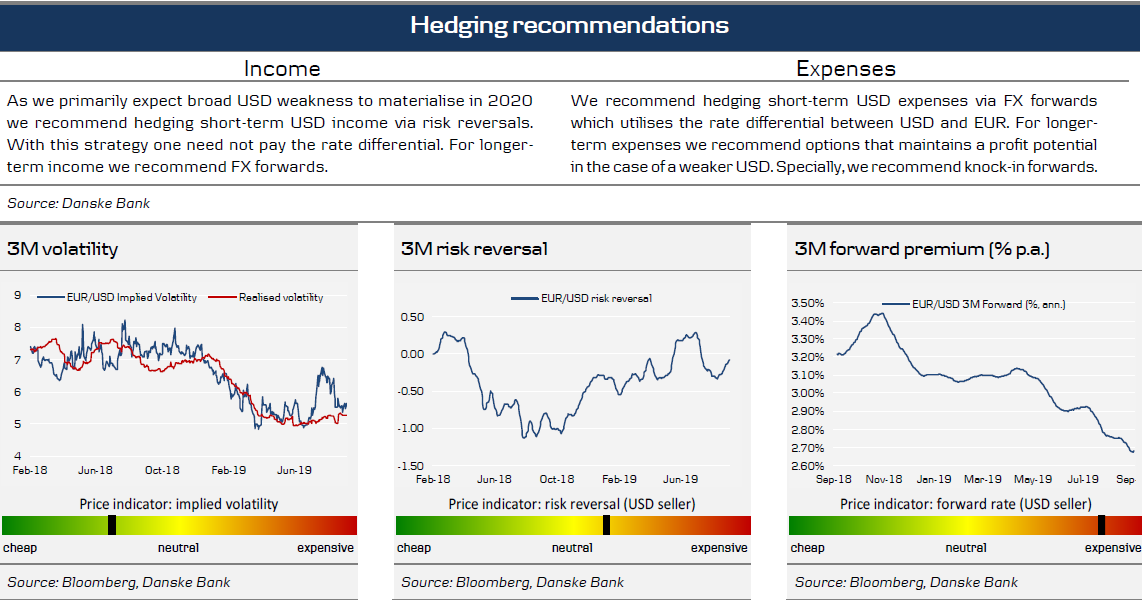

Danske Bank’s hedging recommendations: other majors

FX forecasts

Trade war: where are we now?

Since August, markets have turned more optimistic regarding the October trade talks between the U.S. and China and USD/CNH is back around 7.10. An interim deal could be within reach because both sides seem to have an interest in this. Such a deal could include China buying some agricultural goods again in return for a further delay in tariff rates. While a small interim deal is a possibility in October, a real break-through is hard to envision at this stage.

Brexit: optimism can be fleeting

The GBP has strengthened recently due to Brexit optimism in terms of negotiations between the EU and the UK. However, from here, it may not take much of a change in politics to get a large negative impact on the GBP. We still expect the UK government to ask for an extension (and call a general election) causing the GBP to yet again come under (political and economic) pressure. Looking into 2020, we remain cautiously optimistic that the UK will not end with ‘no deal’.

Oil market: Saudi oil fields attacked

In mid-September, a drone attack on Saudi oil production facilities took place, which was at first estimated to cause a temporary loss of about 5% of the world’s oil output. This is a huge amount of oil and the market responded with a 20% jump in the oil price. However, the oil price fell somewhat back again, as the damage from the attack was not as big as first thought. We also saw limited effects in other financial markets, e.g. NOK did not move much even though it usually follows the oil price closely. However, the attack has increased attention on the geopolitical situation in the region.

Fed cut the policy rate further and we expect to see more

While the Fed cut the interest rate by 25bp again at the last FOMC meeting as expected, it made it very clear that its eyes are on ‘America first’ when it comes to policy – and that it does not commit to further easing for now. Further easing from the Fed will indeed be a help to the weaker global economy, but, at this stage, easing will likely remain half-hearted from a global point of view as the U.S. economy is set to stay ‘too strong’ for Fed to pre-commit to easing monetary policy. However, we still expect four more rate cuts from Fed, which should eventually support a weaker USD, but in a weak global environment and without precommitting to further easing, USD strength persists.

ECB delivered a big package

In September, the ECB cut the deposit rate by 10bp to minus 0.50% and introduced a tiered deposit system, which allows banks to place some of their excess deposits with the ECB at zero interest rate, while the rest will have to be placed at minus 0.50%. This system is introduced in order to cushion some of negative impact that negative interest rates have on banks’ business model, and variants of this system are already known in Denmark, Switzerland and Japan. The ECB also restarted its QE program, where it will purchase EUR20bn/month worth of bonds.

The QE program is ‘open ended’, which means it in principle can run forever or at least until the ECB sees a firm improvement in inflation (expected, and realized).

USD – Fed remains hesitant to pre-commit

The Fed has signalled that its October policy decision is largely contingent on developments in the trade war, global data and US inflation. While it has continued to refrain from pre-committing to further cuts, we expect the Fed will eventually get ahead of the curve and push EUR/USD higher.

Outlook for EUR/USD

Trade war escalation, geopolitical tensions, a downturn in global manufacturing and slow monetary policy adjustments by the Fed and the ECB are factors weighing on the U.S. and euro area. While the U.S. economy still looks relatively stronger, we consider a period of stabilisation around current weaker levels as more likely than an imminent turnaround in either economy.

In our view, the September ECB meeting could turn out to have been a game changer for EUR/USD. Even though the ECB cut its deposit rate less than expected and introduced a tiered deposit system, Draghi and co. came close to convincing markets of their commitment to easing with their strong forward guidance and an open-ended QE programme. Over time, these actions may support higher inflation expectations which, when viewed in isolation, could weigh on EUR/USD. The Fed cut rates again in September and we look for a 25bp rate cut during each of the next four meetings, which would eventually place the Fed ahead of the curve in terms of monetary easing. For now, however, the Fed remains unwilling to pre-commit.

The possibility of more forceful Fed easing in the short term represents a notable upside risk to our forecast. Given the current 50/50 market pricing of a 25bp cut in October, the next releases of ISM and non-farm payrolls will be even more important for EUR/USD in the short term. Ultimately, strong forward guidance from the ECB will give some counterweight to a continuation of Fed rate cuts in the short term. Eventually, we expect the Fed will get ahead of the curve and push EUR/USD higher. We therefore keep our forecasts unchanged at 1.10 in 1M and 3M (NYSE:MMM), 1.13 in 3M and 1.15 in 12M.

GBP – optimism to make way for uncertainty

A spout of autumn optimism has strengthened the GBP in recent weeks, with markets pricing a lower risk of a no-deal Brexit. In our view, renewed political uncertainty remains around the corner and we therefore continue to expect EUR/GBP to trade near 0.90. We anticipate further volatility in the run-up to the 31 October Brexit deadline.

Outlook for EUR/GBP

GBP weakened somewhat after Theresa May stepped down and Boris Johnson took office, with additional weakening stemming from a decline in domestic demand. Since August, however, the mood has turned around and markets now price a lower risk of a no-deal Brexit with EUR/GBP back to hovering around 0.88. We think that optimism will prove short-lived. GDP expectations are currently running around 1%. Although downside risk is prevalent in light of Brexit uncertainty, as of today the numbers out of UK remain decent.

The Bank of England continues to be quite passive. In practice, monetary policy is unlikely to change before either 1) we see a much stronger worsening in UK data, or 2) the completion of a dramatic (or peaceful) Brexit, after which policy may move in either direction.

In the run-up to the Brexit deadline in October, EUR/GBP will remain volatile. Our base case continues to be an extension of Brexit and a new election. We expect EUR/GBP will settle around 0.90. In the case of a decent deal or cancellation of Brexit, we believe EUR/GBP will move to around 0.85. In the case of no deal outcome, we look for EUR/GBP approach but remain below 1.0. In terms of our EUR/GBP forecasts, we keep these unchanged at 0.90 throughout the forecast horizon.

SEK – Riksbank challenged by economic outlook

A deteriorating economic outlook and disappointing inflation prints are challenging the Riksbank’s plans for a year-end rate hike, and increasing the prospects of a policy reversal.

Outlook for EUR/SEK

GDP growth is slowing at a faster pace than the Riksbank expected, as an already weak preliminary Q2 was revised down to 1.0% y/y. The global outlook seems to deteriorate by the day, not least on key export markets. In addition, the labour market has been a clear disappointment over the last couple of months. In our view, these developments will make it difficult for the Riksbank to deliver on its repo rate forecast. The economic slowdown is a headwind for the SEK.

In our view, the Riksbank will have to back down from its plan to raise rates around year-end for the following reasons: (i) inflation and inflation expectations are dropping, (ii) GDP growth is lower, (iii) the labour market is very weak and (iv) other central banks are cutting rates. Such an environment is more conducive to a policy reversal and rate cutting. As such, we look for a -25bp cut around February next year. Since pricing is close to flat, growing expectations of a cut will weigh on the SEK.

Based on the cyclical economic slowdown and a subdued inflation outlook that will continue to challenge the Riksbank, we stick to our bearish medium-term view on the SEK. Moreover, the upcoming wage round will, in our view, not make it any easier for the Riksbank to achieve its target.

As such, we do not expect a rate hike by year-end, but rather expect a policy reversal leading to a rate cut in Q1 20. The market is currently pricing in a flat repo rate path for the coming year, providing room for a SEK-negative re-pricing of the Riksbank in the coming months. Although SEK is likely to remain data dependent, we remain comfortable with an upward-sloping medium-term trajectory for EUR/SEK and leave the forecast profile unchanged at 10.70 in 1M, 10.80 in 3M (NYSE:MMM), 10.90 in 6M and 11.00 in 12M.

NOK – weakness persists despite NB rate hike

With its rate hike this month, Norges Bank remains the sole G10 central bank hiking policy rates. Relative rates continue to have little impact on EUR/NOK movements, however, and we suspect a substantial change to the external environment is required for NOK weakness to abate.

Outlook for EUR/NOK

Recent economic releases out of Norway confirmed that the mainland economy remains insulated against weaker global growth impulses. The reasons are: 1) oil investments, 2) building and construction, 3) strong public demand, and 4) rising real disposable income stemming from rising employment, higher nominal wages and lower inflation. The latest Regional Network Survey indicated average mainland growth of 2.7% y/y over the next 6M. While down from the previous signal of 3.1%, it remains above peer growth and, importantly, above the economy’s trend potential.

As expected, Norges Bank hiked policy rates by 25bp at the September meeting, which again highlighted NB’s emphasis on domestics and a weak NOK. Notably, NB signalled that this was most likely the last hike in the hiking cycle, even if the rate path actually implied a 40% probability of another hike in 2020. As we are slightly more upbeat on the labour market and the mainland economy than NB, we project another hike in March 2020.

The disconnect between relative rates and the spot exchange rate remains firmly entrenched in Norway. While NB again beat market pricing in September and hiked policy rates for a fourth time in a year, both the trade and import weighted NOK are at weaker levels than a year ago. Indeed, the persistency of NOK weakness has been a key reason behind the Norwegian economy’s outperformance. That said, we think a substantial change to the external environment (in terms of USD strength, China deleveraging and broad commodity performance) is required for persistent NOK strength. As we do not expect such a change in 2019, we raise our forecasts to 9.90 in 1M, 10.00 in 3M (NYSE:MMM), 9.70 in 6M, but keep our 12M forecast at 9.50.

Danske Bank’s hedging recommendations: other majors

FX forecasts

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.